Pang Tun Yau

26th September 2024 - 4 min read

RinggitPlus today released the results of the 2024 RinggitPlus Malaysian Financial Literacy Survey (RMFLS), an annual study examining Malaysians’ financial habits, challenges and outlook.

This year’s results found improvements across multiple key indicators, with signs of upward swings for financial security and well-being – but also underscored a continuous growing need for enhanced digital financial literacy nationwide.

Fewer Scam Attempts, but Vigilance Remains a Priority

In 2024, more than one-third of Malaysians (38%) reported encountering fewer financial fraud or scam attempts compared to last year, with the overall number of those who experienced such attempts dropping to 86% from the whopping 94% reported in 2023.

This marks a significant improvement, proving that the anti-scam awareness efforts driven by Malaysia’s governing bodies are bearing fruit. Indeed, 56% of respondents credited the nationwide Jangan Kena Scam awareness campaign for helping them avoid falling victim to financial fraud.

While this is a positive move in the right direction, more needs to be done to safeguard Malaysians. The RMFLS survey also found that up to 32% of Malaysians admitted to uncertainty or a lack of knowledge about what actions to take or whom to contact in the face of common financial scam scenarios, including impersonation scams or fraudulent transaction notifications.

This highlights an ongoing vulnerability that must be addressed, particularly as digitalization grows and Malaysians are increasingly embracing digital tools in their personal finances: 95% of respondents use at least one e-wallet (up from 91% in 2023 and 89% in 2022). Meanwhile, 45% hold an account with at least one digital bank, and 26% plan to open one in the near future. Online insurance and takaful purchases are also on the rise, with 29% preferring this method.

Notably, reliance on social media as a primary source of financial information is increasingly apparent, with trust scores for social platforms rising from 3.7 to 4.0 year-on-year. There is an urgent need to enhance digital financial literacy and ensure Malaysians have the resources they need to combat misinformation and fraud.

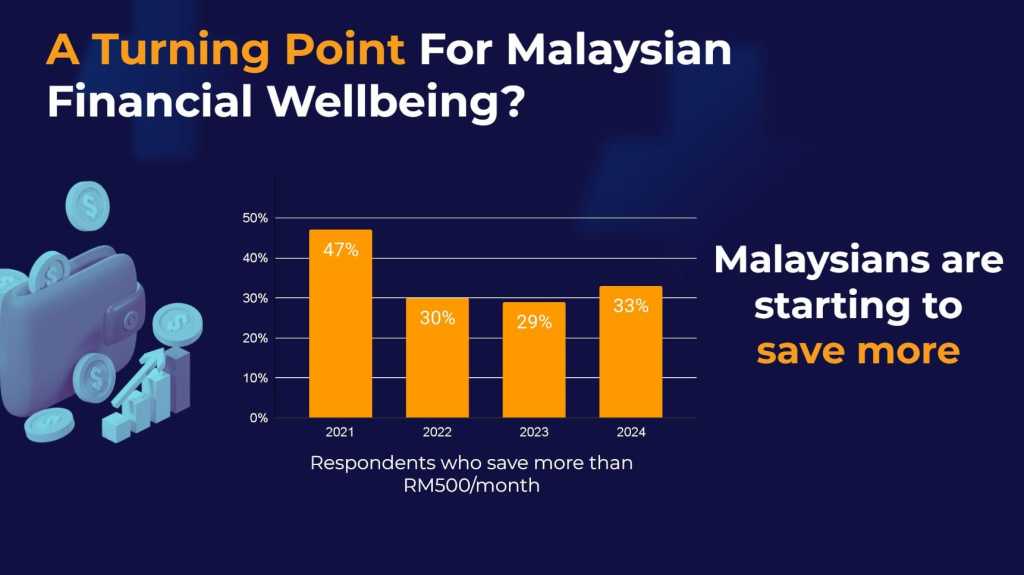

A Turning Point for Malaysian Financial Well-being

For the first time since COVID-19, three key metrics in RMFLS saw positive trends. The first is that Malaysians are starting to save more each month – with the number of respondents who save more than RM500 per month increasing to 33% (vs 29% in 2023). Additionally, 39% of respondents stated they could survive for four months or more in the event of income loss, up from 33% last year. Lastly, 47% of Malaysians reported better financial conditions than last year.

