Alex Cheong Pui Yin

1st November 2021 - 4 min read

The Employees Provident Fund (EPF) has expressed concern that 73% – equivalent to nearly three quarters of its members – are at serious risk of not having enough funds to retire above the poverty line. This is following their use of special withdrawal facilities, namely i-Lestari, i-Sinar, and i-Citra.

Briefly, the i-Lestari, i-Sinar, and i-Citra were rolled out separately over 2020 to 2021, with the aim of helping the public to cope with their financial struggles during the Covid-19 pandemic. The special facilities allowed EPF members to make pre-retirement withdrawals from their Akaun 1 or Akaun 2, provided they meet certain eligibility criteria. Meanwhile, Malaysia’s poverty line income (PLI) is currently set at RM2,208, raised from RM980 after the publication of the Household Income And Basic Amenities Survey Report 2019.

“While they (the exceptional withdrawals) provided some financial relief to members during the pandemic and various MCOs, the withdrawals have inevitably led to 6.1 million members now having less than RM10,000 in their EPF accounts, of which 3.6 million have less than RM1,000, leaving them vulnerable and unprotected for their retirement,” shared the EPF in a statement, adding that members will need to work an extra four to six years to rebuild the savings that were withdrawn during the pandemic.

Moreover, the EPF said that the drop in savings is especially worrying for bumiputera members as they make up 78% of the withdrawal applicants (equivalent to more than three quarters). “As a result, 4.4 million – or 54% bumiputera members – now have less than RM10,000, and 2 million – or 25% – have less than RM1,000,” it stated.

The EPF also reiterated that there has been a significant drop in the percentage of members who are able to meet the basic savings threshold, from 36% in 2020 to an estimated 27% by the end of 2021. Worse, the EPF also noted that the distribution of savings has become fairly distorted.

“The bottom 40% of EPF members (about 5 million members) saw their savings drop by 38% to just RM8 billion, translating into a median savings balance of RM1,005. The middle 40% also suffered a decline of 18% to RM155 billion, or a median balance of RM24,995. Only the top 20% of members aged below 55 saw an increase in savings, but this translates to a median of RM152,043, or equivalent to just RM633 per month for 20 years,” the provident fund explained in the statement.

Separately, the chief strategy officer of the EPF Nurhisham Hussein – who was speaking at a forum session hosted by the Perdana Fellow Alumni Association – noted that only 3% of EPF contributors can now afford retirement. He also shared that by the end of this year, 54% of EPF members at the age of 54 will have less than RM50,000 in their savings account, and a majority of them who withdrew their entire EPF savings upon hitting 55 years old will exhaust it within two to three years.

In light of these data, the EPF stressed that future exceptional withdrawals will have to be very carefully considered, adding that a total of RM101 billion has been disbursed to more than 7.4 million members to date. This translates to about half of its total members.

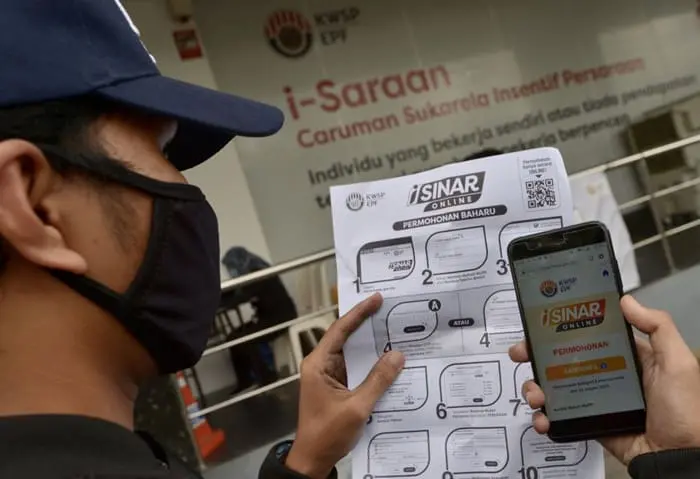

That said, the provident fund highlighted that the government is already planning to take crucial steps to improve the country’s social protection system under the recently announced Budget 2022. These include the improvement of i-Saraan, an incentivised voluntary contribution initiative for members who are self-employed or do not earn regular income. Under Budget 2022, the government will expand the beneficiaries for the i-Saraan initiative to encompass those between the ages of 55 and 60; at present, i-Saraan is only open to members below the age of 55 years old.

(Sources: EPF, Free Malaysia Today)

Comments (2)

Should check against whether investments in ASNB has increased – EPF funds may have flowed into these investments with better returns.

EPF should think out of the box to reward those who did not make any withdrawals (I-lestari,I-Citra or I-Sinar). Definitely there were some members who just follow the flow to make withdrawals. So it’s time to give extra dividends for those who stay on with EPF.