Everything You Need to Know About Fixed Deposits

Fixed deposits offer guaranteed returns of 2.5% to 3.9% per annum with zero investment risk, making them ideal for conservative investors and emergency fund builders. Unlike savings accounts, your money is locked for a fixed period, but you earn significantly higher interest.

However, withdrawing even a day early could forfeit all your earnings. This comprehensive guide shows you how to maximise FD returns while avoiding costly mistakes.

What is a Fixed Deposit?

Considered a haven compared to other investment types, a Fixed Deposit (FD) is a popular choice for many first-time investors. It guarantees a high return, is easy to manage, rewards loyalty, and is protected by government insurance.

Unlike a conventional savings account that earns daily interest and allows for withdrawals at any time, an FD restricts access to the money you have invested.

No interest will be paid out for a fixed deposit if you withdraw just one sen before the maturity date.

How FD Interest is Calculated

Guaranteed Return on Investment

You won't have to keep track of stock prices going up and down, or read any books on Share Trading.

All you have to do is gather your spare cash, open an FD account, and claim your interest at maturity. For example, let's say you want to apply for a 6-month FD with a minimum deposit of RM5,000 at 3.65% per annum (p.a.).

Park your cash in the FD account and you get back your initial deposit (principal) along with interest of 3.65% per annum (p.a.) or an Effective Interest Rate (EIR) of 1.82% after 6 months.

Interest is calculated daily but only paid out at maturity. It is a hassle-free passive investment.

Below, we show you how much you can earn from a short-term fixed deposit if you choose to deposit more:

| 6-Month Fixed Deposit | Interest Rate at 3.65% p.a. |

|---|---|

| Deposit Amount (RM) | 6-month Interest Profit (RM) |

| 5,000 | 90.43 |

| 20,000 | 361.73 |

| 50,000 | 904.32 |

For a placement period of more than 1 year, you have the option to collect your interest earnings either annually or monthly. In Malaysia, the longest placement period you can choose is 5 years.

By now, you must be wondering, “But how do I calculate EIR to find out how much I will earn?”.

To find out your investment’s true rate of return, you need to take note of the interest rate and your placement period.

Let’s use the same example above, an FD with 3.65% p.a. interest for 6 months and an investment of RM20,000.

(Yearly Interest Rate/12 Months) x Placement Period In months = Effective Interest Rate (EIR)

(0.0365/12) x 6 = 1.82%

Principal Investment x EIR = Total Interest Earnings

RM20,000 × 1.82% = RM365

Let us explain what the numbers mean. Looking at the first formula, you’d have to divide your yearly interest rate by 12 to get the rate at which your deposits earn interest for each month of the year, then multiply that by your placement period to get your EIR.

Next, multiply the EIR by your principal amount to get your total interest earnings, as seen in the second (2) formula.

Not too comfortable with numbers? Use the RinggitPlus fixed deposit calculator to know how much you can earn on your investment!

Competitive Interest Rates

Savings accounts allow you to earn interest and withdraw cash from an ATM at any time. Easy access to cash is why people who rely on interest earned from savings accounts as a steady income stream aren’t interested in FDs, even though an FD has a better interest rate.

To understand the value of an FD, you need to think about long-term benefits. Let’s take a look at Mr Andy’s situation: He has RM100,000 in spare cash and can earn 4% p.a. in a 12-month FD, compared to only 2% p.a. in a savings account. He would like an extra RM4,000 to add to his yearly spending budget.

To achieve this, he should place RM96,000 of fresh funds in an FD and RM4,000 in an instant access savings account. He can then spend the money stored in the savings account over the year, knowing the RM3,840 interest earned in the fixed deposit will be enough to make up for it.

This way, Mr Andy can benefit from the high FD rate, but still can withdraw cash. If he just dumped everything into a savings account, he’d earn a much lower amount of interest at the end of 12 months.

Better still, if he's already a customer with a certain bank, they may offer him an even higher rate if he uses fresh funds.

It Pays To Be Loyal

Banks reward existing customers with preferential fixed deposit rates, especially if you have other products with them (loans, credit cards, current accounts).

