Alex Cheong Pui Yin

25th July 2023 - 18 min read

If you’re a Citibank customer, you’ll know by now that Citi has sold its consumer banking business in Malaysia to UOB Bank. Accordingly, UOB has been making preparations since the end of 2022 to migrate Citi’s assets and products into its ecosystem. While UOB has certainly done its level best to keep all stakeholders up to date on its progress, we’re sure that some of you, as outgoing Citi cardholders, may still have questions.

For instance, which UOB credit card are you getting as replacement? Are the benefits of the new card similar to your current Citi card? What about all the other card features, such as the annual fees? In this article, we have the full list of outgoing Citi credit cards in Malaysia, their UOB replacements, as well as the latest perks of the UOB cards – all in one page.

To get things started, here are all the outgoing Citi cards and the UOB cards that they’ll be replaced with – for your quick reference:

| Existing Citi credit cards | Replacement cards from UOB |

| Citi Prestige | UOB Zenith |

| Citi PremierMiles | UOB PRVI Miles Elite |

| Citi Rewards | UOB World |

| Lazada Citi | Lazada UOB |

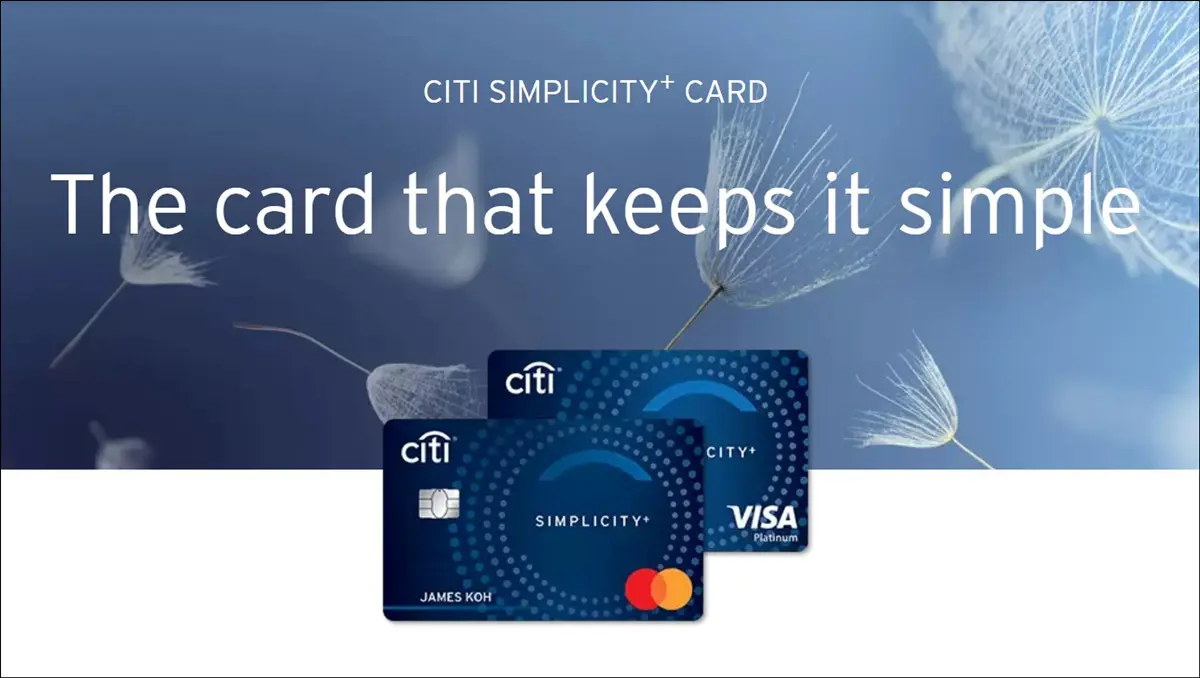

| Citi Simplicity+ | UOB Simple |

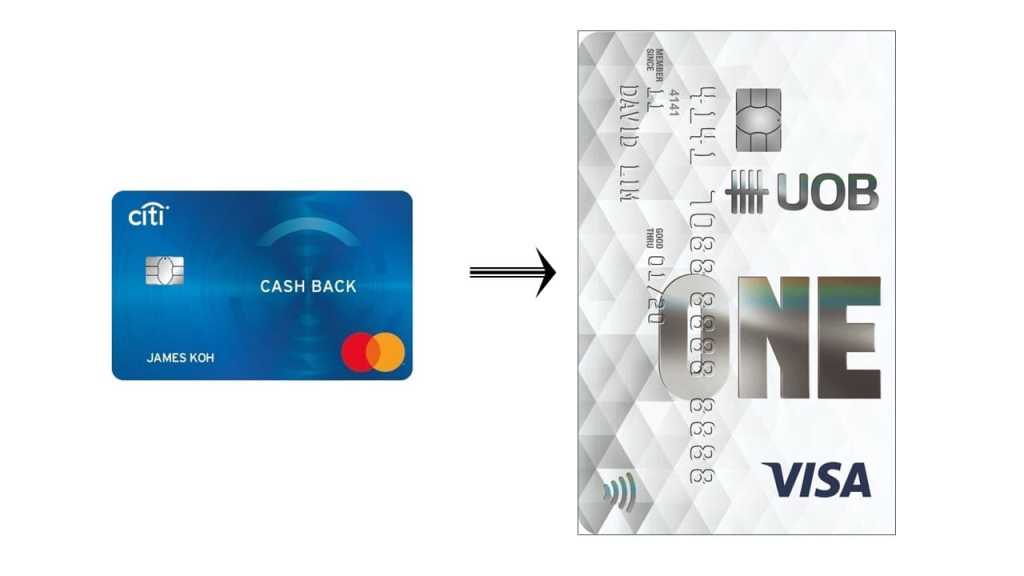

| Citi Cash Back Platinum | UOB ONE Platinum |

| Citi Cash Back Gold | UOB ONE |

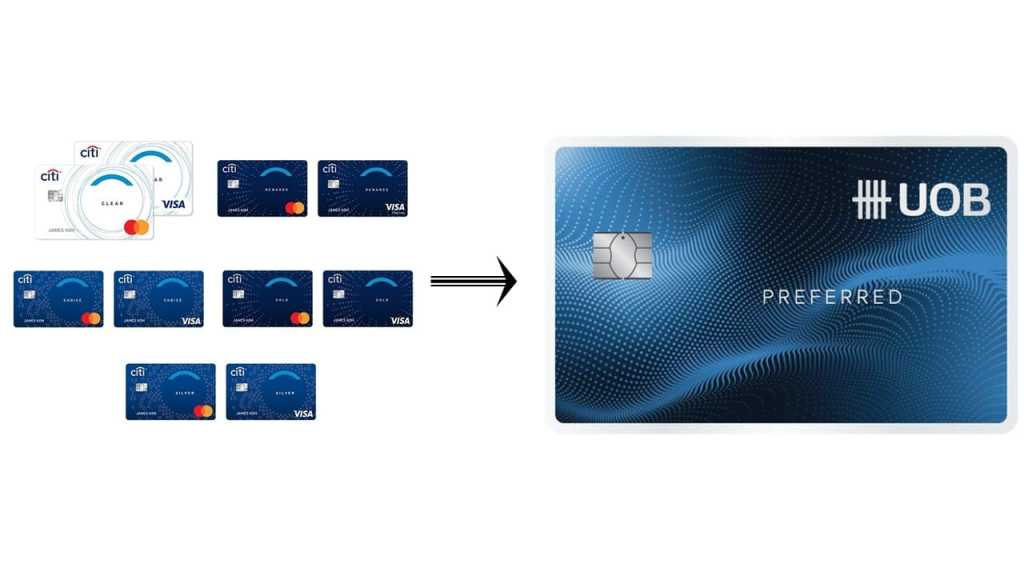

| Citi Clear Citi Rewards Platinum Citi Choice Citi Gold Citi Silver | UOB Preferred |

| Citi Business Platinum | UOB Platinum Business |

Next, we’ll break down the features and benefits of each card, so that you can get a clear comparison and see how your new card will work for you moving forward. To note, we’ll be focusing solely on personal credit cards.