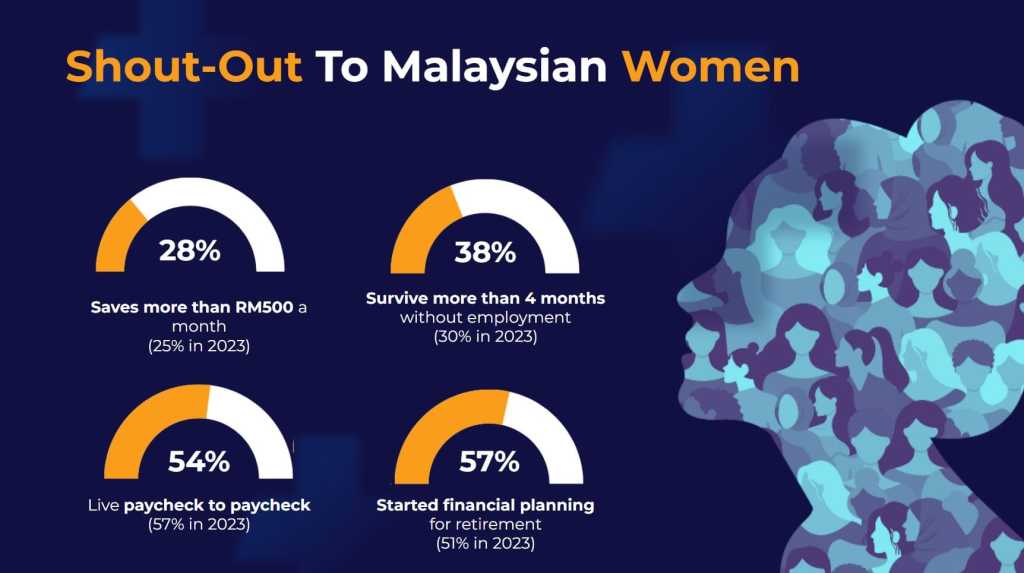

Another highlight is how Malaysian women have become less vulnerable financially, showing improvements year-on-year in important metrics: a 3% increase in women saving more than RM500 a month, an 8% increase in those who can survive without a job for four months or more, a 3% decrease in women living paycheck to paycheck, and a 6% increase in women who have started financially planning for retirement.

While gradual, these are promising indicators of change, though more effort is needed to sustain this trend and achieve greater financial parity between Malaysian women and men.

The survey also found that many are adopting responsible financial habits, cutting back on expenses and initiating retirement planning. Withdrawals from EPF Akaun Fleksibel are for essential needs, such as repaying debts and managing cost of living expenses.

Despite these improvements, 55% of respondents remain anxious or frustrated about their finances, highlighting the need for continued financial discipline. Nonetheless, these findings mark a potential turning point in financial well-being for many Malaysians, which will hopefully maintain an upward trajectory in the future.

“RMFLS 2024 reflects encouraging progress in Malaysians’ financial well-being and literacy levels, especially among women. However, as we advance toward becoming a high-income nation, it is essential that we equip the rakyat with the right knowledge and tools they need not just to survive, but thrive in this increasingly digital world,” said Yuen Tuck Siew, CEO of RinggitPlus.

“At RinggitPlus, we are committed to helping Malaysians tackle their unique financial challenges. Through collaborations with our RMFLS partners, we aim to create focused, relevant and timely content shaped by the survey insights, expanding our reach to educate more Malaysians. We are also enhancing our product and services to drive greater financial inclusivity and empowerment across the nation,” he concluded.

Please click here to download the full 2024 RinggitPlus Malaysian Financial Literacy Survey report, or explore our previous reports to see the trends over the years.

- Read the RMFLS 2023 Report

- Read the RMFLS 2022 Report

- Read the RMFLS 2021 Report

- Read the RMFLS 2020 Report

You can also visit RinggitPlus’ social media channels (Instagram, Facebook and TikTok) for more RMFLS 2024 snippets.

Comments (1)

How can I help you Hridoy?