What Is Cashback Credit Card?

This type of credit card intends to save you money by giving you a certain amount of your expenditure back in cash rebates.

Usually, there is a percentage and cap on the maximum amount of cashback you can earn each month.

Given that it can save you up to hundreds of Ringgit each year, it’s a no-brainer that most Malaysians are on the hunt for a good cashback credit card.

>> Click to compare Best Cashback Credit Cards for Petrol

>> Click to compare Best Cashback Credit Cards for Groceries

>> Click to compare the Best Cashback Credit Cards for Dining

>> Click to compare the Best Cashback Credit Cards for Shopping

>> Click to compare Best Cashback Credit Cards for Utilities

How does a cashback credit card work?

As mentioned, it gives a small percentage of cash back into your account, and it is beneficial to understand how this credit card works to maximize savings.

First, you need to get familiar with some of the cashback features, such as:

1. Cashback rate

Usually, in the form of a percentage value, this is the rate of savings you will get from your cashback credit card.

Let's take the UOB ONE Card as an example. It gives a 10% cashback rate on dining, which means you get to save RM15 from your date night dinner of RM100.

2. Maximum cashback amount (monthly cap)

Do not assume that the more you spend, the more cashback you earn.

Most of the time, there is a set limit on how much cashback you can earn every month, also known as the monthly cap.

Using the same UOB ONE Card example - even if your dinner bill comes up to RM150 at a 10% rate, you are still earning RM15 cashback as that is the maximum amount you can get back every month.

3. Minimum spending conditions

Credit cards with cashback also have minimum spending conditions, which could range from minimum monthly spending to a certain number of transactions per month, certain days of the week, and certain outlets only.

| Example 1: Minimum Monthly Spends | |||

|---|---|---|---|

|

Category |

Statement Balance |

Monthly Cap |

|

|

Below RM3,000 |

RM3,000 & above |

||

| Cinema |

2% |

5% |

RM30 |

| Petrol | |||

| Grocery | |||

| Online Spend |

0.2% (Any monthly amount) |

Unlimited |

|

This credit card has a tiered cashback rate that is based on your total monthly spending. As your total monthly spending increases, the higher the cashback rate you will earn.

Put simply, by spending more than RM3,000 every month, you will save 5% or a maximum of RM30 on all categories, except Online Spend which is uncapped.

If you are looking for a credit card that does not have a minimum monthly spend, they usually have lower cashback rates of below 1%.

Example 2: Certain days of the week to certain outlets only

Maybank Islamic Petronas Ikhwan Visa Gold Card-i gives 8% cashback on petrol spending with a monthly cap of RM50, but it's only valid if the transaction happens over the weekends.

HSBC Amanah MPower Platinum Credit Card-i on the other hand, gives 8% cashback for grocery spending with a minimum monthly spend of RM2,000 and above, but it's only valid for transactions made at Giant, Lotus's, AEON BiG and Mydin.

What to consider when choosing a cashback credit card?

In terms of choosing, it very much depends on where and how much you usually spend your money the most.

Cashback categories

Categories like petrol, shopping, dining, utility payment and grocery are common to qualify for a cashback. Bear in mind that not all cashback credit cards are created equal in terms of categories.

So, the best way to decide is to look at where most of your monthly expenses go and determine which category your purchases fall into.

Tiered cashback

To capture your attention and appeal better, some credit cards offer multiple tiers on their cashback rates. See the below table for an example:

| Example of Tiered Cashback | |||

|---|---|---|---|

|

Cash Back Rate |

Statement Balance |

Monthly Cap |

|

| 15% | RM2,500 and above | RM60 | |

| 10% | RM1,500 to RM2,499 | RM28 | |

| 5% | RM1,000 to RM1,499 | RM12 | |

| 0.2% | Below RM1,000 | RM2 | |

What to avoid: Do not get blindsided by the high cashback rate as it might cater to categories you do not spend a lot of money on.

Based on the table above, we can see that the more you spend with this credit card, the higher the cashback you will get as the rate is tiered to your minimum monthly spend.

What you can do: Figure out the categories you spend the most money on and how much you are willing to spend on this credit card every month to enjoy cash savings.

Who is eligible to earn cashback?

Both principal and supplementary cards are qualified for cashback. However, this also highly depends on the bank.

As such, any spending performed by supplementary cardholder(s) will be aggregated with that of the principal cardholder to count toward the total monthly spend.

In other words, the more supplementary cardholders are on board, the faster you earn cashback to your account.

How to calculate the cashback I earned?

