Best Personal Loans In Malaysia 2024

Do you need a quick loan comparison from various banks and licensed financial lenders? We've compiled a list below for your easy reference.

| Bank/Licensed Lender | Interest/Profit Rate |

Minimum

Monthly Income |

Loan/Financing

Amount |

Loan/Financing Period | Can Government/GLC Apply? |

| Alliance Bank | 4.99% - 16.68% p.a. | RM3,000 | RM5,000 - RM300,000 | 1 - 7 years | Yes |

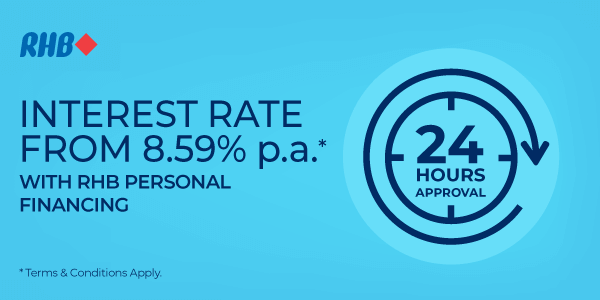

| RHB | 8.59% - 13.76% p.a. | RM2,000 | RM2,000 - RM150,000 | 1 - 7 years | No |

| Al Rajhi Bank | 5.42% - 14.19% p.a. | RM5,000 | RM10,000 - RM250,000 | 1 - 8 years | Yes |

| CIMB | 4.38% - 19.88% p.a. | RM2,000 | RM2,000 - RM100,000 | 2 - 5 years | No |

| First N Ever | 12.00% - 18.00% p.a. | RM4,000 | RM5,000 - RM300,000 | 6 months - 3 years | Yes |

| AEON Credit | 7.92% - 18.00% p.a. | RM1,500 | RM1,000 - RM100,000 | 6 months - 7 years | Yes |

| Adacash | 18.00% p.a. | RM1,000 | RM500 - RM1,000 | 1 month - 3 months | Yes |

| Tambadana | 18.00% p.a. | RM1,500 | RM1,000 - RM10,000 | 1 month - 1 year | Yes |

| Evo Credit | 12.00% - 18.00% p.a. | RM3,500 | RM5,000 - RM400,000 | 2 months - 5 years | Yes |

| BSN | 6.00% - 8.50% p.a. | RM3,000 | RM5,000 - RM400,000 | 2 - 10 years | Yes |

| Maybank | 6.50% - 8.00% p.a. | RM3,500 | RM5,000 - RM100,000 | 2 - 6 years | Yes |

| Hong Leong Islamic Bank | 9.00% - 12.50% p.a. | RM2,000 | RM5,000 - RM150,000 | 2 - 5 years | No |

| JCL | 18.00% - 20.00% p.a. | RM1,000 | RM1,000 - RM50,000 | 6 months - 5 years | Yes |

| Bank Islam | 4.50% - 7.50% p.a. | RM4,000 | RM10,000 - RM300,000 | 1 - 10 years | No |

| MBSB Bank | 7.62% - 13.09% p.a. | RM3,500 | RM10,000 - RM200,000 | 2 - 7 years | Yes |

| HSBC Amanah | 4.88% - 10.50% p.a. | RM3,000 | RM6,000 - RM250,000 | 2 - 7 years | No |

| AmBank | 8.00% - 11.99% p.a. | RM3,000 | RM2,000 - RM150,000 | 1 - 5 years | Yes |

| Bank Rakyat | 7.66% - 10.22% p.a. | RM2,000 | RM5,000 - RM400,000 | 1 - 10 years | No |

| UOB | 9.99% - 11.99% p.a. | RM3,000 | RM5,000 - RM100,000 | 1 - 5 years | Yes |

| instaDuit | 18.00% p.a. | RM1,500 | RM1,000 - RM10,000 | 1 - 4 years | Yes |

Which bank is best for a personal loan?

RHB, Alliance Bank, and Al Rajhi Bank are among the best banks in Malaysia that offer low interest rates and online applications.

If this is your first time applying for a personal loan or you need help choosing the right one, we can help you through our loan recommendation service (it's free!).