UOB Zenith

Replacement for: Citi Prestige

The UOB Zenith is a brand-new credit card that has been introduced by UOB to replace Citi’s highest tier mass consumer credit card: the Citi Prestige. In addition to being able to earn up to 2x Citi Rewards Points for selected expenses, Citi Prestige cardholders were also able to earn bonus Rewards Points via a Relationship Bonus Programme, as well as enjoy perks like a complimentary fourth night stay at selected hotels and resorts.

Many of these benefits under Citi Prestige have been ported over to UOB Zenith, as you can see below:

| Citi Prestige | UOB Zenith | |

| Card benefits | – 1x Citi Rewards Point for every RM1 spent locally – 2x Citi Rewards Points for every RM1 spent overseas – 1x Citi Rewards Point for every RM1 of easy pay (EPP) transaction on local spend | – 1x UNIRM for every RM1 spent locally – 2x UNIRM for every RM1 spent overseas |

| Other bonuses | – 250,000 Citi Reward Points spend bonus with minimum annual spend of RM240,000 – Up to 40% relationship bonus points based on the length of your relationship with the bank | – 250,000 UNIRM spend bonus with minimum annual spend of RM240,000 – Up to 50% relationship bonus points based on the length of your relationship with the bank |

| Travel & lounge, and insurance perks | – 12x complimentary lounge access per annum via LoungeKey – Complimentary night at international hotels or resorts with a minimum four-consecutive-night stay – Complimentary limo rides home from KLIA Terminal 1 (with minimum three retail transactions made overseas, 30 days prior to redemption) – Exclusive services via Citi Prestige Concierge | – 12x complimentary access to Plaza Premium Lounge (PPL) and its affiliate partners per annum – Complimentary night at international hotels or resorts with a minimum four-consecutive-night stay – Complimentary limo ride home from KLIA Terminal 1 (with three retail transactions made overseas, 30 days prior to redemption) – Exclusive services via UOB Zenith Concierge |

| Minimum annual income requirement | RM192,000 per annum | RM192,000 per annum |

| Annual fees | – Principal: RM1,000 – Supplementary: Complimentary | – Principal: RM1,000 – Supplementary: Complimentary |

UOB PRVI Miles Elite

Replacement for: Citi PremierMiles

Another new card by UOB, the UOB PRVI Miles Elite is set to replace the Citi PremierMiles. However, unlike other UOB cards that have been rolled out – which share almost similar benefits and features with its Citi counterpart, including the point multipliers – you’ll notice that the UOB PRVI Miles Elite card diverges a little from this practice.

This is because Citi PremierMiles cardholders do not earn the usual Citi Rewards Points like other Citi rewards points cards; instead, it utilises a separate system that earns PremierMiles points. UOB, meanwhile, opted to keep to its standard UNIRM rewards points system for the PRVI Miles Elite. As such, UOB has adapted the points earning system of its UOB PRVI Miles Elite card to make up for the differences in points calculations with the Citi PremierMiles.

Here are the full benefits of both cards for your comparison:

| Citi PremierMiles | UOB PRVI Miles Elite | |

| Card benefits | – 1x PremierMile for every RM3 spent locally – 2x PremierMiles for every RM3 equivalent spent in foreign currencies and on selected online travel merchants – 1x PremierMile for every RM3 of EPP transactions on local spend | – 10x UNIRM for every RM1 spent on overseas expenses (no cap) – 5x UNIRM for every RM1 spent on airline expenses (no cap) – 1x UNIRM for every RM1 spent on local transactions |

| Other bonuses | – 10,000 PremierMiles every year with payment of annual fee | – 60,000 UNIRM every year with payment of annual fee |