If numbers are not your forte, here are some visual illustrations of how the cashback is calculated:

| The Cashback Structure | |||

|---|---|---|---|

| Criteria | Monthly Statement Balance RM500 & above | Monthly Cashback Capped | |

| Weekday | Weekend | ||

| Petrol | 1% | 8% | RM18 |

| Grocery | 1% | 8% | RM18 |

| Dining | 1% | 8% | RM18 |

| Others | 0.25% | 0.25% | Unlimited |

| There’s no cashback for less than RM500 monthly spending | |||

| Illustration 1: Weekday & Weekend Spending, within RM18 cap | ||||||

|---|---|---|---|---|---|---|

| Illustration 1 | Weekdays | Weekends | ||||

| Categories | Spend | 1% Cashback | Spend | 8% Cashback | Total Cashback | Remarks |

| Petrol | RM70 | RM0.70 | RM100 | RM8 | RM8.70 | Within RM18 cap |

| Grocery | - | - | RM150 | RM12 | RM12 | Within RM18 cap |

| Dining | RM50 | RM0.50 | RM100 | RM8 | RM8.50 | Within RM18 cap |

| Others | RM20 | RM0.05 | RM30 | RM0.08 | RM0.13 | Unlimited |

| TOTAL | RM140 | RM1.25 | RM380 | RM28.08 | RM29.33 |

|

| Total posted transaction for the month, RM140 + RM380 = RM520 | ||||||

| Illustration 2: Weekday & Weekend Spending, more than RM18 cap | ||||||

|---|---|---|---|---|---|---|

| Illustration 2 | Weekdays | Weekends | ||||

| Categories | Spend | 1% Cashback | Spend | 8% Cashback | Total Cashback | Remarks |

| Petrol | RM100 | RM1 | RM300 | RM24 | RM18 | Capped at max RM18 |

| Grocery | RM50 | RM0.50 | RM50 | RM4 | RM4.50 | Within RM18 cap |

| Dining | RM50 | RM0.50 | RM100 | RM8 | RM8.50 | Within RM18 cap |

| Others | RM20 | RM0.05 | RM30 | RM0.08 | RM0.13 | Unlimited |

| TOTAL | RM220 | RM2.05 | RM480 | RM36.08 | RM31.13 | |

| Total posted transaction for the month, RM220 + RM480 = RM700 | ||||||

| Illustration 3: Weekend Spending Only, within RM18 cap | ||||||

|---|---|---|---|---|---|---|

| Illustration 3 | Weekdays | Weekends | ||||

| Categories | Spend | 1% Cashback | Spend | 8% Cashback | Total Cashback | Remarks |

| Petrol | - | - | RM225 | RM18 | RM18 | Within RM18 |

| Grocery | - | - | RM225 | RM18 | RM18 | Within RM18 cap |

| Dining | - | - | RM225 | RM18 | RM18 | Within RM18 cap |

| Others | RM10 | RM0.03 | RM10 | RM0.03 | RM0.05 (rounding) | Unlimited |

| TOTAL | RM10 | RM0.03 | RM685 | RM54.03 | RM54.05 | |

| Total posted transaction for the month, RM10 + RM685 = RM695 | ||||||

How many spending categories are qualified for cashback?

Generally, the most common spending categories that are eligible for cash back include groceries, dining, retail or online shopping, and petrol.

However, some local banks in Malaysia also offer cash rebates over categories like entertainment such as movies, local or overseas retail, utility bill payments, telco payments, insurance premium payments and even other miscellaneous categories.

So, which cashback credit card is best for my lifestyle?

Now that you’ve caught up with how cashback works, we have compiled some of the best cashback credit cards for different types of spending and personas.

Check out which persona relates most to you!

|

|

|

|

|

|

| Top Cashback Credit Cards for Grocery | |||

|---|---|---|---|

|

|

|

|

|

| Highest cashback rate | 8% cashback with a total monthly spend of RM2,000 and above | 15% cashback with a total monthly spend of RM2,500 or above | 10% cashback when the minimum monthly spend requirement of RM1,500 is met |

| Highest cashback amount | RM15 per category |

RM40 per month* *RM20 for each spending category |

RM15 per month |

| Eligible spend to earn the highest cashback rate |

✔ Grocery ✔ Petrol ✔ E-wallets |

✔ Selected grocery plus dining (these two are under one category) ✔ Petrol |

✔ Grocery

✔ Petrol ✔ Dining ✔ Grab |

| Eligible cardholder(s) | Principal only | Principal and Supplementary | Principal and Supplementary |

|

|

|

|

|

|

| Top Cashback Credit Cards for Dining | |||

|---|---|---|---|

|

|

|

|

|

| Highest cashback rate | 10% cashback with a minimum monthly spend of RM1,500 | 15% cashback with a total monthly spend of RM2,500 or above | 5% cashback with a total monthly spend of RM2,001 and above |

| Highest cashback amount | RM15 per category |

RM40 per category* *RM20 per month with dining plus grocery falls under one category |