Now, you must wonder when you should apply for a personal loan. The truth is, there is never the best time to apply for a personal loan when you are not prepared for it.

In this article, you will find the dos and don’ts of a personal loan application based on the experiences and best practices of ordinary Malaysians.

Read on to learn what a personal loan is about, how you can apply with the lowest rate and highest amount, and what to do after a loan is approved or rejected.

Research stage

At this stage, you will uncover various answers to questions about personal loans, and how to use this information to make an informed decision.

How does a personal loan work?

It is quite straightforward until you come across some terms and jargon that you are not familiar with.

Don’t worry, here are some commonly used terms to describe personal loans:

| Terms | Descriptions |

| Interest Rate |

The interest rate or profit rate is the amount (usually shown in a percentage form) charged on the loan amount by the bank to the borrowers for using its money.

It is the same concept as a deposit; you put money in a savings or current account, and the bank will pay you interest or profit for using your money. However, it is important to note that the personal loan interest rate is indicative, which means that your credit and financial background may influence the loan terms you will get. |

|

Per Annum (p.a.) |

The interest rate is charged per annum or yearly basis. For example, an RM10,000 loan is at 5% p.a. interest, the interest charge is RM500 per year. If the repayment tenure is stretched to 3 years, the interest will become RM1,500 (RM500 per year x 3 years). |

|

Principal |

It is the loan amount that you applied for. The interest rate will be calculated based on this amount and added on top of it. Going with the example above, the calculation should be: Principal + Interest = Total Borrowing Amount (RM10,000 + 5% p.a. = RM10,500) |

|

Tenure |

This refers to the loan repayment period. Choosing the right tenure is important for your finances. A shorter loan period has a higher monthly instalment amount, whereas a longer loan comes with a higher interest rate. |

|

Instalment |

You need to pay back your loan every month until the end of your tenure. The instalment amount is fixed and is calculated on the total borrowing amount divided by the total number of months. |

|

Penalty |

The bank charges you this fee on your overdue amount for being late on your repayment. |

|

Default |

A term to describe an event of non-payment of a personal loan for over 3 months. In this situation, the bank usually imposes a higher finance charge or takes legal action against you. Under this circumstance, you will face difficulty in securing any loans in the future as a result of your poor credit score. Your repayment history will stay in the CCRIS database for up to 12 months. |

Before applying for a loan, these are some questions you should ask yourself.

How long will I need to pay off my loan?

Your loan tenure influences how many years you will need to pay your loan. You'll have to make payments for your loan every month until the end of your tenure.

Most banks provide repayment terms between 1 to 7 years. It is important to note that your monthly payments and interest rates will be affected by your chosen repayment period.

Here's a calculation example of how the loan tenure will affect your monthly instalment.

| Period | Shorter (1 - 3 years) | Longer (4 - 10 years) |

| Interest Charge |

Low RM10,000 x 5% x 1 year = RM500 |

High RM10,000 x 5% x 10 years = RM5,000 |

| Monthly Instalment |

High RM10,500 ÷ 1 year = RM875 per month |

Low RM15,000 ÷ 10 years = RM125 per month |

How much interest will I have to pay?

Your interest rate depends on several factors, like your credit score, loan amount, and tenure.

To get the lowest interest rates, you need an excellent credit score and choose as short of a repayment period as possible.

Regardless, you still need to keep in mind that the final interest rate of the loan will be decided by the bank.

What type of personal loan can I get?

Now you have caught up with some of the personal loan basics, this is the time to answer the question of preferences.

By doing a personal loan comparison, you can filter down the best personal loan to apply for.

The interest rate should not be the only factor when comparing personal loans, but your preferences too, such as:

"What is the difference between secured and unsecured loans?"

"Should I get a conventional or Islamic loan?"

"Do I need a Takaful or Insurance coverage?"

Secured vs. Unsecured |

|

|

Secured Loans

|

Unsecured Loans

|

Conventional vs. Islamic |

|

|

Conventional Loans

|

Islamic Loans

|

With Takaful/ Insurance vs. Without Takaful/ Insurance |

|

|

With Takaful or Insurance Coverage

|

Without Takaful or Insurance Coverage

|

When is a personal loan a good idea?

