Alex Cheong Pui Yin

18th March 2024 - 6 min read

They say that in life, you can’t run away from two things: death and taxes. In Malaysia, income tax is compulsory by law, and the income tax you pay is based on your total taxable income for the year. If you’ve just entered the workforce, and have absolutely no idea how all this works, here’s a handy guide on how to file your taxes for the first time.

Before we begin, you should first determine if you are eligible as a taxpayer. According to the Inland Revenue Board (LHDN), a Malaysian individual must register a tax file if they earn an annual employment income of RM34,000 (after EPF deduction).

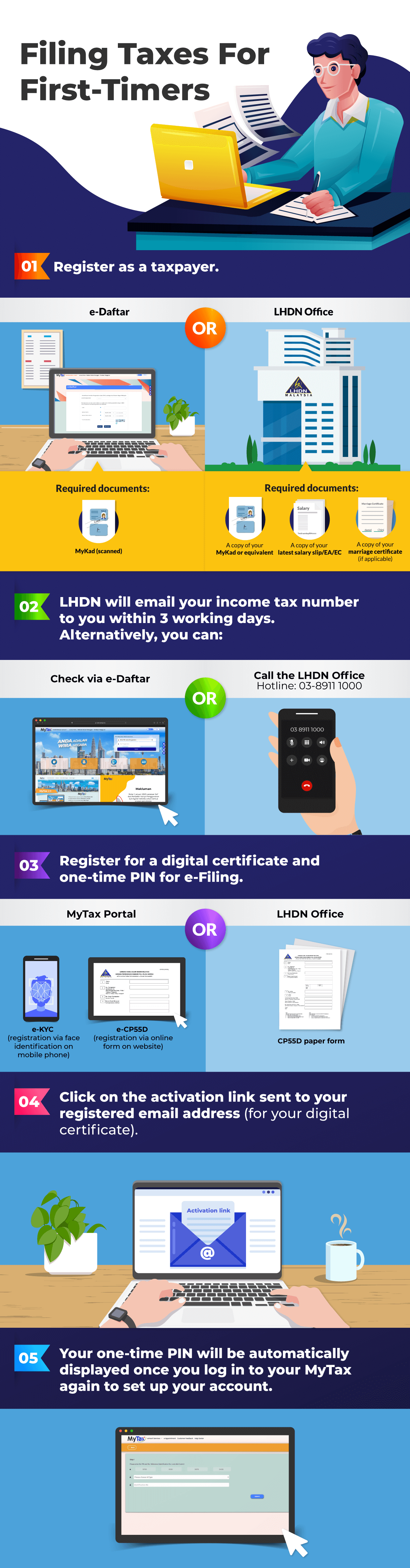

If your annual employment income is above that figure, you will need to do two things: register yourself as a taxpayer with LHDN, and then register for e-Filing (LHDN’s online income tax filing platform). Here’s a quick infographic that summarises the steps you need to take when registering for income tax in Malaysia as a first-time taxpayer, after which we’ll take you through each step in detail:

Step-by-step: How to file your taxes for the first time

Now, we’ll take you through each step of the process in detail: first, to register yourself as a taxpayer with LHDN, then register a MyTax account so that you can access the e-Filing platform to file your taxes. Let’s go!

1) Use e-Daftar to register as a taxpayer online with LHDN

To kickstart the process of registering as a taxpayer, head on over to the MyTax website, which now serves as the one-stop portal for all tax-related matters. From there, click on e-Daftar, which will then lead you to an online form. Fill in the required details, and the website will then notify you that you do not have an income tax number (of course, you’re not yet a registered taxpayer).

Click on the e-Daftar link in the text box, and then you’ll be led to the actual online form that you need to register yourself as a taxpayer with LHDN. Note that this form can be quite extensive as it requires a fair bit of necessary information, including about your basic particulars, your spouse’s particulars (if applicable), legal representatives (such as your parents), and your current employer.

As you can see in the image below (provided by LHDN), there are as many as 10 sections for you to go through:

Note that you are allowed to save and continue filling in this form at a later time if you are unable to finish it in one sitting. The next time you come back to the e-Daftar page from the MyTax website, simply key in your details again, and the website will allow you to resume your registration (click on “Update Details” to do so, as you can see in the image below). Also be aware that you will be required to upload a digital copy of your MyKad as a supporting document, so it would be good to prepare that beforehand.