Uncapped |

| Eligible spend to earn the highest cashback rate |

✔ Dining

✔ Petrol ✔ Groceries ✔ Grab |

✔ Selected dining plus grocery ✔ Petrol |

✔ Dining

✔ Online shopping ✔ Groceries ✔ Petrol ✔ Utilities ✔ Other retail spend |

| Eligible cardholder(s) | Principal and Supplementary | Principal and Supplementary | Principal and Supplementary |

|

|

|

|

|

|

| Top Cashback Credit Cards for Shopping (Online and Retail Outlets) | |||

|---|---|---|---|

|

|

|

|

|

| Highest cashback rate | 8% cashback with a total monthly spend of RM5,000 and above | 2% cashback every day with a minimum spend of RM100 | 5% cashback with a total monthly spend of RM2,000 or less |

| Highest cashback amount | RM30 per month | RM20 per month | RM100 per month |

| Eligible spend to earn the highest cashback rate |

✔ Shopping online/retail (local or overseas) |

Visa: Contactless Transactions

MasterCard: Overseas Transactions |

✔ Visa payWave at AEON BiG Stores during AEON BiG Thank You Member Day (28th of every month) |

| Eligible cardholder(s) | Principal and Supplementary | Principal and Supplementary | Principal and Supplementary |

|

|

|

|

|

|

| Top Cashback Credit Cards for Utility | |||

|---|---|---|---|

|

|

|

CIMB Cash Rebate Platinum MasterCard |

|

| Highest cashback rate | 5% cashback with a total monthly spend of RM2,500 and above | 5% cashback with a total monthly spend of RM2,001 and above | 5% cashback with a total monthly spend of RM3,000 and above |

| Highest cashback amount | RM10 per category | Uncapped | RM30 per month |

| Eligible spend to earn the highest cashback rate |

✔ Utility ✔ Petrol ✔ Dining ✔ Grocery |

✔ Utility ✔ Online Shopping ✔ Groceries ✔ Dining ✔ Petrol ✔ Other Retail Spends |

✔ Utility Bill Payment via Standing Instruction

✔ Cinema ✔ Petrol ✔ Groceries ✔ Mobile Bill Payment via Standing Instruction |

| Eligible cardholder(s) | Principal and Supplementary | Principal and Supplementary | Principal and Supplementary |

|

|

|

|

|

|

What does it mean by “Eligible Spend”?

It is a term that a bank uses to classify the type of retail purchase that is qualified for a cashback. This could mean that out of all retail purchases you have made with your credit card, only a select few are considered eligible for a cashback.

Below are some credit card transactions that are not considered “Eligible Spend” and will be excluded from cashback:

- Balance Transfer, Cash Advance, Easy Payment Plan (EPP) transactions

- Payments of fees, charges and taxes

- Any government-related transactions

- Payments to charity or social services

What is a Merchant Category Code (MCC)?

It is a code to classify a type of goods or services provided by a merchant for which a credit card is accepted as a form of payment.

The MCC is important for the banks to determine the spending category that is qualified for a cashback.

For example, if you constantly swipe your credit card at hypermarkets bearing the MCC 5411, the bank will classify this transaction as “Grocery Spend” under its cashback category.

For Islamic credit cards, these are the general MCCs prohibited by the issuing banks:

| General MCC Prohibitions for Islamic Credit Cards | |

|---|---|

| MCC | Descriptions |

| 5813 | Bars, Cocktail Lounges, Discotheques |

| 5921 | Package Stores, Beer, Wine, Liquor |

| 5993 | Cigar Stores and Stands |

| 7995 | Gambling Transactions |

| 7273 | Dating and Escort Services |

[FAQs] Cashback Credit Cards

1. When does a weekend cashback start and end?

The weekend cashback typically starts at 12AM on Saturday and will end on Sunday, at 11:59PM.

The timeline, however, may vary from bank to bank, so be sure to check their terms and conditions.

2. When will the cashback be credited to my account?

The cashback earned for the month will be calculated up until the statement date of the current month.

The cut-off date for cashback calculation happens one day before the statement date.

The total cashback amount for the current month will then be posted on the next month's statement date.

Any eligible transactions posted after the statement date will be credited into the next statement cycle.

3. What happens to my cashback if I don’t pay my credit card bill on time?

If you miss your monthly payment or only pay the minimum amount, usually banks will forfeit your cashback for that month.

Some cards even require full payment to qualify for cashback. Late payments also lead to finance charges and late payment penalties, which can be higher than the cashback you earned.