Everyone has goals to achieve and a lot of times, they require money to kick-start the journey.

We can gain money from any means possible such as employment, selling products or services, own savings, as well as loans.

Some people are lucky enough to fund their goals with one or more combinations of the above methods.

But what about others who have limited options or whose limited options are not viable? Often, they shy away from the last option, a loan.

If we look at this objectively, applying for a personal loan is practical for several reasons:

- Education

- Investment

- Emergency cash

- Funding for business

- Buy a property (house, car, equipment etc.); or

- Consolidate debts

How do I consolidate debts and which bank offers it?

A debt consolidation loan is a financial tool that simplifies multiple debts into a single facility or financing.

When you have multiple debts of different sizes, banks, due dates, tenures and interest rates, it can be strenuous to keep track of the repayments.

However, with a debt consolidation loan, you can repay your multiple debts at a lower interest rate and longer tenure to save on monthly instalments and have more disposable income.

An example of a personal loan with a debt consolidation option is Al Rajhi Personal Financing-i.

How does a debt consolidation loan work?

Let's look at some calculation examples before and after a debt consolidation loan to get a clearer picture of how it works.

Please note that the calculations shown below are just an example. The bank will provide you with an actual calculation and details.

Before debt consolidation:

Assuming you have one credit card from Bank A and two personal loans from Bank B and Bank C.

All three finances have different monthly instalments and outstanding balances, making up a total monthly commitment of RM2,000 on your end to pay to the banks.

| Debt | Monthly Instalment | Outstanding Balance |

| Credit card from Bank A | RM500 | RM15,000 |

| Personal loan from Bank B | RM500 | RM10,000 |

| Personal loan from Bank C | RM1,000 | RM25,000 |

| Total | RM2,000 | RM50,000 |

After debt consolidation:

Paying RM2,000 monthly to the banks might not be feasible for some, so here's how you can consolidate them into a lower monthly instalment for a certain tenure.

| Interest rate example | 9.78% p.a. |

| Tenure | 60 months (5 years) |

| Applied loan amount | RM50,000 (outstanding balances from all Banks above) |

| Total interest paid |

Principal amount

x Annual interest rate x Tenure RM50,000 x 9.78% p.a. x 5 years = RM24,450 |

| Total repayment amount |

Principal amount

+ Interest charges RM50,000 + RM24,450 = RM74,450 |

| Monthly Instalment |

Total repayment amount

÷ Tenure RM74,450 ÷ 60 months = RM1,241 |

How much do you save after consolidating credit cards and personal loan debts into a single loan?

RM2,000 – RM1,241 = RM759 ÷ RM2,000 x 100% =

38%

If you have a minimum monthly income of RM5,000, that means you are committing roughly 25% of your total monthly income to pay for your consolidated debts.

Important: The calculations above are just an example of how debt consolidation works. The actual calculation will be done by the Bank.

Personal loan application journey

To apply for a loan, you need to consider a few things such as the amount you can apply for, the amount the bank can lend you, the required documents and the places to apply for a personal loan.

How much of a personal loan can I borrow?

The typical loan amount you can borrow from banks ranges from RM5,000 to RM200,000, known as the principal amount.

Once you have decided on your principal loan amount, you must choose a tenure that suits your financial capacity.

RinggitPlus has a personal loan calculator that can estimate your monthly repayments simply by filling up the borrowing amount, your monthly income and your tenure of choice.

However, this calculator does not include your other monthly commitments such as car loans, home loans, credit cards, student loans etc., which the bank will also consider before approving your applied loan amount.

Therefore, to better manage your expectations (such as high loan interest rates and fast approval), you must check if you can afford to pay your total monthly commitments by determining your debt-service ratio (DSR).

What is a debt-service ratio?

Debt-service ratio (DSR) is a calculation that helps measure your available cash flow after meeting your debt obligations.

Banks use this to see if you have enough money to pay your monthly instalment via this formula:

|

Total Monthly Commitments ÷ Total Monthly Income x 100% = DSR

e.g. RM1,500 ÷ RM3,000 x 100% = 50% |

There is a consensus on the optimum DSR level to increase the chances of loan approval: your total monthly commitments should not exceed your total monthly income.

