Iman Aminuddin

1st October 2025 - 4 min read

RinggitPlus has unveiled the results of the 2025 RinggitPlus Malaysian Financial Literacy Survey (RMFLS), an in-depth look at the evolving financial habits, challenges, and outlook of Malaysians.

The survey indicates progress in financial literacy and resilience, particularly among younger generations and low-income groups, while also noting financial pressures faced by middle-income households. Rising living costs and reduced savings are creating challenges for many in this group in maintaining financial stability.

Middle-Income Households Under Pressure

Our data points to a concerning erosion of the financial backbone that drives Malaysia’s economic growth. The survey found that only 23% of middle-income earners (RM5,000–RM10,000 monthly) now save less than RM1,000 – RM1,500 per month, down from 29% in 2024.

This group’s ability to withstand financial shocks is weakening, with just 27% saying they could last more than six months without income, compared to 32% last year. To cope with tighter budgets, many are cutting back on discretionary spending like leisure activities, dining out, and subscriptions.

Gen Z And Low-Income Earners Show Resilience

In sharp contrast, our survey reveals a bright spot among the nation’s youth and low-income earners, who are both making measurable progress.

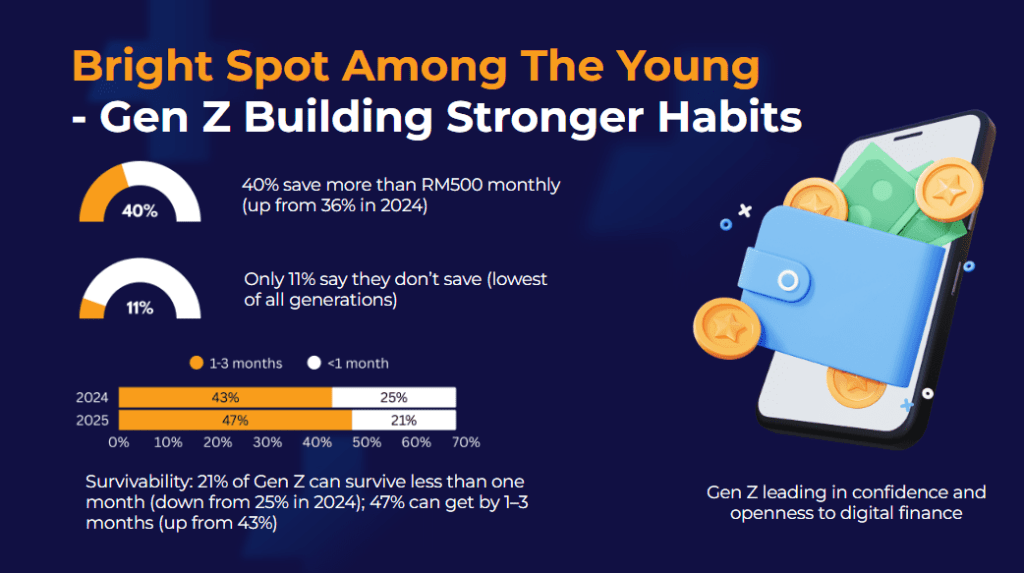

The data shows that Gen Z is building stronger saving habits, with 40% now saving more than RM500 monthly , and improving their financial resilience, developing a disciplined foundation early in their careers. Similarly, individuals earning in the lower income brackets showed encouraging growth in long-term financial planning.

Key Market Shifts Forcing Financial Adjustments

RMFLS 2025 also tracked how Malaysians are adapting to a challenging economic landscape, with rising costs forcing difficult decisions, especially around the financial and wellness protections offered by insurance products.

The majority of policyholders maintained their insurance coverage, though it’s clear that rising premiums have become a significant stressor on household budgets. This pressure is forcing a notable portion of the population to make difficult choices about their financial safety nets.

Financial Literacy And Digital Trends Continue To Evolve

RMFLS 2025 makes it clear that Malaysians are continuing to grow their use of digital platforms for financial services and education, and clear patterns are emerging along income and generational lines.