To enjoy the full benefits of your cashback card, always pay your statement balance in full and on time.

4. What are the benefits of a cashback credit card?

Cashback credit cards offer several practical financial benefits, including:

- Instant savings every time you spend on eligible categories like petrol, groceries, and online shopping.

- Monthly cashback rebates help you reduce your total expenses, making it easier to budget.

- Some cards come with unlimited cashback and no annual fees, giving you even better long-term value.

- Special promos, partner deals, and exclusive merchant offers help you save more beyond just cashback.

For everyday consumers, cashback cards are a smart way to stretch your ringgit and get rewarded for regular spending.

5. How can I get the maximum cashback every month?

To maximise your monthly cashback earnings in Malaysia, follow these smart strategies:

- Choose cards based on your spending habits: For example, use a card that gives 8% cashback on groceries if you spend heavily at supermarkets.

- Always meet the minimum spend requirement to qualify for the bonus cashback tier.

- Track your cashback caps – many cards have a monthly limit, so try not to exceed it.

- Use multiple cards for different categories (e.g. petrol, online shopping, dining) to optimise savings.

- Enable auto-payment and set reminders to always pay your bills in full and on time to avoid forfeiting your cashback.

You might wonder: “Is cashback free money?” In many ways, yes! Cashback is like bonus money for spending wisely, but only if you avoid interest charges and stick to your budget.

6. Is a cashback credit card better than a rewards points credit card?

It depends on your personal goals. Cashback cards are best for those who want straightforward savings every month. You immediately see the benefit in the form of cash rebates, which can offset your expenses.

Rewards cards, on the other hand, are more suited for those who prefer to accumulate points and redeem them for flights, gadgets, or vouchers.

If you’re a budget-conscious consumer, cashback credit cards are usually the better option for everyday use.

7. What happens if I don’t redeem my cashback?

If your card requires manual redemption, and you don’t redeem your cashback before the expiry period, you could lose your earned rewards.

For example, some banks allow redemptions only after reaching RM50 cashback, and if left untouched, it may expire after a year. That means you miss out on free money.

Always read the T&Cs and set reminders to redeem your cashback regularly either to your statement or as a credit to your account.

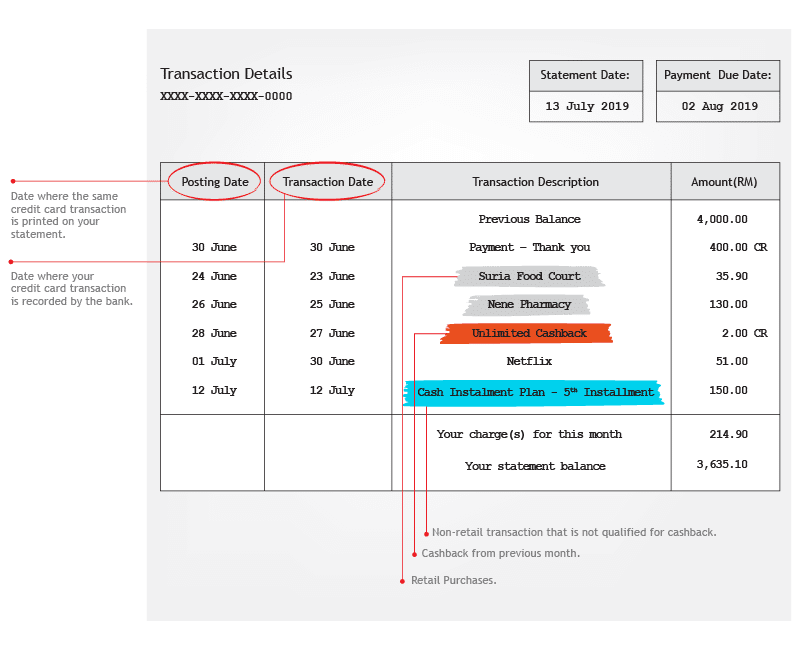

8. How to check for cashback on my credit card statement?

You can check for the cashback that you have earned through your credit card statement. Example below:

9. Can you define the transaction date and posted date?

A transaction date is a date when your credit card transaction is recorded by the bank, whereas, a posted date is a date when the same credit card transaction is printed on your statement.

Here is the tricky part of cashback: cashback will usually be awarded to a credit cardholder based on the posted date of a transaction.

Apply for cashback credit cards online!

Do you know that you can sign up for cashback credit cards online with RinggitPlus? We can even help you decide which cashback credit card is suitable for you based on your income with our credit card recommendation service.

While you're at it, keep an eye out for our weekly sign-up offers and stand a chance to bring home attractive gifts as well!