Why banks do this: Banks compete aggressively for your deposits. By offering better rates to loyal customers, they encourage you to consolidate your finances with them instead of spreading money across competitors.

What Are "Fresh Funds"?

You'll often see promotional FD rates that require "fresh funds". This simply means money that's new to the bank.

Fresh Funds (Qualifies for promotional rates):

- Cash from another bank (transferring RM10,000 from CIMB to Maybank)

- Physical cash deposits

- Money from a different bank's savings account

NOT Fresh Funds (Won't get promotional rates):

- Transferring from your Maybank savings to Maybank FD

- Moving money between your own accounts at the same bank

- Rolling over an existing FD at the same bank

Practical Example Bank A is running a promotion: 4.25% p.a. for loyal customers with a RM5,000 minimum deposit.

Scenario 1 (Wrong approach): You transfer RM5,000 from your Bank A savings account → You get the standard board rate (around 2.5-2.8%), NOT the promotional 4.25%

Scenario 2 (Correct approach): You transfer RM5,000 from your Bank B savings account → You qualify for the promotional 4.25% because it's fresh funds to Bank A

That said, here's how to maximise promotional rates:

- Keep savings accounts at multiple banks (even with small balances)

- When you see a good promotional rate, transfer money FROM a different bank

- Don't move money within the same bank, expecting promotional rates

Important: Always read the Terms and Conditions. Some promotions require fresh funds, others require you to be an existing customer, and some require both.

Types of Fixed Deposits (Step-Up, CASA)

Ever flip through the newspaper and see absurdly high interest rates advertised for fixed deposit promotions?

Most of the time, there’s some sort of catch. Without even going into the mechanics of the promotion, a strong tell-tale sign that all is not what it seems is the words: ‘you can earn up to X% p.a.’

There are two main methods banks use to ‘inflate’ the interest rate for their products during a promotion: by scaling the interest rates, commonly known as Step-Up, or bundling the FD with a current or savings account (CASA Bundling).

Some FD promotions may even include both Step-Up and CASA Bundling!

Step-Up Fixed Deposit

Think of a Step-Up FD as a staircase.

Here, your FD placement period is split and placed on a staircase. Think of each step as a different month, with a different interest rate. Each step gets higher as you climb. In this case, the advertised rate is usually only available for the final month, or ‘step’ of the FD period. The Effective Interest Rate (EIR) will always be lower than the advertised rate.

