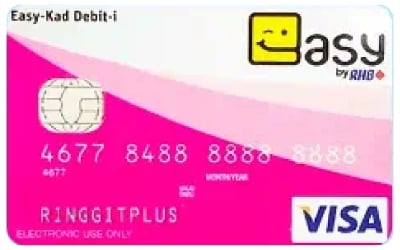

What Is This Card RHB Easy Debit Card-i About?

The RHB Easy Debit Card-i is designed for maximum simplicity and convenience, offering you a Shariah-compliant way to manage your funds globally. As a debit card, it allows you to pay for goods and services using the cash balance in your linked RHB Islamic deposit account-i, making it an excellent tool for responsible spending.

What Benefits Do I Get?

- Global Payment Flexibility: Use your card at millions of physical and online retail establishments worldwide that accept Visa or MasterCard.

- Easy Cashless Transactions: Utilise the PayWave (Contactless) feature to simply wave or tap your card for fast, hassle-free payments.

- Convenient Cash Access: Withdraw cash easily at any local Automatic Teller Machine (ATM).

- Linked to Profit: Continue to enjoy profit (or Hibah) from the linked RHB Islamic Bank deposit account-i.

- Open to All: The application process is straightforward with no minimum income requirement needed.

Any Other Features?

- Online Transaction Capability: You can use the card for secure online purchases if you have activated this function with the bank.

- Debit Transaction Principle: The card is strictly debit-based, meaning all purchases are immediately debited from your deposit account-i, promoting financial discipline.

What Are the Fees Associated With This Card?

- Issuance Fee: RM12.00 (One-time fee upon issuance).

- Annual Fee: While a definitive figure for this specific card is not explicitly separated from the issuance fee in the quick summary, related RHB cards typically carry an annual fee of RM12.00.

- RHB ATM Withdrawal Fee: Free.

- Local Bank MEPS ATM Withdrawal Fee: RM1.00 per withdrawal.

- Foreign Visa/MasterCard Network ATM Withdrawal Fee: RM12.00 (or equivalent in foreign currency) per withdrawal.

- Card Replacement Fee: RM15.00 (for lost, stolen, or damaged cards).

What Are the Transaction Limits?

| Age Group | Default Cash Withdrawal Limit (per day) | Default Retail Spend Limit (per day) |

| 18 years and above | RM3,000 | RM3,000 |

Note: These limits can typically be adjusted up to a maximum of the available account balance upon request.

Who Is Eligible to Apply?

- Individuals aged 18 years and above.

- Account Requirement: You must hold a linked RHB Islamic Bank deposit account-i (Current or Savings Account-i).

- Joint Accounts: Joint account holders may apply if the account instruction is "either to-sign."

What Are the Required Documents to Apply for This Debit Card?

- A fully completed application form.

- A photocopy of your Identification Card (front and back portions).

- Your Account passbook or Statement with the account number.