RinggitPlus

27th April 2022 - 9 min read

Even under regular circumstances, taking steps to future-proof your finances is a good piece of advice that the public should consider. With setbacks brought on by Covid-19 and other calamities – such as the floods that took place since the end of 2021 – it is now more crucial than ever to plan and manage your finances for sustainability.

In this article, I’ll be sharing some insights as to how you can reset your finances and bounce back from financial difficulties that you may be currently facing, as well as other steps you can take moving forward.

Future-proofing your finances

While Malaysia’s financial and economic circumstances are not thriving as well as it once did, this is not the first time that we as a nation have gone through something similar. Some of you may remember the 1997 crisis. Back then, consequences that Malaysia had to bear with included inflation, a rise in unemployment, and an increased cost of living – all of which we are also going through today.

But more importantly, what can we do about the situation moving forward? What are some of the key steps that you should focus on first to future-proof your finances? Here are some ideas from me.

1) Build an emergency fund

For those who have been more severely impacted by the pandemic and the floods, and have a smaller amount of accessible savings, I would advise you to start by rebuilding your emergency fund. This is to ensure that you’ll able to support yourself through any emergencies that you may encounter in the future.

Try to keep at least three to six times of your total expenses for your emergency fund. For example, if your monthly expenses come up to RM5,000 per month, then do your best to save up to about RM 15,000 to RM 30,000. As for those who are starting from scratch – without an existing emergency fund – you can begin by putting aside RM 100 to RM 1,000 each month. Any amount saved will go a long way in covering future emergencies.

2) Choose the right savings instruments

On that note, what would be a good place for you to keep your emergency fund, given the fact that different savings instruments will offer different benefits?

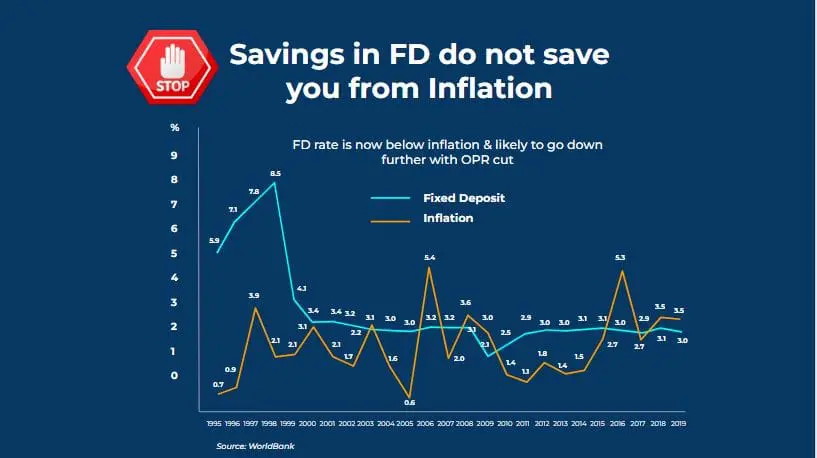

Off the bat, I would advise you against keeping your emergency fund in savings, or even fixed deposit (FD) accounts. While FDs used to offer fairly good returns back in the 90s, it is now less likely to save you from the effects of inflation. As you can see from the graph below, there have been instances in the past where the FD returns on average have not managed to beat the inflation rate. This means the value of your savings could steadily erode with time.

Ultimately, the most suitable savings or investment instrument for your emergency fund should meet three criteria:

Must be very low risk

Ensure that the investments are not of high volatility. High-risk investments may offer you the chance of higher returns, but you may not be comfortable with the higher probability of loss too.

Must be a liquid asset

Emergency funds are kept for urgent occasions. For this reason, it must be a liquid asset – meaning you need to be able to withdraw your money as soon as you need it. The timeline that you should look at is within a day. You can also try keeping your emergency fund in a low-risk liquid account that can earn you interest at the same time.

Must beat inflation

Finally, the savings instrument for your emergency fund must be able to beat inflation, or you will lose out in the long term. As I’ve mentioned earlier, FDs have not been able to do so in recent days, which means you should look for an alternative.

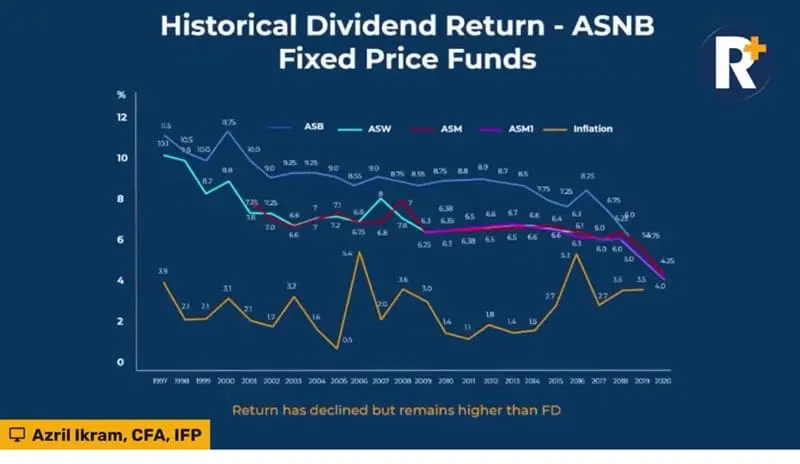

Given the three criteria mentioned, there are a few assets that you can consider – and one of the most favourable options is the fixed price unit trusts offered by Amanah Saham Nasional Bhd (ASNB). These include funds such as the Amanah Saham Bumiputera (ASB), Amanah Saham Bumiputera 2 (ASB2), and Amanah Saham Malaysia (ASM).