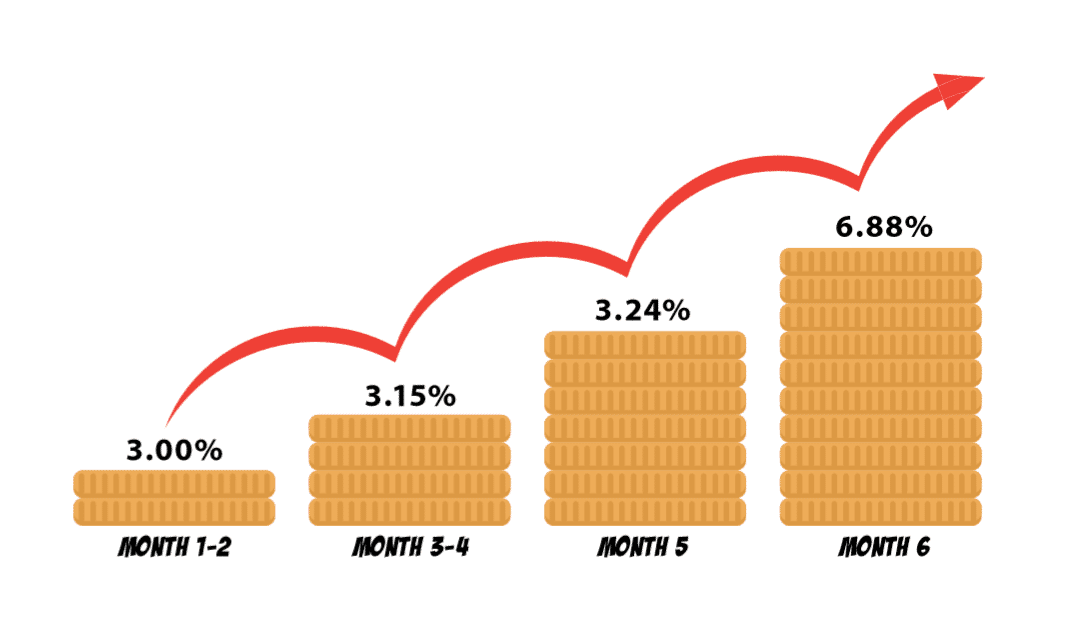

For example, Bank A’s Campaign boasts an interest of up to 6.88% interest p.a. for a 6-month Fixed Deposit, but a closer look shows this:

| --- | Month 1 - 2 | Month 3 - 4 | Month 5 | Month 6 | TOTAL |

|---|---|---|---|---|---|

| Interest rate(p.a.) | 3.00% | 3.15% | 3.24% | 6.88% | 3.73% |

| Interest earned on RM10,000 (RM) | 49.39 | 52.08 | 26.88 | 56.31 | 184.66 |

As you can see from the table above, the 6.88% p.a. offered is only available during the 6th and final month of the tenure.

Calculating the EIR gives you only 3.73% interest p.a. and a profit of RM184.66 when all 6 months are taken into account.

Fixed Deposit with CASA Bundling

An FD bundled with a current or savings account (CASA) may offer a better interest rate, but you’ll need to open a current or savings account with a minimum deposit to get all the benefits.

The amount you have to put into a Current or Savings Account is usually a fixed amount or a percentage of the total invested in the FD.

A bundled FD rate might look attractive, but don’t forget that the money you put into the CASA calculates interest at a lower interest rate. The more you have to put into your CASA, the lower your EIR will be.

For example, Bank B advertises an interest rate of 4.28% p.a. for their 6-month FD, but you have to deposit 50% of your FD amount into a CASA as well.

This means that if you want to deposit RM10,000 into the FD, you've also got to deposit RM5,000 into a CASA, bringing the total amount deposited to RM15,000. You’ll still earn the same amount in interest, but you need to deposit more money.

As shown below, the EIR calculated comes up to 3.01% p.a., which is 1.27% lower than advertised.

| --- | 6-Month Promo FD | 6-Month CASA | TOTAL |

|---|---|---|---|

| Initial Deposit | 10,000 | 5,000 | 15,000 |

| Interest rate (p.a.) | 4.28% | 0.5% | 3.01% |

| Interest earned (RM) | 211.76 | 2.50 | 214.25 |

Now that you know how banks determine your earnings, we’re sure you’ll want to know that other things will affect your interest payments, sometimes even slashing them to only half the promised amount.

We’ve mentioned this before – it’s to your disadvantage to take out money from your FD account before it matures.

FD vs Savings Account

A savings account offers instant access to cash; a Fixed Deposit account doesn’t. Banks will offer lower interest rates on savings accounts.

An FD account is an investment in which the customer deposits a large sum of money, usually starting at RM1,000, for a fixed period.

Since you agree to keep the money deposited with the bank for a fixed period of time and are discouraged from withdrawing, the bank gives you an attractive interest rate.

The many savings and fixed deposit accounts on offer complement each other. One allows you to earn high interest (FD), and the other provides access to cash for everyday expenses and short-term emergencies (Savings Account).

We’ve summarised the main differences between a fixed deposit and a savings account below:

| --- | Fixed Deposit | Savings Account |

|---|---|---|

| Reasons To Apply | To earn high interest on large sums of cash | Used for incomes savings and cashless spending |

| Interest Rate | Higher interest rate | Lower interest rate |

| Placement Period | Fixed period. Principal and interest paid out at maturity | Continuous nature. Free to close account anytime |

| Minimum Deposit | Higher deposit of at least RM1,000 or RM5,000 | Deposits can be as low as RM20 |

| Frequency Of Deposits | Amount deposited only once. However, it can be renewed with fresh funds. | Can be done any number of times. No restrictions |

| Cash Withdrawals | Not encouraged. Will terminate account and lose out on interest earnings | Can be done anytime, but subject to withdrawal limit |

The story doesn’t end here, however – we’ve only begun to dip our toes into the Fixed Deposits pool. Read on and you’ll soon learn that some FDs insist that you open a savings or current account to enjoy the higher fixed deposit rate.

