Iman Aminuddin

25th August 2025 - 4 min read

Looking to score new tech or extra cash with your next credit card? Unbox This Week with RinggitPlus makes it happen! Apply for a credit card through us and you could win RM2,888 Touch ‘n Go eWallet Credits, iPad Pro M4, iPhone 16 Pro, or secure cash prizes!

Never joined Unbox This Week before? Here’s the scoop: every week, we unveil flash deals from our partner banks. All you need to do is apply for specific credit cards from these banks of the week on RinggitPlus, and a prize could be yours.

Mark your calendars! From 25 August to 2 September 2025, we’re featuring UOB, HSBC, Alliance Bank, and RHB. If one of these banks has been on your radar for a new credit card, now’s the ideal time to apply and enjoy some extra rewards. Why just get a card when you can get so much more?

UOB – RM2,888 Touch ‘n Go eWallet Credits

Apply for a UOB Credit Card for a chance to win RM2,888 in Touch ‘n Go eWallet credits!

Whether you’re eyeing a new gadget, planning a last-minute getaway, or simply looking to ease your monthly expenses, this reward gives you the freedom to spend where it matters most. With flexible usage across travel, retail, dining, and essentials, RM2,888 could go a long way.

To redeem your gift, apply for your card on our website, get approved by UOB, and activate your card.

HSBC – iPad Pro M4

Apply for an HSBC Visa Signature Credit Card this week and you could be one of the lucky winners to win an iPad Pro M4.

Designed for performance and built for professionals, the iPad Pro M4 features a brilliant Ultra Retina XDR display and powerful hardware capable of handling your most demanding creative and productivity apps.

All you’ll need to do is apply for an HSBC Credit Card this week to get your guaranteed gift. Don’t forget to activate and spend a minimum of RM1,000 on your new card within 60 days upon gaining approval to be eligible for this gift. That said, do note that current cardholders and applicants who were denied within six months prior to this campaign, as well as those who have cancelled their HSBC Credit Cards within six months prior to this campaign are not eligible for our campaign.

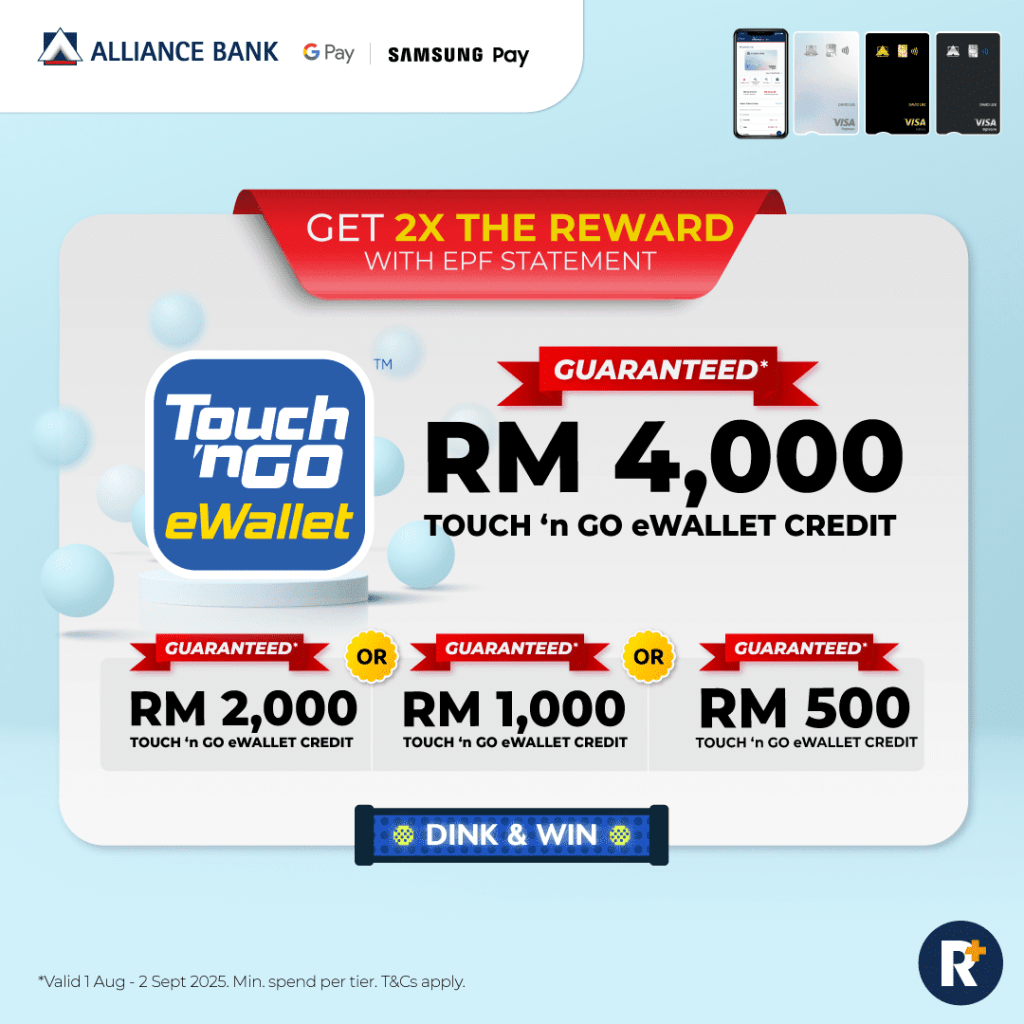

Alliance Bank – Up To RM4,000 Touch ‘n Go eWallet Credits Guaranteed

This week, apply for an Alliance Bank Credit Card with your EPF Statement and you are guaranteed to walk away with RM4,000, RM2,000, RM1,000, or RM500 in Touch ‘n Go eWallet Credits!

Celebrate over a great meal or put your reward towards something that truly delights.

Please note: This campaign is not open to existing Alliance Bank credit cardholders, or anyone who has held or cancelled an Alliance Bank credit card in the past six months. If that’s not you, then what are you waiting for? Apply for your Alliance Bank Credit Card today!

RHB – iPhone 16 Pro

Apply for an RHB Credit Card and you could win an iPhone 16 Pro.

Capture your ideas in stunning detail with the iPhone 16 Pro. Whether you’re filming in 4K, editing on the go, or taking crisp low-light shots, its advanced camera system and powerful A18 Pro chip give you full creative control.

For those who are not selected, you will still be guaranteed RM400 Touch ‘n Go eWallet Credits when you apply for 2 cards, and RM250 Touch ‘n Go eWallet Credits when you apply for a single card.

To claim your prize or guaranteed credits, simply apply for your RHB Credit Card via RinggitPlus, get approved, and then activate and spend to meet the campaign’s requirements. Existing cardholders of any RHB Bank Credit Card and individuals who have held or cancelled an RHB Bank Credit Card in the past six months are not eligible for this campaign.

***

Finally, be sure to start your application with our WhatsApp chatbot so that your eligibility is guaranteed, and we can always be at hand to help you when you need us.

While this week’s flash deal ends on 2 September 2025 (11am), do follow us on our Facebook page to receive the latest Unbox This Week offers as we refresh the deals every week.

Real deals don’t last long. Stay ahead by joining our WhatsApp Channel.

Comments (0)