Christina Chandra

28th March 2025 - 3 min read

As Malaysia continues its economic recovery, individuals who have changed jobs or faced unemployment in 2024 may have questions about the tax-filing process for the Year of Assessment (YA) 2024. This article aims to address these concerns and provide updated information relevant to tax filing in 2025.

If You Changed Jobs in 2024

The tax-filing process for individuals who changed jobs in 2024 remains largely consistent with standard procedures, with some additional considerations.

Similar Process, but with Extra EA Forms

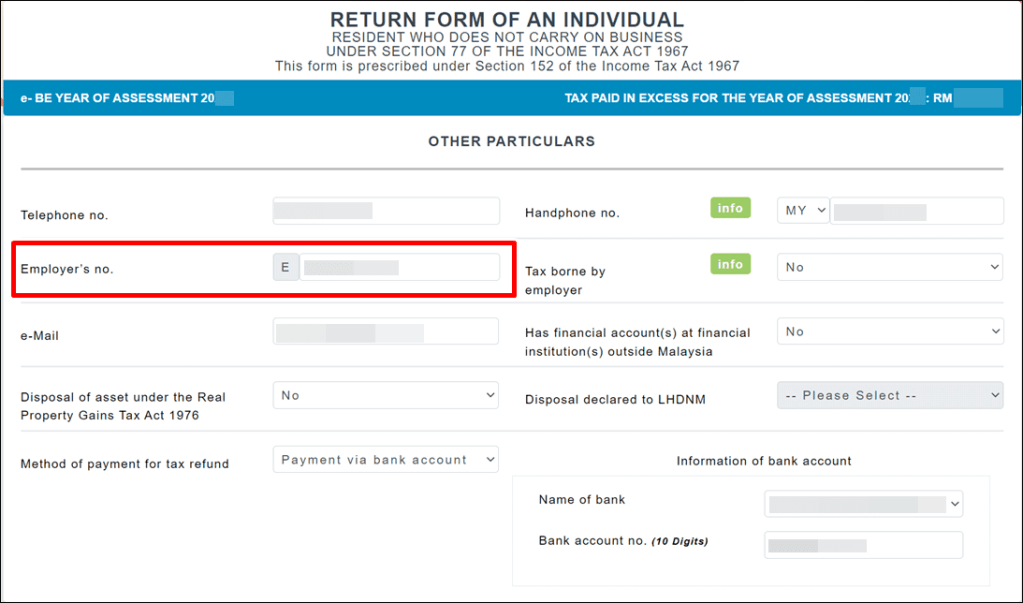

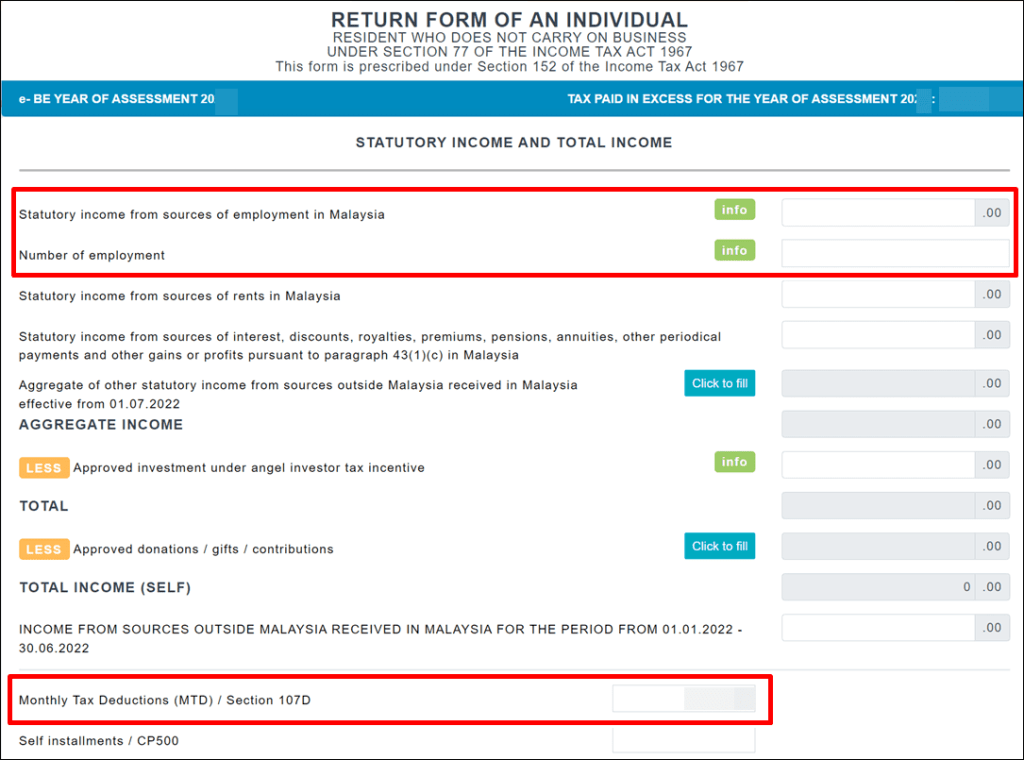

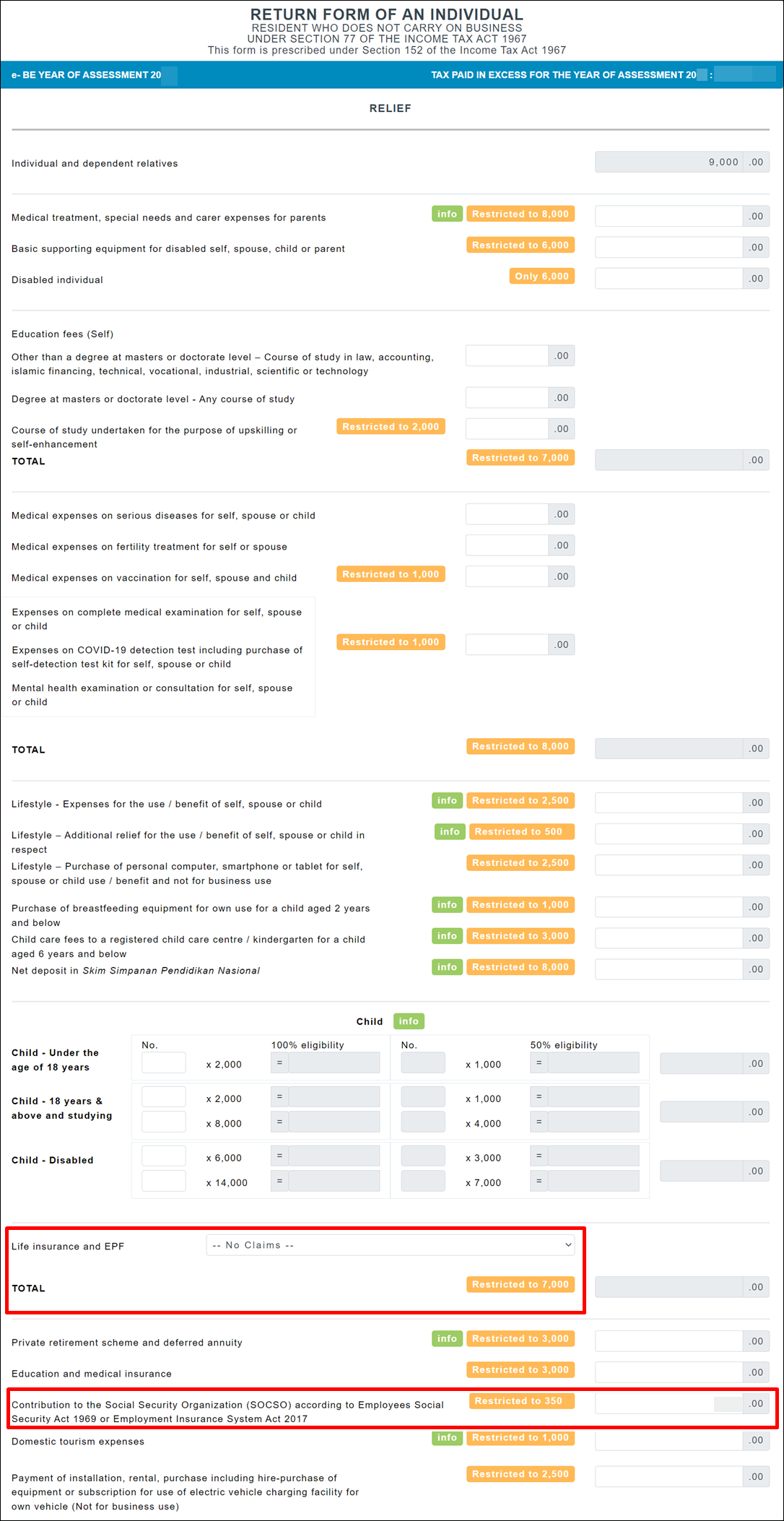

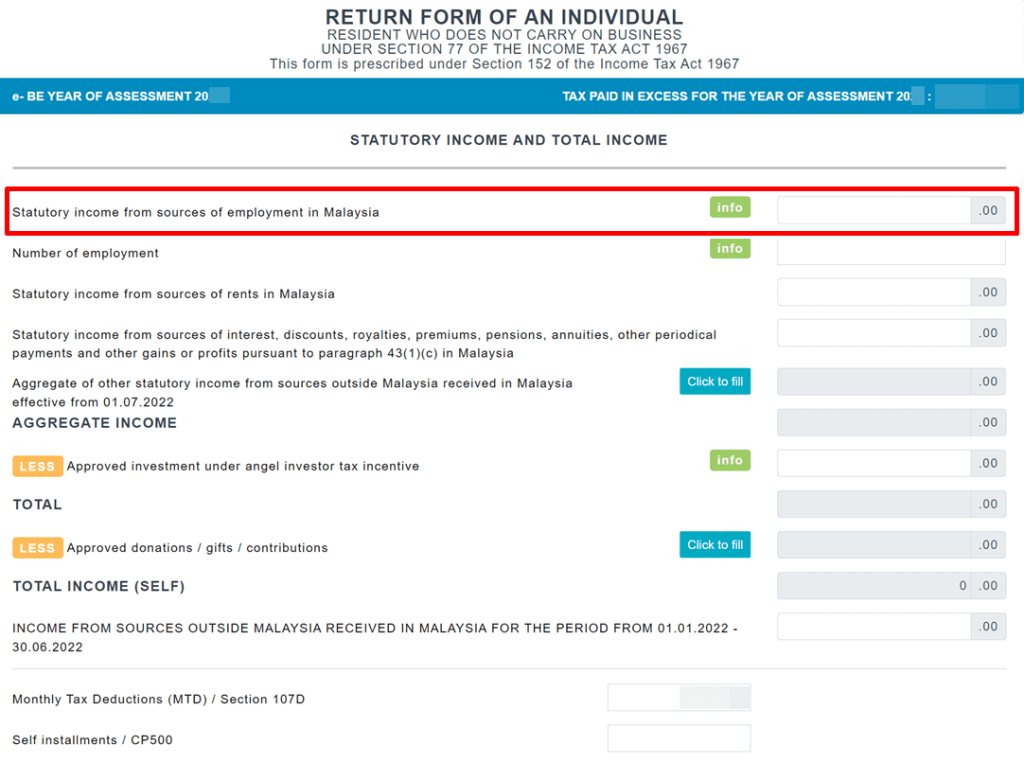

When you’ve had multiple employers in a single assessment year, you’ll need to consolidate the total income earned from all employers into a single BE form. To facilitate this, obtain EA forms from each of your employers, as they are legally required to provide them. These forms summarise essential information such as total income, Employees’ Provident Fund (EPF) contributions, Social Security Organisation (SOCSO) contributions, and monthly tax deductions. When completing your BE form, add together the respective amounts from all EA forms. Additionally, update your employer’s tax number (E Number) to reflect your current employer.

