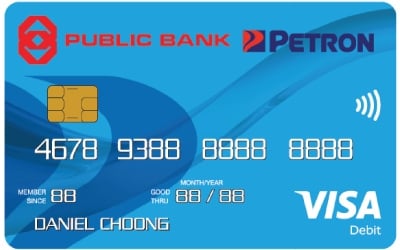

Pump Petrol And Save Every Month With Public Bank-Petron Visa Debit Card

The PB-Petron Visa Debit Card is a fantastic co-branded card in partnership with Petron, designed to reward you every time you visit the pump! It functions as a standard Visa Debit Card, linking directly to your Public Bank Savings or Current Account, and notably offers an Automatic Sweep feature to ensure you always have funds ready for transactions.

What Are the Benefits?

- Guaranteed Cash Rebate at Petron: Enjoy a straight 0.5% Cash Rebate on every fuel and non-fuel purchase at Petron stations, up to a generous RM30 cap monthly.

- Free For Life: You never have to worry about annual fees—it's waived for life with no conditions attached!

- Automatic Fund Top-Up: The optional Automatic Sweep facility automatically transfers funds from your linked account to ensure the debit card balance is topped up to RM200 daily, preventing unexpected transaction shortfalls.

- Free ATM Withdrawals: Cash withdrawals at any local Public Bank ATM are waived from the standard RM10 fee.

- Earn Interest: You passively earn interest every month based on the daily balance held in your card account.

Who Can Apply For This Debit Card?

- Principal applicants must be at least 12 years of age.

- Supplementary applicants must be at least 12 years of age.

- Applicants aged between 12 and 18 years old must have the application form completed and signed by a parent or guardian.

What Are the Required Documents to Apply for This Debit Card?

- You must hold a valid Personal Deposit Account (Savings Account or Current Account) with Public Bank.

- A completed application form (requires parent/guardian signature for minors aged 12-18).

- Identification Document (e.g., NRIC or Passport) is typically required.

What Are the Fees That I Need to Pay?

- Annual Fee: Free-For-Life (waived without condition).

- Cash Withdrawal at PB ATM: Waived.

- Cash Withdrawal at Non-PB ATM (Local or Overseas): RM10.00 per successful transaction.

- Overseas Conversion Fee: The prevailing Visa exchange rate + 1.25% foreign exchange spread charged by Public Bank.

- Card Replacement Fee (Lost/Stolen/Damaged): RM12.00.

- Cash-Out Fee (via POS): RM1.50 per successful transaction.

- Petrol Pre-Authorization Hold: RM200 hold is placed on your account when fueling at outdoor pumps (reversed after settlement, usually within 3 days).