Upon submitting your form, your application may either be immediately approved (in which case, you’ll get your income tax number on the spot), or you’ll receive an acknowledgement receipt and your application number (and your income tax number will be emailed to you within three working days). You can also check via e-Daftar or give LHDN a call to check your application status.

Of course, if you prefer to visit the LHDN office in person to register as a taxpayer, that’s also possible. Simply head on over to the nearest LHDN office, and speak to a personnel to assist you. Again, make sure to bring along a copy of your IC and your latest salary slip or EA form for the process.

2. Register for your e-Filing account

Now that you’re registered as a taxpayer with your own tax file, it’s time to register for the MyTax account to access the e-Filing platform as well! The registration for e-Filing is necessary because this is where you’ll file your returns online as an official taxpayer, and to do so, you’ll need to get a digital certificate and a one-time PIN.

a) Getting your digital certificate

To start the process, head back to MyTax and key in your IC number. You’ll then be informed that your “Digital Certificate does not exist”. Again, don’t panic, that’s normal! This is because even though you’re already registered as a taxpayer with LHDN, you’ve not actually set up your MyTax account yet, which gives you access to the e-Filing portal (and all the other tax-related services provided by LHDN).

So once you see the message, you’ll be prompted to apply for a digital certificate either via the e-CP55D online form (for MyTax web portal) or e-KYC (for MyTax app). Our guide here will focus on the e-CP55D application online form as taxpayers are more likely to use this method.

If you click on e-CP55D, you’ll be asked to confirm your registered email address and your personal details (IC number, full name, and email); amend them if necessary, then submit.

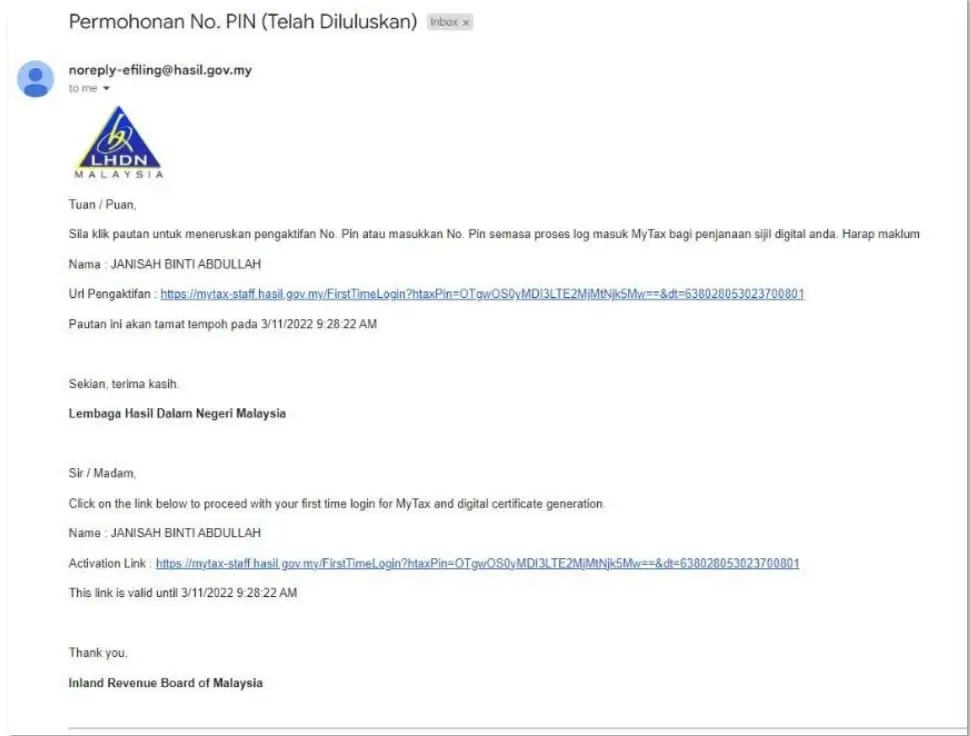

Once done, an activation link will be sent to your email, which you must then click to activate your digital certificate (note that this link is only valid for two days, so try to do it as soon as you can!).

b) Getting your one-time PIN…and access to MyTax & e-Filing!