What If You Didn’t Receive Your EA Form from a Previous Employer?

If you haven’t received an EA form from a previous employer, you can still file your taxes by gathering the necessary information from your salary slips, EPF, and SOCSO statements for the assessment year. This approach requires meticulous record-keeping to ensure accuracy. It’s advisable to follow up with former employers to obtain your EA form before resorting to manual calculations.

If You Were Retrenched or Unemployed in 2024

Individuals earning a minimum of RM37,333 after EPF deductions are required to file taxes. If you were retrenched or unemployed during 2024 and your income fell below this threshold, you are still obligated to file your taxes if you have a registered tax file. This is particularly important as compensation for loss of employment is considered taxable income, though certain exceptions may apply.

Compensation for Loss of Employment

According to the Inland Revenue Board of Malaysia (LHDN), compensation for loss of employment includes payments made by employers upon termination, such as salary in lieu of notice, breach of contract compensation, and severance payments. A portion of these compensations may be exempted from tax under specific conditions:

- Full Exemption: If termination is due to ill health, the compensation is fully exempt from tax.

- Partial Exemption: An exemption of RM10,000 is granted for each completed year of service with the same employer or companies within the same group.

Filing Your Taxes as an Unemployed Individual

The tax-filing process for unemployed individuals mirrors the standard procedure. Include the compensation amount as part of your statutory income from employment, deducting the allowable exemption before reporting. Ensure you retain all relevant documents, such as termination letters, contracts, payslips, and EA forms, to substantiate the compensation received.

Mandatory e-Filing for YA 2024

Starting from YA 2024, LHDN mandates that all taxpayers submit their Income Tax Return Forms electronically via the MyTax portal. Manual and paper-based submissions are no longer accepted, streamlining the process and reducing errors.

Key Deadlines for YA 2024 Tax Filing

- Form BE (Individuals with employment income): Due by April 30, 2025, for manual filing; May 15, 2025, for e-Filing.

- Form B (Individuals with business income): Due by June 30, 2025, for manual filing; July 15, 2025, for e-Filing.

By understanding these updates and preparing accordingly, you can navigate the tax-filing process for YA 2024 with greater confidence and ease. Need a more comprehensive guide to file your taxes, check out Malaysia Personal Income Tax Guide 2025 (YA 2024)

Comments (0)