In the example above, the total loan commitments are 50% of the total monthly income, which means a borrower allocates half of his/her monthly income on debt servicing alone, with little room to save, spend and invest (if any).

In this situation, the bank usually reduces the loan amount to reduce your DSR level. Therefore, you can calculate your DSR first before the loan application to increase the chances of approval.

What documents should I prepare to apply for a personal loan?

You should prepare documents such as your Identification Card and income proof to speed up your loan application process.

The type of document may vary from bank to bank depending on your employment type. So best to check with the bank of your choice beforehand.

All in all, you can find the general requirements in the table below:

| Documents | Loan Application for Salaried Individuals | Loan Application for Self-Employed Individuals | Loan Application for Senior Citizens/Pensioners |

| Application Form |

✓ |

✓ |

✓ |

| Copy of IC/Passport |

✓ |

✓ |

✓

|

|

Income Proof (Depending on the bank) |

1) Up to the latest 6 months' salary slips 2) Up to the latest 6 months' EPF Statement 3) Up to the latest 6 months' bank statement 4) Latest BE or EA Form with official tax receipts |

1) Your Business Registration Certificate 2) Latest B or BE Form with official tax receipts 3) Up to the latest 6 months' company/personal bank statement 4) A copy of Forms 9, 24 and 49 |

1) A copy of your pension returns 2) A copy of the BE or EA Form with official tax receipts 3) Up to the latest 6 months' bank statement |

|

Others (Depending on the bank) |

1) Your letter of employment/offer letter or working contract 2) Payment track record or sanction letter for any existing loans 3) Resident proof such as utility bills, etc. |

1) Proof of office/shop establishment, if any 2) Valid documents such as utility bills to prove office/shop address and ownership |

1) Payment track record or sanction letter for any existing loans 2) Resident proof such as utility bills, etc. |

Where to apply for a personal loan?

You can apply by visiting the bank and speaking to a loan officer or online such as via RinggitPlus.

Applying online is always recommended because you can easily compare personal loans and use some tools to determine your credit score, calculate loan affordability, download statements and many more – all at your fingertips.

Another way is calling the bank’s customer service contact centre for a more personalised service. However, the downside is that you may not have the flexibility of time and money.

Here at RinggitPlus, we have a wide range of personal loans that can meet your needs with a fast and easy online loan application.