| Travel & lounge, and insurance perks | – 8x complimentary lounge access per annum to PPL in nine countries and territories – Complimentary limo rides home from KLIA Terminal 1 (with minimum three retail transactions made overseas, 30 days prior to redemption) – Personal accident and travel inconvenience coverage of up to RM300,000 | – 8x complimentary lounge access per annum to PPL in nine countries and territories – Complimentary limo rides home from KLIA Terminal 1 (with minimum three retail transactions made overseas, 30 days prior to redemption) – Personal accident coverage of up to RM300,000 – Special conversion rate for points of 9,000 UNIRM to 1,000 miles |

| Minimum annual income requirement | RM100,000 per annum | RM100,000 per annum |

| Annual fees | – Principal: RM600 (waived for the first three years) – Supplementary: Complimentary | – Principal: RM600 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: Complimentary |

UOB World

Replacement for: Citi Rewards World Mastercard

As the replacement for the Citi Rewards World Mastercard, the UOB World card offers pretty similar perks. For context, Citi Rewards World Mastercard cardholders have the ability to earn up to 12x Citi Rewards Points for selected expenses, spend bonus of 125,000 Citi Rewards Points, and various additional travel perks, like 6x complimentary access to PPL (limited to KLIA Terminal 1 and KLIA Terminal 2 only).

Meanwhile, here’s what the UOB World has to offer – in comparison to the card that it is to replace:

| Citi Rewards World Mastercard | UOB World | |

| Card benefits | – 12x Citi Rewards Point for every RM1 spent on selected e-wallet and online spend (capped at RM300 per merchant per month) – 5x Citi Rewards Points for every RM1 spent at selected departmental stores and supermarkets (capped at RM3,000 per month) – 5x Citi Rewards Points for every RM1 spent overseas (capped at RM24,000 per annum) – 1x Citi Rewards Point for every RM1 spent on local transactions, as well as EPP transactions on local spend | – 12x UNIRM for every RM1 spent on selected e-wallet and online spend* (capped at RM300 per merchant per month) – 5x UNIRM for every RM1 spent at selected departmental stores and supermarkets (capped at RM3,000 per month) – 5x UNIRM for every RM1 spent overseas (capped at RM24,000 per annum) – 1x UNIRM for every RM1 spent on local transactions *same merchants as Citi Rewards World Mastercard |

| Other bonuses | – 125,000 Citi Reward Points spend bonus with minimum annual spend of RM48,000 | – 125,000 UNIRM spend bonus with minimum annual spend of RM48,000 |

| Travel & lounge, and insurance perks | – 6x complimentary lounge access per annum to PPL at KLIA Terminal 1 and KLIA Terminal 2 – Overseas personal accident coverage of up to RM50,000 | – 6x complimentary lounge access per annum to PPL at KLIA Terminal 1 and KLIA Terminal 2 – Overseas personal accident coverage of up to RM50,000 |

| Minimum annual income requirement | RM60,000 per annum | RM60,000 per annum |

| Annual fees | – Principal: RM600 (waived for first three years) – Supplementary: RM150 | – Principal: RM600 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM150 |

Lazada UOB

Replacement for: Lazada Citi

Lazada Citi was a co-branded card between e-commerce platform Lazada and Citi that offered up to 10x Rewards Points on selected expenses, as well as exclusive offers during Lazada’s sales days. You can also use your Citi Rewards Points to offset certain Lazada purchases.

To replace this card, UOB had also signed a memorandum of understanding (MoU) with Lazada to roll out a Lazada UOB card with similar benefits:

| Lazada Citi card | Lazada UOB card | |

| Card benefits | – 10x Citi Rewards Point for every RM1 spent on Lazada purchases and Lazada Wallet top-ups (capped at RM500 per month) – 5x Citi Rewards Points for every RM1 spent on selected online entertainment, lifestyle/online food delivery, telco, and insurance spend (capped at RM500 per month for online entertainment and food delivery, and another RM500 for telco and insurance) – 1x Citi Rewards Point for every RM1 spent on local and petrol transactions – Use Citi Rewards Points to offset Lazada purchases | – 10x UNIRM for every RM1 spent on Lazada purchases and Lazada Wallet top-ups (capped at RM500 per month) – 5x UNIRM for every RM1 spent on selected online entertainment, lifestyle/online food delivery, telco, and insurance spend* (capped at RM500 per month for online entertainment and food delivery, and another RM500 for telco and insurance) – 1x UNIRM for every RM1 spent on local and petrol transactions – Use UNIRM to offset Lazada purchases *same merchants as Lazada Citi card |

