Pang Tun Yau

2nd December 2021 - 9 min read

Investing in crypto wasn’t something I had planned. I had a good job in a multinational company and a career my 17-year-old self would have been shocked at. But in mid-2020 quite a lot changed – around the world, and for me.

Within the span of two months I was no longer employed (thankfully with a solid VSS), and found myself with a lot of time to spare while I work out my next move. During that time, I met with some friends who were full-on “cryptobros” – new-age investors who shy away from the traditional investment norms and instead focus on the thrilling world of cryptocurrencies. After an extensive explainer, they mentioned that I can get a head start by investing in Luno, a cryptocurrency exchange, thanks to a generous RM150 bonus just by buying RM1,000 in crypto.

Thus began my cryptocurrency adventure. Being a passive investor, I usually invest in unit trusts and into blue chip stocks, so the world of crypto was an epic culture shock – I couldn’t wrap my head around so many things, but over time, I learned a lot.

Of course, my knowledge and experience is nowhere near what many “cryptobros” have, but over the past year, here are six of the most important things I learned when investing in cryptocurrencies.

1) Invest only what you can afford to lose

One of the first – and most painful lessons – in my crypto journey. I usually allocate a sum of money aside for investments, but being new to the crypto market’s volatility meant more panic selling and FOMO buying than I’d like to admit. It sure wasn’t fun seeing a coin drop 30-40% and you panic sell to cut further losses only to see a massive rebound mere hours later. Every crypto buddy I know has a story to tell about this – different coin, different time, same outcome.

Thankfully, since I usually do dollar cost averaging (DCA) by setting aside some funds for investments each month, my initial losses were contained somewhat, and I quickly learned to set larger stop-loss points for some coins – and simply HODL for the big tokens.

2) Learn to love volatility

The wild swings in the crypto market can really scare the living daylights out of you if you’re not used to it – 24-hour swings of 10% up or down are common across many coins. Then there are the “flash crashes”, where the entire market just plunges for no reason before recovering as quickly as it happened; you never forget your first. These are classic examples of the high levels of volatility in the crypto market, and if you’re going to invest in crypto you better learn to live with it.

Over time, I realised that the volatility within the crypto markets ultimately present buying opportunities. And if I so wished, they are also incredibly profitable swing trade opportunities (but alas, my TA skills are non-existent). So I did what every cryptobro preaches: buy the dips, and if the dips dip deeper, just keep buying and tell yourself you’re in it for the tech! (By the way, prudent DCA is great here too – I try to top up at every 10% drop, with larger amounts the further down it goes.)

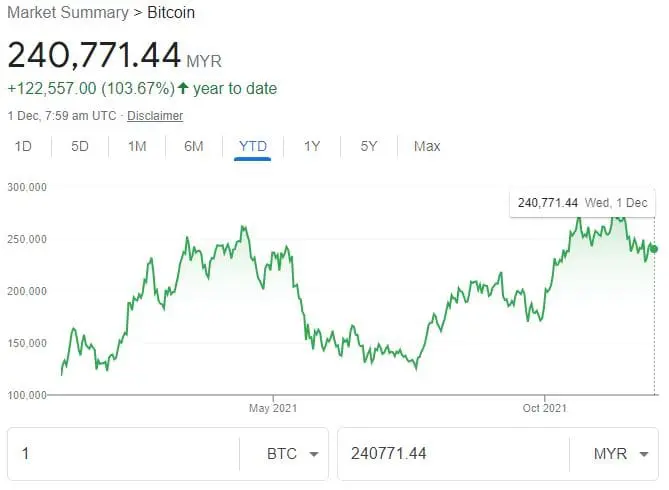

Oh, and one more thing – volatility isn’t just measured over 24 hours, but over longer periods of time. Take Bitcoin prices in 2021, for example. In May it peaked at over US$60,000 before the major crypto correction sent its prices plunging to just above US$28,000 in July – that’s more than a 50% drop in just over a month. And of course, with every correction comes a rebound…though in recent months, it was more of a bullish market where many tokens saw double-digit gains. Bitcoin’s new all-time high was hit in mid-November at US$68,500 – almost a 150% gain from this year’s bottom. Compare that to the equities market, where a +20% annualised return is considered outstanding!

3) Manage expectations

When I first started out, the culture shock was real – from the exchange markets that never sleep, the altcoin (alternative coins, i.e. coins that are not Bitcoin) space where 1000% gains overnight is just as possible as 99% losses, the “flash crashes” with the long red candles followed by longer green candles, and not forgetting the “rug-pull” projects – it’s quite clear that this is not like any other asset class I was used to, and definitely not an investment that will grow overnight.

Over time, I learned to temper the excitement, not to FOMO, and most importantly, be able to disengage from crypto whenever needed. I knew what my risk appetite was and while the potential 10x gains were always there, the chances of being caught bagholding (holding a token worth a fraction of its value) are just as high – so no aping into Shiba Inu or Safemoon for me!

After a few months into my crypto journey, I saw that the crypto market shares some parallels with the equities market. You have your blue chips like Bitcoin and Ether, “growth equities” like Solana and Cardano, “high-yield stocks” like Pancakeswap (yes it’s a weird name, I know), and your penny stocks (aka pump and dump stocks) as well. Which leads me to my next point…

(Note: several of the tokens mentioned above are digital assets that are not approved by the Securities Commission of Malaysia. Currently, the only digital assets approved are Bitcoin (BTC), Ether (ETH), Ripple (XRP), Litecoin (LTC), and Bitcoin Cash (BCH)).

