Alex Cheong Pui Yin

23rd December 2020 - 2 min read

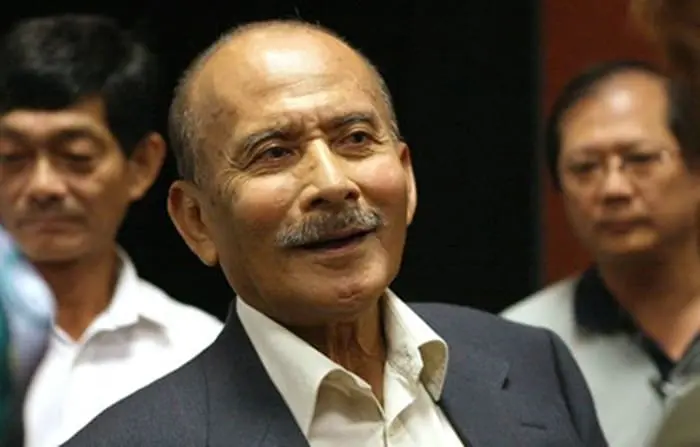

(Image: The Star)

Former inspector-general of police (IGP), Tun Mohammed Hanif Omar has commented that the security system for the banking industry in Malaysia needs to be constantly updated with the latest technology to prevent hacks and intrusions on classified information.

Tun Mohammed Hanif said that although there is no specific or long-term solution to the issue, efforts should still be made to address such threats. “This (hacking of banking systems) is happening all over the world, even in the United States, China, Russia, as well as other countries. No one knows for sure (how to prevent hackers) from obtaining classified information. So, we have to ‘keep up-to-date firewall security’ systems and all this requires huge expenses to ensure the existing system is safe to use,” he stressed.

(Image: Utusan Malaysia)

Tun Mohammed Hanif made this remark following an earlier statement by former hacker Aman Shah bin Ahmad in an exclusive interview with Utusan Malaysia. During the interview, Aman Shah had claimed that the coding in the security systems used by some banks in the country was just a “copy-and-paste” from previous systems. He further criticised some institutions for using open-source software and programmes to build their coding as this is a cheaper alternative, despite it making them more vulnerable to the threats of hackers.

Aman Shah – who was formerly a banking executive at Hock Hua Bank – rose to fame after he carried out an online fraud by transferring 1 sen from every account entrusted to his employer, to his own proxy account in another bank. He was subsequently sentenced to five years in prison in 1990 after being found guilty of criminal breach of trust.

(Source: Bernama)

Comments (0)