Iman Aminuddin

23rd June 2025 - 4 min read

On Unbox This Week, you have the chance to bring home BOTH the iPad Air M3 + AirPods Pro 2, and up to RM6,666 Touch ‘n Go eWallet Credits when you apply for a credit card via RinggitPlus.

For those who are new to this campaign, Unbox This Week is a weekly event where we present to you fantastic weekly flash deals from our featured bank partners. All you need to do is apply for selected credit cards from these banks of the week through RinggitPlus and you’ll take home some great prizes.

From 23 June 2025 to 30 June 2025, our featured bank partners are none other than UOB, HSBC, Alliance Bank and RHB. So, if you’ve considered applying for a credit card with any of these banks, you know what to do to get more out of your application!

UOB – iPad Air M3 + AirPods Pro 2

Apply for a UOB Credit Card and you could receive the iPad Air M3 and Apple Pencil!

The iPad Air offers a balanced combination of performance and portability, while the Apple Pencil adds precision for note-taking, drawing, and everyday tasks.

If you don’t win these prizes, you’ll still get up to RM500 Touch ‘n Go eWallet Credits guaranteed.

To redeem your gift, apply for your card via the RinggitPlus website, get approved by UOB, and activate your card. Apply for your UOB Credit Card here.

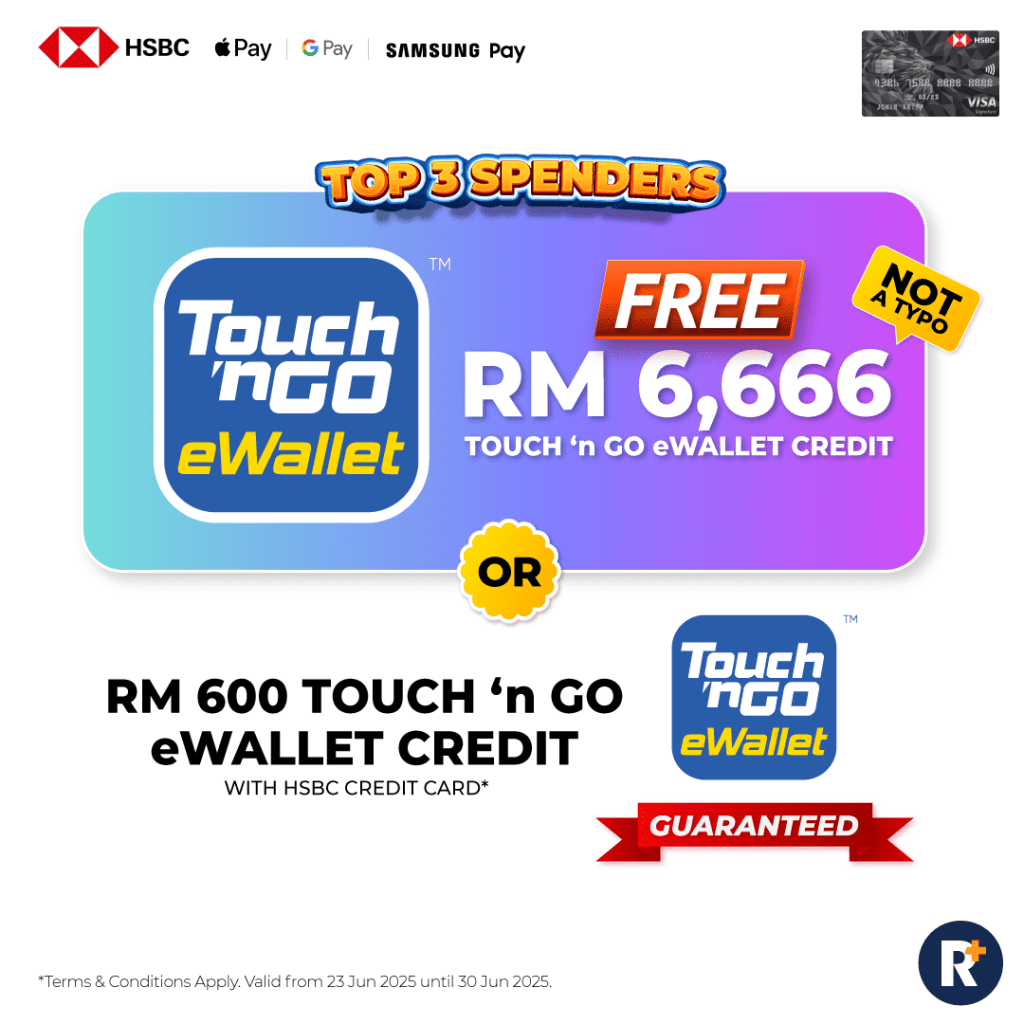

HSBC – RM6,666 Touch ‘n Go eWallet Credits

Be a top 3 spender and walk away with RM6,666 in Touch ’n Go eWallet Credits when you apply for and spend with an HSBC Visa Signature Credit Card!

Use your credits for groceries, dining, petrol, bills, public transport, online shopping, and more at thousands of participating Touch ’n Go merchants. No complicated redemptions. No waiting. Just instant, flexible spending power at your fingertips.

If you don’t win the big prize, you’ll still RM600 Touch ‘n Go eWallet Credits guaranteed.