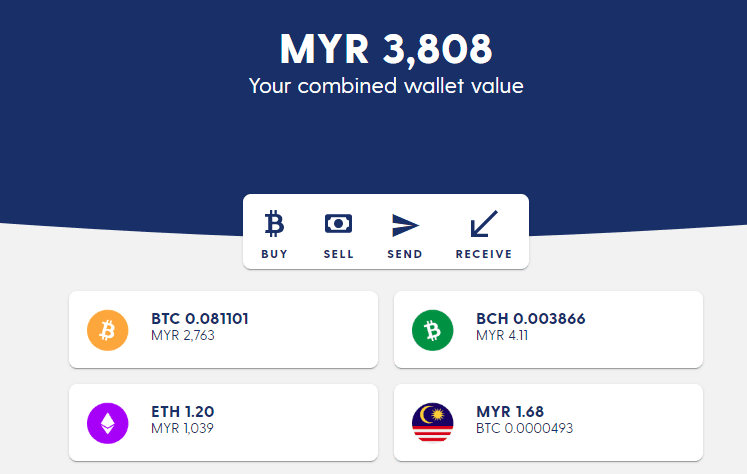

4) Build a portfolio

For every “Dogecoin millionaire” who makes headlines, there’s a Crypto Pauper who lost it all on an extremely risky bet. You’ll never hear of them, because that’s not as compelling a story as a guy who put his life savings into crypto and still have a happy ending.

Just as you would build a portfolio of unit trust funds and stocks, you should also build a portfolio of crypto tokens that can not only spread your risk across several tokens, but also expose you to potentially higher gains. As I shared in the previous point, it’s not easy for Bitcoin’s prices to move up in the same way as other tokens like Cardano or even Ether can – Bitcoin’s return year-to-date (YTD) stands at 103.02%, but for the same time period, Cardano’s return is a whopping 851.59% and Ether is up 578.64%. Even the opinion-splitting Ripple token is up 330.24% YTD. And if you’re curious, Dogecoin’s YTD returns are an eye-watering 3943.20%. (returns calculated as of 1 December 2021)

So build a portfolio of tokens, and if you’re feeling adventurous, spare a few percent of your portfolio for so-called meme coins that might tank or fly to the moon. But remember, at the end of the day, your portfolio should always match your risk appetite.

5) The crypto community is entertainingly self-deprecating

As a fledgling cryptobro, I try to stay in the loop by joining various crypto group chats on Telegram, and regularly browse Reddit and other forums. And that’s both good and bad.

What I genuinely love about the crypto community isn’t the analysis or predictions or even sharing of new projects, but the banter of a group of individuals who in real life may have absolutely nothing in common – and yet share a common bond through their journey in crypto investing. It’s wholesome, even if the jokes are about losing all their money in crypto and having to flip burgers at a fast-food chain.

But just as how there are stock market gurus, there are crypto gurus who spend their day shilling about their favourite token and giving detailed analyses on why “it’s just a matter of time” for this project to take off and make them rich (not to forget their favourite “have fun staying poor” line if you don’t listen to them).

They may be right or they may be wrong, but should you trust a random stranger on the internet with your hard-earned money? You already know the answer.

6) The “Cryptoverse” is exciting, but has its own set of risks

As I read more into what the thousands of projects are doing with blockchain technology, it was clear that cryptocurrencies are more than just DeFi (decentralised finance). The cryptoverse may be over a decade old, but we’re still only scratching the surface of the realm of possibilities where blockchain technology can, quite literally, revolutionise entire industries. We’re seeing it already in the financial industry, and now into gaming – what else can be next? Then again, whether a project can actually do so, of course, is another matter altogether.

So if you’re like me from one year ago and are interested in starting your own crypto adventure, it’s better to start off on a safe and regulated platform such as Luno. You have the assurance of investing on a platform that is approved by the Securities Commission, and its layout can be tweaked to be more beginner-friendly to make it less daunting. It’s also got its own community with regular activities that aim to educate investors.

Looking back, this journey is just the start for me. I may not have as much time now that I’ve got a new job (thankfully not at a fast-food joint), but I’m quite happy to have taken the plunge into crypto and the knowledge gained. I’ve learned a lot, which makes me confident to hold on to my crypto investments with diamond hands as a long-term investment alongside other traditional ones. Maybe one day, I’ll actually get to choose the colour of my Lambo, too.

*****

This article was contributed by a friend of the editorial team who wishes to remain anonymous. The views expressed in this article are of the contributor’s own opinions and do not represent an official viewpoint from Luno.

Comments (3)

Thank you for sharing such an engaging and educational post. It’s great to learn from personal experiences like these. For those who want to learn more about the best cryptocurrency in India, this blog is a valuable resource. Keep posting such wonderful content!

Thank you for your kind words! I’m glad you found the post engaging and informative. I agree, personal experiences can offer valuable insights. I’m happy to hear that the blog has been helpful, and we’ll continue to share more content like this. Stay tuned for more updates!

Good sharing and content ….keep it up.