Upon clicking the activation link, you’ll be led back to the MyTax website. Go ahead and key in your IC number; this time you should be able to log in, with your PIN number automatically displayed. Fill in the rest of the details required – which involves creating your password and security phrase for MyTax – then click on “Submit”.

A quick note: as you create your password and security phrase, remember that it’s best practice to avoid using your name or IC numbers. You should also utilise a mix of alphanumeric characters, as well as upper and lower caps, to help increase the strength of your password.

Once submitted, you’ll go back to the MyTax website again, and this time, when you log in for the third time, you’ll be able to log in to your MyTax dashboard (third time’s the charm!). More importantly, you’ll now also gain access to the e-Filing service.

3. File your taxes

And with that, congratulations! You’ve successfully registered as a taxpayer, created an account for MyTax and e-Filing, and completed all first-time login procedures! Now it’s time to file your taxes, and (hopefully) get a tax refund. We’ll be helping you all the way with this step-by-step guide for filing your income tax in Malaysia 2024 (YA 2023), so if you’re ever in doubt, feel free to check! Find more income tax related content in our income tax page as well.

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (28)

Good afternoon, do i need to declare Singapore CPF that transfer to Malaysia bank account?

You don’t need to declare your Singapore CPF transfer to a Malaysian bank account as it is considered foreign-sourced income and is generally tax-exempt in Malaysia.

I only been deducted for PCB for year 2023 bonuses. I still need to submit the e-filling right?

Yes, you should still submit your e-filing for the 2023 tax year, even if you’ve only been deducted for PCB on your bonuses. You can reach them through their hotline at 1-800-88-5436 or visit their website for more contact options and information.

I invested in some Malaysian reits. Can I claim back the withholding from LHDN as depicted on the vouchers? If yes, how to go about it? Thanks.

Such a great article! thank you it made the process so easy

This article is really helpful. Thank you so much for such a comprehensive and thorough article Ringgit Malaysia.

I been trying to register recently but mine doesn’t work as the image shown in this blog. After I search in edaftar page, it return to me this ‘Tax Identification Number (TIN) for Identification Card Number xxxx has been registered in the Inland Revenue Board Of Malaysia.’ and nothing else happens.

Hi, im facing the same issue. May I know whether you already figure out the solution? If yes, I would appreciate if you could share.

Thank you in advance.

Thanks alot!!

Thanks Alex, your income guidance is like a one-stop clinic, all doubts cleared.

If my salary is less than Rm2.5k, so I will not have to register income tax right? Because according to LHDN, Malaysian employees are required to pay taxes if annual income of at least RM34,000 (after EPF* deduction).

No need yet. But I would recommend you to open one since salary will increase over years (and bonus)

If request PIN number through online, but didn’t get any email after 7 working days, what should I do?

Not working :(((((

If Malaysian stay at other country as Tax resident, would still need submit it in Malaysia?

If i used to earn more than 34k p.a and paid my taxes when i was earning that amount then i was laid off and my income since then is less than 34k p.a do i need to declare my taxes after that?

Hi, I’m an expat working here since September 2021. I was just wondering if I need to be physically present to file my first income tax @ LHDN? I was previously told that this is the case if it was my first time filing. I got my tax number, PIN, and registered thru MyTax already. Hoping to get your insight.

If a person has switched job from on to another with different incomes in the span of 12 months how does it work then?

We got you covered for that too!

https://ringgitplus.com/en/blog/income-tax/how-to-file-your-income-tax-if-you-changed-jobs-in-the-previous-year.html

Very detailed. Did not have to refer to anything else.

Articles like these are a godsend with our horrible government website interfaces. Good stuff.

Thank you for the information !

If a person is working less then a year , and income says less then rm20,000 , does he need to submit the personal tax for the 1st year . Or need to register ?

Since the person doesn’t qualify (yet) to be a taxpayer (due to annual income after EPF deduction below RM34,000), there is no action needed.

Thanks for the post. it has helped a lot as a to register as a tax payer for the first time. Keep up your good works.

Good job, Alex. you must done lots of the research. very useful & informative for me. thanks.

Very helpful. Thank you RinggitPlus