- Retirement Planning: Long-term financial planning is improving overall, with 64% of Malaysians now actively planning for retirement, up from 60% last year. Confidence in EPF savings is also slowly rising.

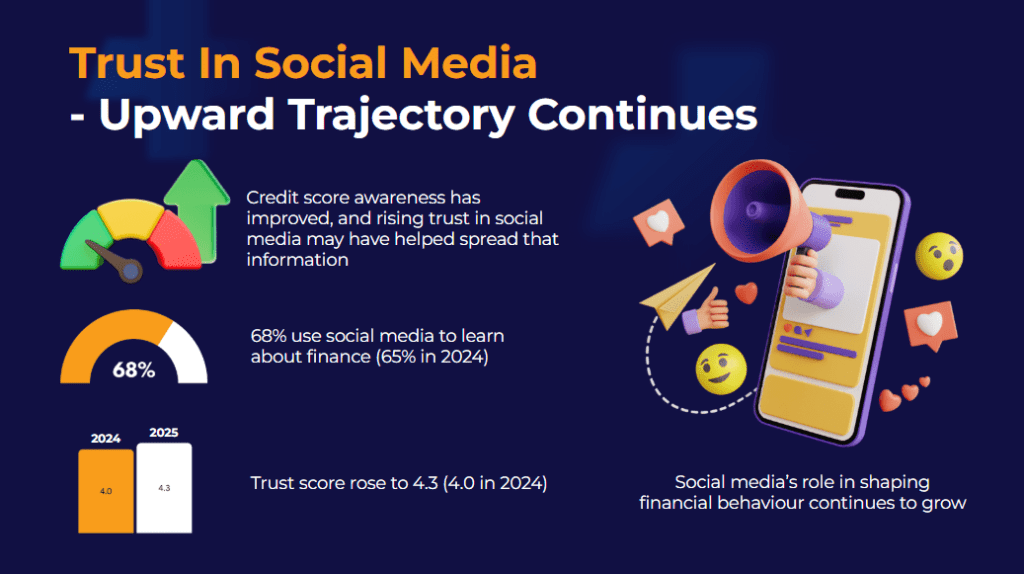

- Financial Literacy: Education efforts are making headway. The number of Malaysians unaware of what a credit score is has dropped to 26% from 30% in 2024.

- Social Media’s Role: Social media is now the primary source for financial learning for 68% of Malaysians, with its trust score rising to 4.3 from 4.0 in 2024.

- Digital Tools: Digital tools, including BNPL and AI, are being adopted in increasingly sophisticated ways, with how and why people use them varying by age and income.

A Dual Challenge Ahead

In partnership with KAF Digital Bank, CIMB Foundation and Experian, RinggitPlus believes the RMFLS 2025 highlights two key challenges facing Malaysians today: providing greater support to middle-income families feeling the financial squeeze, and helping all Malaysians build stronger, more practical financial literacy skills.

“RMFLS 2025 reflects the resilience of the Malaysian people. Many lower-income and Gen Z Malaysians are taking steps in the right direction — saving regularly, planning for retirement, and building good financial habits despite the challenges they face,” said Yuen Tuck Siew, CEO of RinggitPlus.

For additional background on how digital banking and economic shifts are reshaping Malaysian finances, read our earlier feature on RMFLS 2025.

Explore the complete 2025 survey report for more detailed findings. You can also revisit past editions for year-on-year trends:

Stay tuned to the RinggitPlus blog for in-depth analyses, and follow us on WhatsApp for the latest money tips and updates.

Comments (2)

Great to see that Gen Z and lower-income groups are making strides in financial literacy and saving habits!

Absolutely! It’s one of the most encouraging findings from this year’s survey. 🙌

It’s a reminder that even in challenging economic times, Malaysians are finding ways to take control of their finances

Thanks for sharing the positivity!