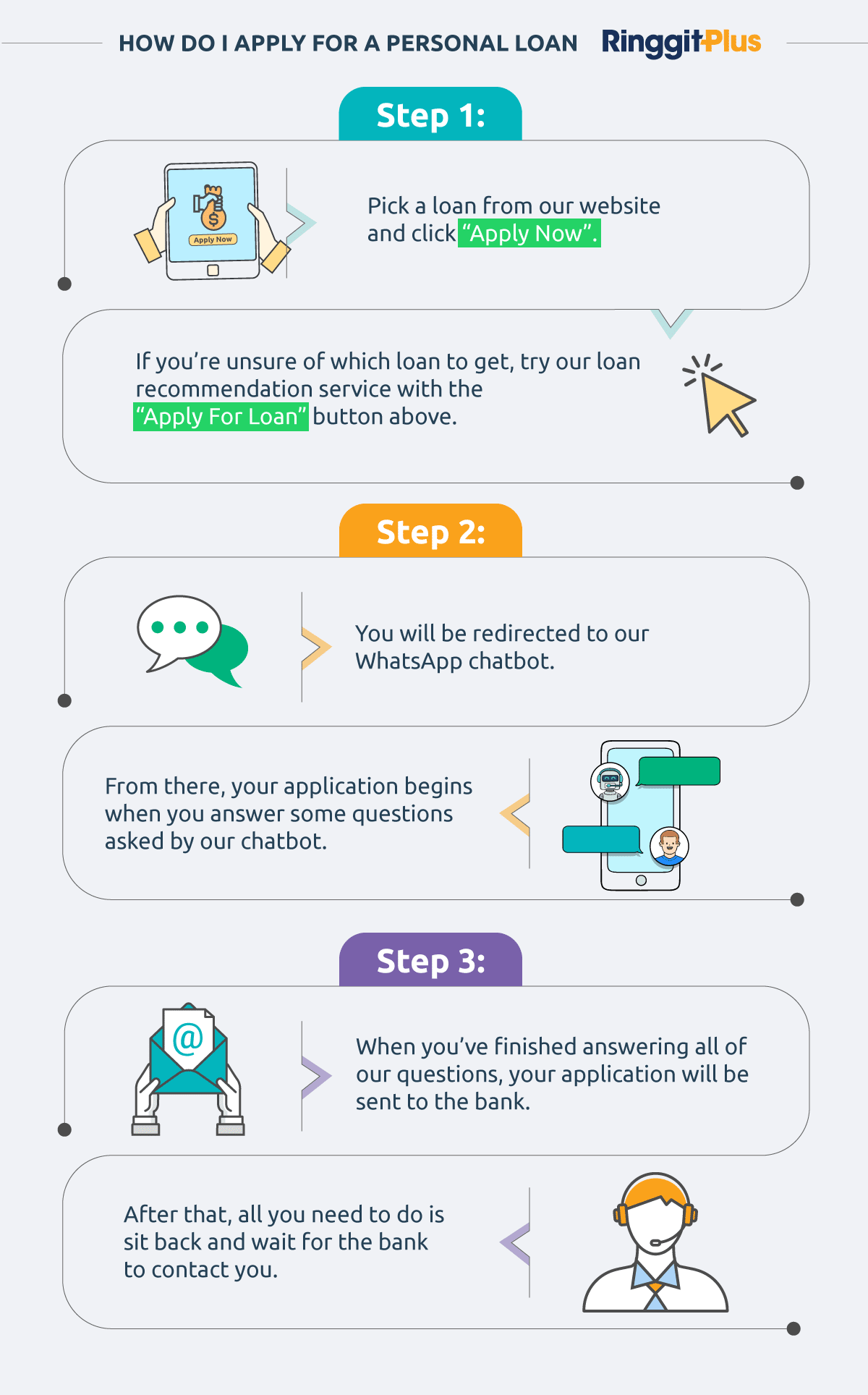

How do I make an application with RinggitPlus?

The application steps are simple. You can apply in just 10 minutes or less from the comfort of your home.

We will help check your eligibility so you don’t have to worry about applying for loans with low approvals.

Loan approval process

There are multiple ways banks can disburse the approved loan to you. Some banks require you to open a savings account with them, whereas others will pass you the cheque or do an IBG Transfer to your designated bank account.

Keep in mind that your eligibility, credit history and credit score play major roles in determining your loan application approval.

How do I qualify for a personal loan?

You must first meet the eligibility criteria as set out by the bank, including but not limited to:

- Nationality: Malaysian, permanent resident or foreigner

- Age: 21 to 60 years

- Employment type: salaried employee (public/private sector) or self-employed

- Income type: fixed, contract, commission basis

- Residential status: own house, rented, living with family/relatives, company provided etc.

Tips: Your lifestyle is also a contributing factor to your loan approval. If the bank spots an inconsistency in your employment histories, salary and disposable incomes, and places of residence, you may not be a favourable borrower.

Does the bank check my credit report before approving my loan application?

Yes, they do. A credit report shows an extensive record of all your debt repayments, which indicates your ability to commit to loan repayment.

The banks typically will reference the Central Credit Reference Information System (CCRIS) to gain insight into your previous repayment habits.

This credit report stores all your credit histories from all financial service providers in Malaysia for up to 12 months.

What is a credit score? And how can I check for mine?

A credit score is a 3-digit numerical rating that evaluates borrowers’ creditworthiness based on their credit histories or reports.

A good credit score can increase your chances of getting a loan approved with lower interest rates and faster loan approval.

A high credit score means you are favourable to the bank, whereas a lower credit score means your application may not be favourable or get rejected.

It's always a good practice to check your credit score often if you have multiple credits. And you can do so with CTOS which is a privately-run credit agency that collects data from public sources and is also referenced by the banks when approving a personal loan.