To give you an idea of the returns that you can reap via these funds, here’s a graph that shows you their historical performance:

As you can see, the returns from these ASNB fixed price unit trust funds are all quite high. What you get is a consistent return above inflation. Of course, that’s not to say that ASNB funds will always perform above the inflation rate; there’s also a declining trend, and you will need to constantly monitor this from time to time.

3) Invest in undervalued assets with long-term horizon

For those with a bit more funds to spare, you can then begin to think about investing in long-term assets that can potentially give you higher returns. For this occasion, I’ll focus on property, equities, and alternative assets as they have been of more interest to the public as of late.

Property/Real estate

The market is at a level of oversupply that we have not seen before; in 2020, we recorded surplus of 50,000 unsold units, with fairly little improvement in 2021. As such, this is a good time for you to look at undervalued properties as a form of investment. Make sure to do your due diligence and review your options, as well as ensure that your mortgage does not take up more than 30% of your monthly income.

Additionally, abide by the Rule of 200 in terms of return and rental if you’re planning to rent your property out. Here’s how it works: If you purchase a property at RM500,000, rent your house at a minimum of RM2,500 (RM500,000 divided by 200). This way, you’ll get a 5-6% rental return at the very least, allowing you to support the mortgage payment and other associated costs.

Equities

Another asset that you can also consider looking at is equities. Typically, the equity market will grow in tandem with the recovery of the economy, so this is a good opportunity to get a head start. It is, however, important that you select equities that provide you with sufficient diversification and exposure to the global market. Quite unfortunately, a majority of Malaysians have 70-80%, even up to 90% of their assets that are grounded locally (inclusive of their properties, Employees Provident Fund (EPF) savings, FDs, and other investments).

Diversification of your equity investments can be done in various ways, one of which is by opening a brokerage account that lets you directly invest in global markets, such as the United States and China. Alternatively, you can buy trust funds that invest globally, as well as exchange-traded funds (ETF) that are available on robo-advisors.

Alternative assets

Finally, those who are a bit more adventurous can consider investing in alternative assets. Many have cropped up over the past few years as a result of fintech advancement, with some interesting ones being cryptocurrencies, peer-to-peer (P2P) investments, and equity crowdfunding.

My advice is to ensure that only about 10% of your portfolio is dedicated to alternative assets; this will help you to mitigate risk to a certain level. And most importantly, invest only in assets that you know and understand well; avoid succumbing to fear-of-missing-out (FOMO) sentiments and making investments because of your family and friends.

4) Invest intelligently with the right allocation

Most of the assets available to investors can be categorised under one of the following four groups:

- Commodities: Gold, silver, oil, etc.

- Stable assets: Bonds, EPF, ASNB fixed price unit trusts

- Growth assets: Shares, ETFs, other equities

- Alternative assets: Cryptocurrencies, derivatives, P2P investments, equity crowdfunding

How should you allocate your investments based on these four groups though? Should most of your portfolio go into stable assets, or growth assets? Or should you focus on commodities instead, just to be safe? Well, you can use the Rule of 100 to give you some guidance.

To clarify, we use the Rule of 100 to help our clients estimate the percentage of their portfolio that should be dedicated to growth assets. Here’s how it works: assuming that you’re now 30 years old, the Rule of 100 requires you to minus your age (30 years) from 100, giving you 70. This means that if you’re willing, you can reasonably tolerate the risk of allocating 70% of your portfolio into growth assets. Meanwhile, the remaining 30% can be invested in stable assets and commodities (including your EPF savings, ASNB investments, etc).

If you’re looking to gain exposure in alternative assets as well, then make sure to reduce some of the allocations in your growth assets as these two groups pose pretty high risk. So taking the above example again, a 30-year-old who wishes to also invest in alternative assets can dedicate 60% of his portfolio to growth assets, and 10% to alternative assets (total 70%). Again, I wouldn’t recommend more than 10% of exposure to alternative assets, although the final decision is up to you.

Correspondingly, as your age increases, the Rule of 100 dictates that the amount invested in growth assets (and alternative assets) should reduce. Instead, you should invest more in stable assets.

***

With this, I hope that you’ve gained some idea as to how you can begin to manage your finances more effectively for the future. If you’re convinced enough to take some of the above steps, I’d recommend for you to start as soon as you can. For more in-depth thoughts on this topic, here’s the full discussion for you:

This article was contributed by Azril Ikram, a licensed financial planner with RinggitPlus Financial Planner, a 1-to-1 financial planning service. RinggitPlus Financial Planner covers your everything from tax efficiency all the way down to wealth planning and retirement savings.

Comments (0)