All you’ll need to do is apply for an HSBC Visa Signature Credit Card this week to get your guaranteed gift. Don’t forget to activate and spend a minimum of RM1,000 on your new card within 60 days upon gaining approval to be eligible for this gift. That said, do note that current cardholders and applicants who were denied within six months prior to this campaign, as well as those who have cancelled their HSBC Credit Cards within six months prior to this campaign are not eligible for our campaign. Otherwise, you can apply for your HSBC Credit Card here.

Alliance Bank – RM700 Touch ‘n Go eWallet Credits Guaranteed

For the next 48 hours only, apply for an Alliance Bank Credit Card and walk away with RM700 Touch ’n Go eWallet Credits guaranteed!

This limited-time offer gives you instant rewards you can use for groceries, dining, fuel, transport, and more.

Upon approval, you just have to activate and spend to meet the requirements of the campaign and be eligible to win the gift. Existing cardholders of any Alliance Bank Credit Card and individuals who have held or cancelled an Alliance Bank Credit Card in the past six months are not eligible for this campaign. Apply for an Alliance Bank Credit Card here.

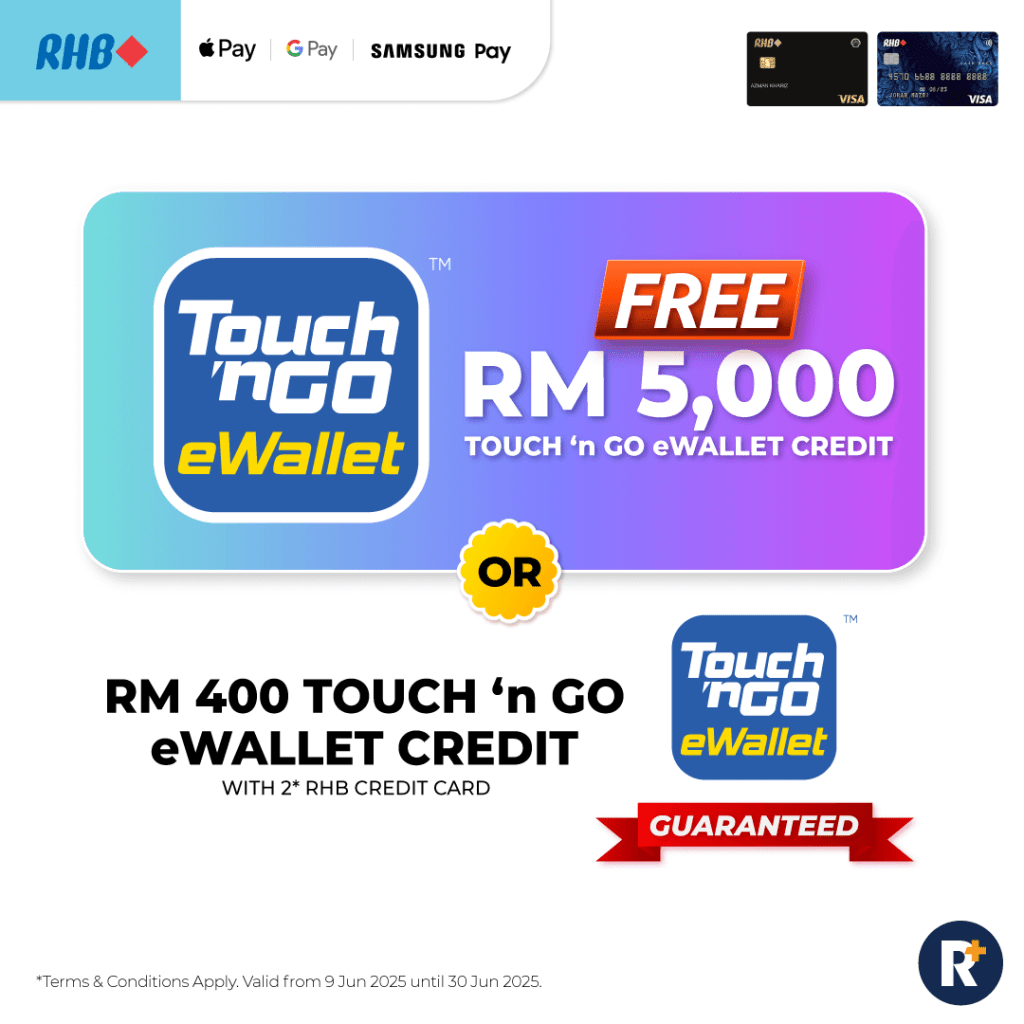

RHB – RM5,000 Touch ‘n Go eWallet Credits

Apply for an RHB Credit Card for a chance to win RM5,000 in Touch ’n Go eWallet Credits!

Even if you’re not among the lucky winners, you won’t walk away empty-handed. Receive a guaranteed RM400 Touch ’n Go eWallet Credits when you apply for two cards, or RM300 Touch ’n Go eWallet Credits when you apply for a single card.

Once approved, you just have to activate and spend to meet the requirements of the campaign and be eligible to get the gift. Existing cardholders of any RHB Bank Credit Card and individuals who have held or cancelled an RHB Bank Credit Card in the past six months are not eligible for this campaign. Apply for an RHB Bank Credit Card here.

***

Finally, be sure to start your application with our WhatsApp chatbot so that your eligibility is guaranteed, and we can always be at hand to help you when you need us.

While this week’s flash deal ends on 30 June 2025 (11am), do follow us on our Facebook page to receive the latest Unbox This Week offers as we refresh the deals every week.

Comments (0)