Alex Cheong Pui Yin

7th January 2022 - 3 min read

The Malaysian Institute of Economic Research (MIER) has joined several other entities in opposing the call for yet another round of Employees Provident Fund (EPF) withdrawal, this time to help cope with the recent flooding happening across the country.

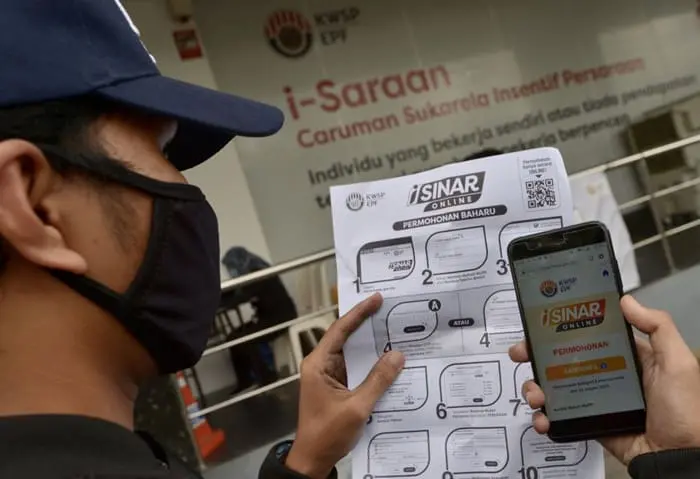

According to MIER, such EPF withdrawals – namely the i-Lestari, i-Sinar, and i-Citra facilities – should be guided by sound economic reasoning, and were only ever meant to be short-term measures. It also emphasised that they must never be repeated.

“The EPF is not designed to deal with calamities and pandemics, rather, it is intended to ensure that its contributors enjoy a decent life after retirement. This is compounded by the fact that Malaysia is fast becoming an ageing society. Malaysia is just nine years short of becoming an aged nation in 2030, and further EPF withdrawals will put additional pressure on the future cost of healthcare, income security, and a post-retirement income stream,” the organisation said.

MIER also highlighted the regretful consequences of the three EPF schemes, which saw approximately RM101 billion of retirement savings withdrawn. While the facilities may have provided some financial relief for present concerns, they also resulted in the severe depletion of retirement funds for many EPF members, it said.

MIER further suggested some short-term and long-term measures moving forward. “To address the short-term fiscal constraints Malaysians face, there is a strong economic justification for the government in providing sufficient unconditional cash assistance to the households and firms,” it said.

Meanwhile, long-term measures include adjusting employers’ EPF contribution rate without increasing their labour cost burden. “The government can marginally increase employers’ contribution rate for workers above a specific threshold limit and simultaneously decrease the rate for those below the threshold level,” said MIER.

Additionally, the organisation noted that the government should also consider broader social protection and social safety net strategies. For instance, contingency plans and schemes should be put in place to help with calamities and other crises. Other alternatives include starting a disaster relief fund and strengthening the coverage and adequacy of social protection for Malaysians, particularly for the self-employed and those in the informal sector.

“The recent past has taught us that we, as a nation, cannot be complacent since emergencies and other unexpected disasters can occur. The burden of these events is usually worst felt by those who are least prepared to face them, and they need the government’s support to rebuild their lives,” MIER stressed.

Aside from MIER, several other individuals have also stepped up to counter recent requests to allow another one-off i-Citra withdrawal of RM10,000. These include the Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz, who emphasised that the EPF should not be seen as a solution to every challenge faced, as well as economist Prof Dr Barjoya Bardai. The EPF also warned that there will be “an erosion of trust” and dire consequences on Malaysia’s capital markets if it were to permit more withdrawals.

(Source: Malay Mail)

Comments (0)