| Other bonuses | – 1,000 Rewards Points spend bonus per month with a minimum monthly spend of RM1,500 – Exclusive Lazada offers, including RM28 discount for every Monday, RM8 discount vouchers every month, and free shipping vouchers every Friday | – 1,000 UNIRM spend bonus per month with a minimum monthly spend of RM1,500 – Exclusive Lazada offers, including RM28 discount for every Monday, RM8 discount vouchers every month, and free shipping vouchers every Friday |

| Minimum annual income requirement | RM24,000 per annum | RM24,000 per annum |

| Annual fees | – Principal: RM100 (waived for first three years; annual fee for subsequent years waived with annual minimum spend of RM15,000 during current year) – Supplementary: RM70 | – Principal: RM100 (waived for the first three years under ongoing campaign; annual fee for following years waived with annual minimum spend of RM15,000 during current year) – Supplementary: RM70 |

UOB Simple

Replacement for: Citi Simplicity+

The Citi Simplicity+ was a different type of cashback card that focused on helping you offset some of the finance charges of your purchases and cash advances (and not on your expenses itself). It also comes with no extra fees, including annual fees. Its replacement is the brand new UOB Simple card:

| Citi Simplicity+ | UOB Simple | |

| Card benefits | – 10% cashback on finance charges of your purchases and cash advances every month, if you pay at least the minimum monthly due amount on time (no cashback cap) – No late payment charges – No annual fees – No overlimit fee when you go over your credit limit | – 10% cashback on finance charges of your purchases and cash advances every month, if you pay at least the minimum monthly due amount on time (no cashback cap) – No late payment charges – No annual fees |

| Minimum annual income requirement | RM24,000 per annum | RM24,000 per annum |

| Annual fees | N/A | N/A |

UOB ONE & ONE Platinum

Replacement for: Citi Cash Back Gold & Platinum

The Citi Cash Back card has two variants – Gold and Platinum – both offering the same cashback benefits, namely up to 10% cashback for four categories of essential expenses (petrol, groceries, dining, and Grab transactions). The differences between the two cards lie in the cashback cap and the minimum monthly spend requirement that must be achieved in order to unlock the maximum cashback rate – with Platinum having the higher cap and monthly spending requirement.

Those holding these popular cards will receive the UOB ONE Classic and UOB Classic Platinum as replacement, with the following benefits:

i) Citi Cash Back Gold & UOB ONE Classic

| Citi Cash Back Gold | UOB ONE Classic | |

| Card benefits | Monthly spend RM500 and above – 10% cashback for petrol, groceries, dining, and Grab transactions (capped at RM10 per category) – 0.2% cashback for other retail purchases (no cap) Monthly spend less than RM500 – 0.2% cashback for petrol, groceries, dining, and Grab transactions (capped at RM10 per category) – 0.2% cashback for other retail purchases (no cap) | Monthly spend RM500 and above – 10% cashback for petrol, groceries, dining, and Grab transactions (capped at RM10 per category) – 0.2% cashback for other retail purchases (no cap) Monthly spend less than RM500 – 0.2% cashback for petrol, groceries, dining, and Grab transactions (capped at RM10 per category) – 0.2% cashback for other retail purchases (no cap) |

| Minimum annual income requirement | RM36,000 per annum | RM24,000 per annum |

| Annual fees | – Principal: RM120 (waived for first three years) – Supplementary: RM60 | – Principal: RM120 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM60 |