To give you a general idea of the credit score and what it means to lenders, refer to the table below!

| Credit Score | What It Means to Lenders |

| 744 - 850 |

Excellent. You're viewed very favourably by lenders. |

|

718 - 743

|

Very Good. You're viewed as a prime customer. |

| 697 - 717 |

Good. You're above average and viable for new credit. |

| 651 - 696 |

Fair. You're below average and less viable for credit. |

| 529 - 650 |

Low. You may face difficulties when applying for credit. |

| 300 - 528 |

Poor. Your credit applications will likely be affected. |

Best case scenario when your loan application is approved

- 1 to 5 working days for loan approval

- Get notified by the bank upon disbursement

- Received contract documents consist of a product disclosure sheet, personal loan repayment table, and terms and conditions

- Check the bank account for the money

Worst case scenario when your loan application is rejected

- Call the bank to follow up

- Check your repayment history (previous loan such as PTPTN) via CCRIS

- Check your credit score via CTOS

- Improve your creditworthiness by making prompt repayment

- Wait for a while before applying for a new personal loan from a bank

- Explore other personal loan options and reapply

Monthly commitment

This is the most important stage after getting your loan approved.

Your future loan applications, especially home loans, will be greatly affected if you don’t service your current debts properly.

When is the due date of my loan?

Your first monthly instalment will commence one month after you get the approved loan in your bank account.

As per your personal loan’s terms and conditions, your monthly instalment due date can fall either on the first or in the middle of the month.

If at any time during the instalment period, you are not able to commit to the full amount, you can pay a minimum amount as recommended by the bank.

Doing so will save you from being penalised for late payment, however, it attracts finance charges between 15% to 18% per annum on the remaining unpaid balances.

What happens if I pay my loan instalment late?

The bank will penalise you a 1% late payment fee, while non-banks or financial lenders often charge an 8% fee. The late payment fee is calculated daily until you pay it off. That's not all, your credit score will take a turn for the worse too.

Hence it is important to pay your instalment in full before or on the due date.

Below is a calculation example if you are late in paying your loan instalment.

For example:

| Overdue amount: | RM875 |

| Number of days overdue: | 10 days |

| Late payment charge: | 1% per annum |

| RM857 x 1% per annum x (10 ÷ 365 days) = RM0.23 | |

If you are on the verge of defaulting on your loan, you must immediately inform the bank to discuss a possible recourse on your repayments.

Alternatively, you can engage Agensi Kaunseling dan Pengurusan Kredit (AKPK), a debt management program by Bank Negara Malaysia that offers free services on money management, credit counselling and debt restructuring for individuals.

Can I settle my outstanding loan balances early?

You can settle your outstanding loan balances before the end of your tenure, subject to the terms and conditions of your loan.

Tips: A personal loan is usually calculated on a flat rate basis; therefore, a partial settlement is not advisable. If you have double-paid your monthly instalment for the month, the bank will deem it an “Advance Payment” which will not reduce your interest payment and the principal amount for the month.

You must inform the bank in a written notice before your loan early settlement. Furthermore, an Early Settlement fee may or may not be charged, depending on your loan agreement.

How do I make my monthly instalment payment?

You have the flexibility to make your monthly instalment payment in various channels such as follows:

- Online banking (IBFT or IBG transfer, bill payment etc.)

- Standing instruction (auto deduction)

- Cash deposit

- Over the counter

Tips: You may earn cashback on your interest payments when you make a prompt repayment every month throughout the tenure. Check out these top personal loans with a cashback program:

Financial freedom

Achieving financial freedom means you are no longer tied down with unmanageable debts.

These comprehensive personal loan guides and tips can help you make a sound financial decision and get your loan approved as expected.

At RinggitPlus, we understand your unique needs and worries when applying for a personal loan.

You can navigate to our other online personal loan pages that are designed to meet your income, affordability and preferences:

Compare and apply for fast approval loan

Compare and apply personal loans for low-income earners

Compare and apply for personal loans with low interest rates

Compare and apply personal loans for government/glc employees