Christina Chandra

21st March 2025 - 6 min read

Freelancing in Malaysia is bigger than ever in 2025, and it’s not just limited to designers or writers anymore. With the rise of AI tools, social media, and digital businesses, more people are finding ways to earn an income on their own terms. Whether it’s selling on TikTok, running an online store, or offering niche services, freelancing has become a viable career option.

At the same time, with the increasing cost of living, many Malaysians are turning to freelancing as a way to supplement their income. If you’re freelancing, staying on top of your tax obligations is crucial to ensure you’re not paying more than necessary while also keeping things compliant with the authorities.

Government Support For The Gig Economy

The Malaysian government has ramped up its efforts to support gig workers in recent years. One of the key developments is the establishment of the Gig Workers Commission (SEGiM), which aims to oversee and protect gig workers. Additionally, the Gig Workers’ Economy Bill, tabled in December 2024, is designed to offer better financial security for freelancers. This includes facilitating EPF contributions and ensuring that freelancers have access to 24-hour social security coverage. These initiatives reflect the government’s growing recognition of the gig economy and the need for stronger protections for freelancers.

If you’ve been freelancing—either full-time or part-time—you may have questions about how to handle your taxes. Do you need to file taxes even if you don’t have an official employer? What forms should you use? How is the process different from a salaried employee? Here’s everything you need to know about filing taxes as a freelancer in Malaysia.

What Is Considered Freelance Work?

Freelancers fall under the category of self-employed individuals, meaning their income is directly tied to the profits of their work. This includes gig economy workers such as e-hailing drivers, delivery riders, content creators, online sellers, and independent service providers. The Malaysian government officially recognises freelancers as self-employed individuals, which means they qualify for schemes like the Self-Employment Social Security Scheme (SESSS), offering benefits similar to salaried employees.

Do Freelancers Need To File Taxes?

Yes. If your annual income exceeds RM37,333 after EPF deductions or if you already have a registered tax file, you are required to file your taxes. This applies whether you work full-time as a freelancer or earn extra income through side gigs.

Is The Tax Filing Process Different For Freelancers?

Freelancers follow a slightly different tax filing process compared to salaried employees. Here are the key differences:

EA Form

Salaried employees receive an EA Form from their employer, summarising their income and deductions for easy tax filing. However, freelancers must calculate their own earnings by keeping track of invoices and expenses. This makes proper bookkeeping essential to ensure an accurate tax declaration.

Monthly Tax Deduction (MTD)

Employees have a portion of their salary automatically deducted each month for tax purposes under the Monthly Tax Deduction (MTD or PCB) system. This allows them to spread out their tax payments over the year. In contrast, freelancers must pay their taxes in a lump sum at the end of the year, which can be a significant amount. To avoid financial strain, it’s advisable for freelancers to set aside a portion of their income for tax payments throughout the year.

Which Tax Form Should Freelancers Use?

- BE Form: If you have not registered a business, you will file your taxes using this form.

- B Form: If you have registered your freelance work as a business with SSM, you will need to use this form instead.