Tip 1: Want to go on a shopping spree? Sign up for a 1-month FD beforehand so you’ll have extra cash at the end of the month to soften the blow to your credit card bill!

Can I Make Full or Partial Cash Withdrawals?

If you’re a smart saver, you’ll only open an FD when you can put cash aside for the entire investment period. Banks will offer tenures as short as one month or as long as five years.

If your itchy hands partially or fully withdraw your cash, depending on how long you choose to invest, you will either lose some or all of your interest earnings.

Placement of 1, 2 or 3 Months

Early withdrawals for fixed deposit accounts of 1 to 3 months' tenure might result in you losing all the interest generated on your stored cash.

Yes, even if you decide to withdraw a small sum the day before maturity, you will not be entitled to a single sen in interest. Check the small print!

Placement of more than 3 Months

For fixed deposits that run for more than three months, there are a few scenarios, which you risk losing your interest.

In many cases, if you choose to make a premature full or partial withdrawal any time during the first three months, you lose all interest generated. If you choose to make withdrawals after placement of at least three months, you will still earn interest, but only at half of the interest rate you were offered.

This means 50% of the interest you’ve earned will be kept by the bank as an early withdrawal fee, and you’ll only be allowed to earn at a pro-rated rate. That means the EIR for the remaining period.

Plan Your Investments Carefully

At the end of the day, it is most important that you are comfortable with your savings and budget and have a very good idea of how much cash you can afford to lock away for the period of the Fixed Deposit.

There are various fixed deposit accounts to choose from, so taking time to research and compare interest rates on RinggitPlus is crucial. We include our analysis of the small print in each of our FD reviews too!

Decide whether to place a short-term deposit and have it automatically renewed, or to sign up for a longer term to benefit from a higher interest rate.

If your fixed deposit account allows for auto renewals (roll-over), the bank will reinvest your money, which may or may not include any interest earned, in a new fixed deposit investment as soon as the old placement reaches maturity.

Let’s revisit Mr Andy for another example: he takes an FD of 1 month at 3% p.a. and for a 12-month tenure at 3.40% p.a.

Say he decides to deposit RM5,000 into a fixed deposit account for 1 month at a rate of 3% p.a., and continuously rolls over at maturity for a year.

He will potentially earn RM150 in interest and also the flexibility of withdrawing his cash at the end of each month. Auto-renewing a fixed deposit investment can be to repeat the same tenure, but the interest rate may not necessarily be the same.

The same RM5,000 in a deposit account with a 12-month tenure at 3.40% interest p.a. will earn RM170 in interest. That’s a slight increase of RM20, at the cost of the freedom to withdraw – he must decide if the slight bump in earnings is worth not having easy access to his cash at the end of each month.

This is where proper financial planning comes into play. If he can save RM100,000 over the years, he’d potentially earn up to RM3,400 at 3.4% p.a. for a 1-year FD! He can use that money to offset insurance or loan repayments – the wait would be worth it!

With so much money at stake, you might be worried about how safe your hard-earned cash is when stored in the bank.

Tip 2: Always take advantage of FD promotions. These promos appear a few times a year to attract new and loyal customers. Interest rates from these promotions are always higher than the board rate.

How Safe Are My Deposits, Really?

Should you even question the safety of your wealth stored up in a fixed deposit account?

After the Global Financial Crisis of 2008, many were quick to stash their money under their mattresses when banks around the world started failing. But is it really that bad these days?