ii) Citi Cash Back Platinum & UOB ONE Platinum

| Citi Cash Back Platinum | UOB ONE Platinum | |

| Card benefits | Monthly spend RM1,500 and above – 10% cashback for petrol, groceries, dining, and Grab transactions (capped at RM15 per category) – 0.2% cashback for other retail purchases (no cap) Monthly spend less than RM1,500 – 0.2% cashback for petrol, groceries, dining, and Grab transactions (capped at RM15 per category) – 0.2% cashback for other retail purchases (no cap) | Monthly spend RM1,500 and above – 10% cashback for petrol, groceries, dining, and Grab transactions (capped at RM15 per category) – 0.2% cashback for other retail purchases (no cap) Monthly spend less than RM1,500 – 0.2% cashback for petrol, groceries, dining, and Grab transactions (capped at RM15 per category) – 0.2% cashback for other retail purchases (no cap) |

| Minimum annual income requirement | RM60,000 per annum | RM48,000 per annum |

| Annual fees | – Principal: RM195 (waived for first three years) – Supplementary: RM100 | – Principal: RM120 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM60 |

UOB Preferred

Replacement for: Citi Clear, Citi Rewards Platinum, Citi Gold, Citi Silver, and Citi Choice

Finally, UOB has made its UOB Preferred as something of a catch-all replacement card for five Citi credit cards. As such, those holding these Citi cards will need to evaluate if the benefits provided by the UOB Preferred card will still fit their needs. Here are the full comparisons between all the five Citi cards and the UOB Preferred card:

i) Citi Clear & UOB Preferred

| Citi Clear | UOB Preferred | |

| Card benefits | – 3x Citi Rewards Points for every RM1 spent with selected lifestyle merchants (dining and apparel) – 1x Citi Rewards Points for every RM1 spent on other local transactions, as well as EPP transactions on local spend | – 5x UNIRM for every RM1 spent on dining, grocery, and entertainment expenses (up to RM1,000 per category) – 3x UNIRM for every RM1 spent on petrol and recurring spend in selected categories (up to RM500 for petrol, unlimited for recurring spend) – 1x UNIRM for every RM1 spent on any other expenses |

| Other bonuses | – 1-for-1 drink offer at The Coffee Bean & Tea Leaf outlets from Monday to Friday – 1-for-1 movie ticket offer at Golden Screen Cinemas (GSC) on Fridays | – 1-for-1 drink offer at The Coffee Bean & Tea Leaf outlets from Monday to Friday – 1-for-1 movie ticket offer at Golden Screen Cinemas (GSC) on Fridays |

| Minimum annual income requirement | RM24,000 per annum | RM40,000 per annum |

| Annual fees | – Principal: RM90 (waived for first three years) – Supplementary: RM60 | – Principal: RM198 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM30 |

ii) Citi Rewards Platinum & UOB Preferred

| Citi Rewards Platinum | UOB Preferred | |

| Card benefits | – 5x Citi Rewards Points for every RM1 spent on selected expense categories that you opt to subscribe to (shopping, home, travel, petrol, and dining/entertainment – capped at specified amounts) – 1x Citi Rewards Points for every RM1 spent on other local transactions, as well as EPP transactions on local spend (except petrol and other ineligible transactions) | – 5x UNIRM for every RM1 spent on dining, grocery, and entertainment expenses (up to RM1,000 per category) – 3x UNIRM for every RM1 spent on petrol and recurring spend in selected categories (up to RM500 for petrol, unlimited for recurring spend) – 1x UNIRM for every RM1 spent on any other expenses |

| Other bonuses | N/A | – 1-for-1 drink offer at The Coffee Bean & Tea Leaf outlets from Monday to Friday – 1-for-1 movie ticket offer at Golden Screen Cinemas (GSC) on Fridays |

| Minimum annual income requirement | N/A | RM40,000 per annum |

| Annual fees | RM100 for every expense category that you are subscribed to (you may earn free subscription to categories by reaching a minimum annual spend) | – Principal: RM198 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM30 |