How to Declare Your Freelance Income

Part-Time Freelancers

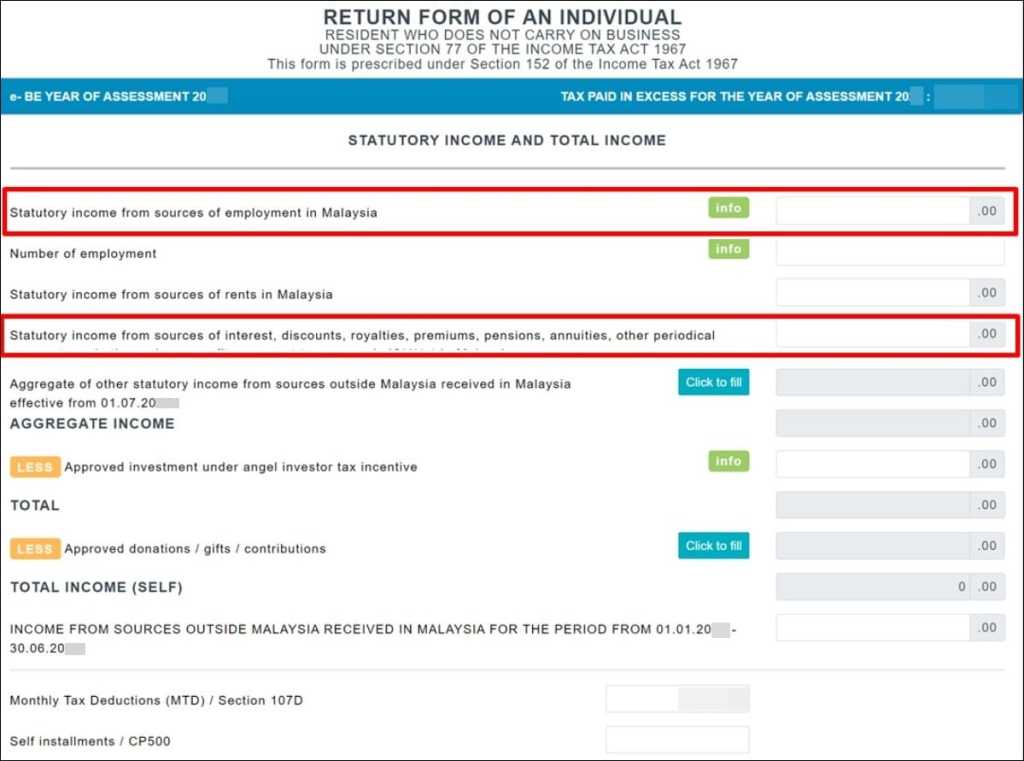

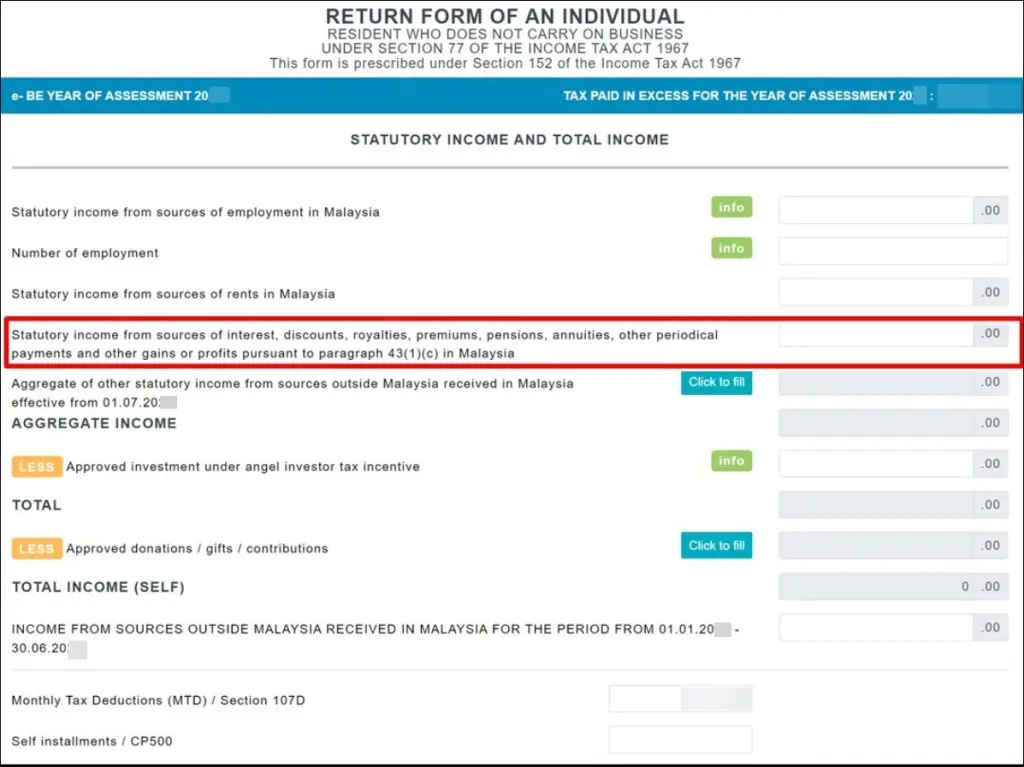

If you freelance on the side while working a salaried job, you need to report your primary employment income under “Statutory income from employment” on the BE form. Your freelance income should be declared under “Statutory income from interest, discounts, royalties, pensions, annuities, other periodical payments, and other gains and profits.”

Full-Time Freelancers

Full-time freelancers will report all their earnings under “Statutory income from interest, discounts, royalties, pensions, annuities, other periodical payments, and other gains and profits” on the BE form as well. Since they do not have an employer, they do not need to provide an employer’s number or employment details. This is only applicable if you have not registered your freelance business.

Tax Exemptions, Deductions, and Reliefs for Freelancers

While most freelance earnings are taxable, there are certain exemptions you may qualify for:

- Up to RM10,000 for the publication of artistic works, recording discs, or tapes.

- Up to RM12,000 for the translation of books and literary works.

- Up to RM20,000 for the publication of literary works, original paintings, or musical compositions.

- 50% exemption on statutory income derived from research findings that have been commercialised.

Additionally, full-time freelancers can reduce their taxable income by contributing to SESSS or the EPF Voluntary Contribution (i-Saraan) program, which functions similarly to SOCSO and EPF for salaried workers.

What About Foreign Freelance Income?

Initially, under Budget 2022, the Malaysian government proposed taxing foreign-sourced income received in the country. However, Budget 2025 has introduced a new exemption that extends until December 2036. To qualify for this exemption, freelancers must meet the following conditions:

- The income must be taxed in the country where it was earned.

- Proof must be provided that the income comes from business operations conducted outside Malaysia.

For freelancers working with foreign clients, it’s essential to keep proper documentation, such as invoices and receipts, to ensure tax compliance.

Do You Have To Register Your Freelance Work as a Business?

No, freelancers in Malaysia don’t have to register a company. You can operate as an individual without any issues.

But registering your freelance work as a business with Suruhanjaya Syarikat Malaysia (SSM) can open up more tax deductions. As a registered business, you may be able to claim expenses related to your work, such as equipment, software, and utilities, as business costs.

The registration fees for a sole proprietorship are:

- RM30 for a business under a personal name.

- RM60 for a business under a trade name.

Final Thoughts

Filing taxes as a freelancer may seem daunting, but keeping proper records and understanding available deductions can help you save money. If your tax situation is complex, consider hiring a tax consultant to maximise your benefits and ensure compliance with LHDN regulations. Staying informed and keeping track of the latest tax updates will help you manage your finances effectively as a freelancer.

You can also check out our other tax articles for this year, including:

Malaysia Personal Income Tax Guide 2025 (YA 2024)

Comments (0)