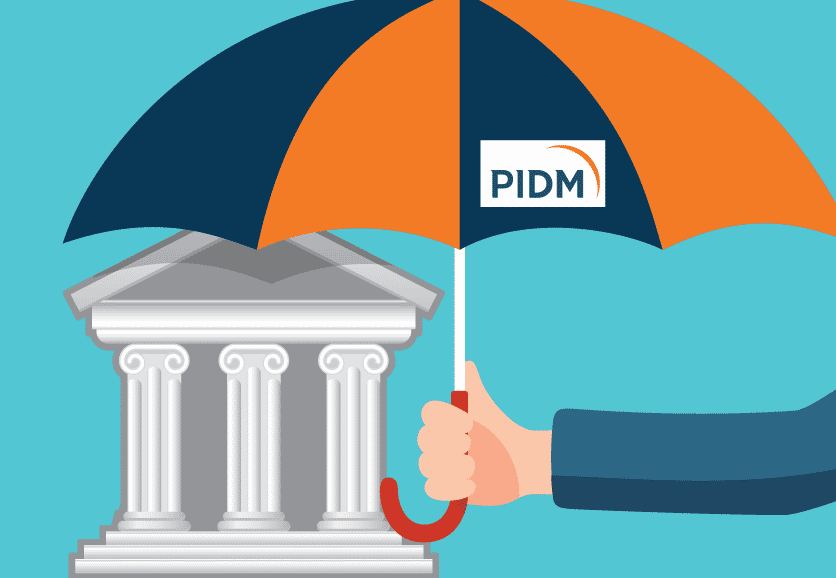

The short answer to the question is: No, cash deposited in local or foreign banks in Malaysia is protected and insured by either PIDM or DFIA.

Protection for commercial banks

If there’s a rule of thumb for keeping your deposits safe, make sure that you park your cash in a regulated Malaysian commercial bank that is covered under the Perbadanan Insurans Deposit Malaysia (PIDM) membership scheme.

PIDM protects your bank deposits and will promptly reimburse you on your insured deposits should a member bank fail. There is no charge or premium payments for this insurance protection.

Savings of up to RM250,000 are guaranteed by PIDM per person, per bank. If you have more than RM250,000 to set aside, you can get complete protection by dividing your savings into several FD accounts from different banks.

Here’s an example: You’ve won the lottery to the tune of RM1,000,000. Like any sensible human being, you’d be losing your mind, but don’t spend it all in one fell swoop or stuff your wealth in a single bank account – be sensible and open FD and CASA accounts with different banks to spread around your risks.

Imagine having one account full of money and someone getting a hold of your bank card number and draining your account! The horror!

Another way to protect your savings is to open joint accounts because they also enjoy separate deposit insurance under the PIDM scheme.

You could place RM250,000 into your own FD but also open joint FD accounts with a parent, spouse, or even your children. That way, you can enjoy high fixed deposit rates on large balances without worrying about having them insured.

Protection for co-operative banks

Now, let’s take a look at protection for co-operative banks that provide loans mainly to farmers and small-time businessmen, with protection coming directly from the Malaysian Ministry of Finance through the Development of Financial Institution Act 2002 (DFIA).

The DFIA does not protect depositors and banks in the event of a member bank failure specifically, but has a broader responsibility to promote stability of the financial system as a whole.

In short, DFIA is an Act introduced by the Malaysian government that provides banks with guidelines for financial products and banking services to suit the specific needs of the public, as well as to offer consultation and advisory services to keep the banks in line and perform their roles efficiently and effectively.

However, when we relate this to deposit protection, it all depends on the individual banks – what do we mean?

Simply, there’s no standard insured amount for your bank deposits. When the RinggitPlus team took a look at the protection offered by co-operative banks such as Bank Rakyat and AgroBank, we found that they guarantee a return of 100% on your savings and investments for both principal and interest earned.

Tip 3: Split your savings into three parts using the 3:3:4 and 4:4:2 ratio. During regular months, put 30% in your savings account, 30% in short-term FD and 40% in long-term FD.

In festive months, you can change the ratio to 4:4:2 to allow for more cash on hand!

How About Islamic Deposit Accounts, Is It Haram?