iii) Citi Gold & UOB Preferred

| Citi Gold | UOB Preferred | |

| Card benefits | – 3x Citi Rewards Points for every RM1 spent at selected supermarkets and hypermarkets (up to RM3,000) – 1x Citi Rewards Points for every RM1 spent on other local transactions, as well as EPP transactions on local spend | – 5x UNIRM for every RM1 spent on dining, grocery, and entertainment expenses (up to RM1,000 per category) – 3x UNIRM for every RM1 spent on petrol and recurring spend in selected categories (up to RM500 for petrol, unlimited for recurring spend) – 1x UNIRM for every RM1 spent on any other expenses |

| Other bonuses | N/A | – 1-for-1 drink offer at The Coffee Bean & Tea Leaf outlets from Monday to Friday – 1-for-1 movie ticket offer at Golden Screen Cinemas (GSC) on Fridays |

| Minimum annual income requirement | N/A | RM40,000 per annum |

| Annual fees | – Principal: RM195 – Supplementary: RM100 | – Principal: RM198 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM30 |

iv) Citi Silver & UOB Preferred

| Citi Silver | UOB Preferred | |

| Card benefits | – 1x Citi Rewards Points for every RM1 spent on local transactions | – 5x UNIRM for every RM1 spent on dining, grocery, and entertainment expenses (up to RM1,000 per category) – 3x UNIRM for every RM1 spent on petrol and recurring spend in selected categories (up to RM500 for petrol, unlimited for recurring spend) – 1x UNIRM for every RM1 spent on any other expenses |

| Other bonuses | N/A | – 1-for-1 drink offer at The Coffee Bean & Tea Leaf outlets from Monday to Friday – 1-for-1 movie ticket offer at Golden Screen Cinemas (GSC) on Fridays |

| Minimum annual income requirement | N/A | RM40,000 per annum |

| Annual fees | – Principal: RM70 – Supplementary: RM45 | – Principal: RM198 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM30 |

v) Citi Choice & UOB Preferred

| Citi Silver | UOB Preferred | |

| Card benefits | – 50x Citi Rewards Points for every RM50 spent on local transactions | – 5x UNIRM for every RM1 spent on dining, grocery, and entertainment expenses (up to RM1,000 per category) – 3x UNIRM for every RM1 spent on petrol and recurring spend in selected categories (up to RM500 for petrol, unlimited for recurring spend) – 1x UNIRM for every RM1 spent on any other expenses |

| Other bonuses | N/A | – 1-for-1 drink offer at The Coffee Bean & Tea Leaf outlets from Monday to Friday – 1-for-1 movie ticket offer at Golden Screen Cinemas (GSC) on Fridays |

| Minimum annual income requirement | N/A | RM40,000 per annum |

| Annual fees | – Principal: N/A – Supplementary: N/A | – Principal: RM198 (waived for the first three years under an ongoing acquisition campaign) – Supplementary: RM30 |

—

With this list, we hope all Citi cardholders are now clear on which replacement card that they’ll receive from UOB. UOB has also stated that depending on which Citi card you own, you may be sent new UOB cards to you starting from October 2023 – but regardless, now that the migration is completed, your current Citi cards are all UOB credit cards with the new set of benefits.

Note that post-migration, your card number, CVV, and expiry date all do not change, but if you’re making payments to the card from another bank, you’ll need to make payments to UOB (using the same card number) instead of Citi – this also means existing saved/favourite transfers will no longer work.

Aside from that, there are also some notable details that you may want to take note of. For instance, with regard to annual fees of the UOB Preferred card (replacing Citi Clear, Citi Rewards Platinum, Citi Gold, Citi Silver, and Citi Choice), UOB is offering a concession where you are not required to pay the RM198 annual fee of the card. Instead, you only need to pay the highest annual fee of your current Citi cards – although it is not clarified if this is a temporary or permanent arrangement.

On top of that, all Citi Rewards Points previously earned by Citi cardholders – which are evergreen – will also not expire when they are ported over to UOB’s system as UNIRM. New UNIRM earned via the replacement cards, however, will have the usual three-year validity.

Lastly, we’ll continue to keep and eye out and report on any new updates regarding UOB’s migration of Citi’s assets and products, so do check back with us every now and then!

Comments (1)

citi privmiles depreciated so much after migrated to UOB (double on local spend to convert 1k miles)