So far, we’ve only discussed conventional fixed deposits, but let’s not forget those who wish to invest but don’t want to violate Islamic laws against earning interest.

These investments can be challenging to understand for some, but they’re not that much different in terms of profiting on your deposits.

Mudharabah General Investment Accounts, also known as GIA, are the Islamic counterpart of the conventional fixed deposit.

The most distinct feature of GIA by comparison to FD is profit processing – it follows the Syariah principle of Mudharabah, or cost-plus-profit, where your profit margins are predetermined by the bank to avoid paying interest or ‘riba’, which is not Halal.

Islamic banking in Malaysia is also covered under the Perbadanan Insuran Deposits Malaysia. However, this insurance coverage will be restricted when the new framework for deposit accounts takes effect in tandem with the phasing out of Mudharabah GIA under the Islamic Financial Services Act 2013.

Islamic Financial Services Act 2013 (IFSA)

Administered and regulated by Bank Negara Malaysia, the Islamic Financial Services Act 2013 (IFSA) provides a framework of reference for Islamic banks and financial institutions to ensure financial stability and compliance with Syariah law.

This Act introduces two major classifications of products: into either principal guaranteed or investment accounts, targeted to be fully effective by June 2015.

While some Islamic banks will still offer customers GIAs, your deposits won’t be insured any longer. Instead, you’d want to shift your attention towards principal guaranteed Islamic ‘term deposit’ accounts.

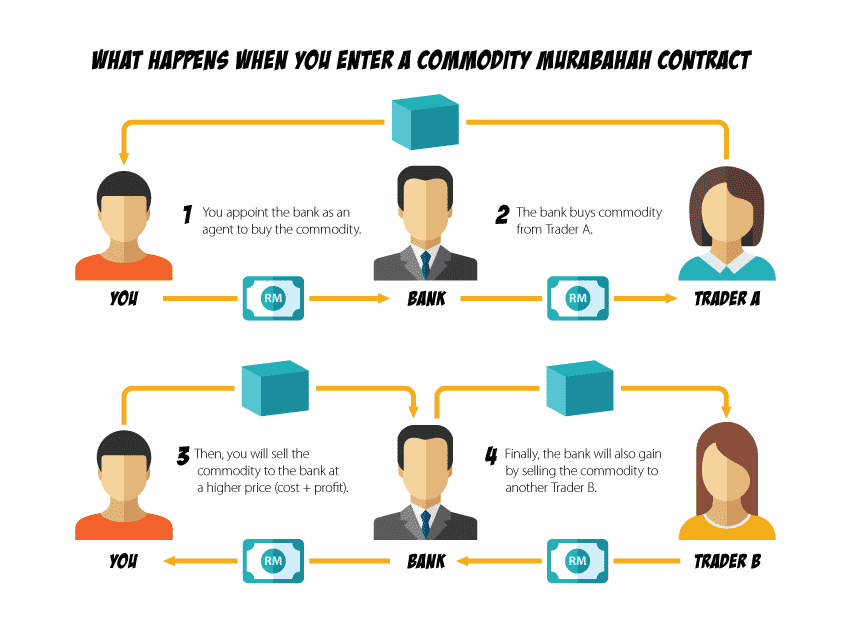

These kinds of deposits are based on the concept of Commodity Murabahah where commodities, such as palm oil, copper, and other raw materials, are used as assets for the purchase and sale between you, the bank, and commodity traders.

Under this arrangement, you will appoint your Islamic bank as an agent for the purchase of a commodity from trader A using your investments.

After the commodity is purchased, the next step is for you to sell it back to the bank at a higher price for profit, credited to you at a deferred basis throughout your placement period.

Finally, the Islamic bank will also gain by selling the commodity to another party, Trader B.

Similar to a conventional FD, your deposit will be guaranteed and insured by PIDM, while still guaranteed as Halal.

Still confused? So were we at first, until we drew it out step-by-step! Take a look at the flowchart below to better understand this Syariah process.

How Do I Open A Fixed Deposit Account?

Eager to start investing? Most banks will allow both Malaysian residents and non-residents aged 18 years old and above to set up a fixed deposit account.

Before heading out, you need to prepare your documents so your FD application goes as quickly and smoothly as possible.

Prepare Your Supporting Documents

There are only two things that you need to prepare before making your way down to your nearest bank branch to make an application:

• Generally, you’ll need a minimum initial deposit of RM1,000 for 1 month or RM5,000 for 2 months or above. (can be prepared in cash, cheque, or direct cash transfer to the FD bank account) • Your MyKad for identification

If you’re thinking of opening a joint account with a spouse or family member, they also need to provide a copy of their MyKad.

Always Know Where Your Fixed Deposit Certificate Is

When you sign up for a fixed deposit, the bank will issue you a fixed deposit certificate or statement as proof of placement.

With this certificate, you can check your principal deposit amount, placement period and the agreed interest rate, as well as the date of maturity.

To withdraw your money or terminate your investment, you will need to present the certificate, so do keep it safe! If lost, you must inform the bank as soon as possible.

The bank will issue a new certificate to you, but of course, it won’t be for free. You will be charged RM10 for stamp duty and a service fee of up to RM15.

However, many local banks such as Maybank and CIMB Bank are starting to offer customers the option to make fixed deposit placements online – without the worry of having to keep a physical certificate, while other banks will allow you to renew your placement period or top-up your investments using their online banking applications.

Now You’re All Set To Go!

You’ve reached the end of our guide and are now ready to take the plunge and sign up for an FD account.

Go ahead and use our fixed deposit calculator on RinggitPlus to compare both conventional and Islamic deposit accounts, calculate your interest earnings, and apply online to start growing your wealth!

Best Fixed Deposit Rates in Malaysia (November 2025)

Are you ready to start building your wealth safely? Let's compare the fixed deposits offered by reputable banks in the Malaysian market.

| Fixed Deposits | FD Rates | Deposit Period | Minimum Deposit | Early Withdrawal | Depositor's Insurance |

|---|---|---|---|---|---|

| Bank Rakyat | 2.10% - 2.40% p.a. | 1 - 60 months | RM500 | No | Malaysian Government |

| Bank Muamalat | 2.05% - 2.35% p.a. | 1 - 60 months | RM1,000 | No | PIDM |

| HSBC | 2.05% - 2.25% p.a. | 1 - 60 months | RM1,000 | Yes | PIDM |

| MBSB Bank | 1.90% - 2.20% p.a. | 1 - 60 months | RM500 | No | PIDM |

| Al Rajhi Bank | 2.65% - 3.35% p.a. | 1 - 60 months | RM500 | Yes | PIDM |

| BSN | 2.15% - 2.45% p.a. | 12 - 60 months | RM500 | No | PIDM |

| Agrobank | 2.50% - 3.30% p.a. | 1 - 60 months | RM1,000 | No | Malaysian Government |

| Maybank | 1.85% - 2.20% p.a. | 1 - 60 months | RM1,000 | Yes | PIDM |

| CIMB | 1.75% - 2.15% p.a. | 1 - 60 months | RM1,000 | Yes | PIDM |

| Public Bank | 1.75% - 2.05% p.a. | 1 - 60 months | RM1,000 | No | PIDM |

| RHB Islamic Bank | 1.75% - 2.05% p.a. | 1 - 60 months | RM1,000 | Yes | PIDM |

| OCBC | 2.10% - 2.30% p.a. | 1 - 60 months | RM1,000 | Yes | PIDM |

| Alliance Bank | 2.10% - 2.45% p.a. | 1 - 60 months | RM500 | No | PIDM |

| Affin Islamic Bank | 1.25% - 2.10% p.a. | 1 - 60 months | RM500 | Yes | PIDM |

| Standard Chartered | 1.85% - 2.25% p.a. | 1 - 60 months | RM1,000 | No | PIDM |

| Hong Leong Bank | 1.90% - 2.10% p.a. | 1 - 60 months | RM500 | Yes | PIDM |

| AmBank Islamic | 1.75% - 2.20% p.a. | 1 - 60 months | RM500 | Yes | PIDM |