RinggitPlus

19th May 2021 - 5 min read

In the past, global investing has not always been something that seemed readily accessible to Malaysians. Expensive transaction fees and high starting capital made investing in foreign markets inconvenient, but technological advancements are beginning to bridge the gap between Malaysian retail investors and global markets.

According to Focus Malaysia, Malaysians had shown keen interest in global tech stocks on an investment portal with US-based semiconductor company Advanced Micro Devices (AMD) – a popular stock – having recorded a 114% increase in trading in April last year.

Branching out to global markets can be seen as advantageous to your portfolio as diversifying across asset classes, currencies, and markets may help reduce risk when it comes to investing. Even so, trading in the global markets comes with its own risks and challenges, so investors must do their due diligence and research before investing.

But, if you’re looking to diversify your portfolio and explore investment opportunities, here are four reasons why you can consider taking your investments overseas.

1. Easier And Cheaper In The Digital Age

It seems like people have not only been indulging in newfound hobbies like baking during the pandemic but also dedicating their free time at home to researching and trading stocks. Investopedia said that many people have used extra time in 2020 to create and control their own portfolios.

Malaysians have been able to invest remotely and access the US and other listed securities via various secured online platforms for many years. However, more recently, the advent of online brokerage platforms has made it easier and cheaper for investors to open new accounts and invest directly through their smartphones.

For example, the Employee Provident Fund’s (EPF) very own online investment platform, EPF i-Invest, also allows its members to conveniently gain overseas investment exposure at reduced charges.

2. Putting Your Eggs Into Multiple Baskets

As mentioned earlier, investing in a foreign market may pose some challenges but it may help investors diversify by spreading out their risk. By investing in markets in different countries, you have less to worry about if one country’s stock market performs badly, as opposed to putting your full basket of eggs in only one country.

These days, we’re no longer limited by the location we’re based at, and with technology advancements, we can invest in foreign stocks that have high growth potential.

The value of diversification should not be undermined. In fact, according to the Employees Provident Fund (EPF), the EPF’s overseas diversification strategy has helped add value to its overall performance last year.

As of the end of June 2020, EPF’s investment assets stood at RM929.64 billion, of which 30% was invested in overseas investments. In the second quarter of the year, 39% of the total gross investment income recorded was contributed by the EPF’s overseas investments.

3. Access To More Quality Companies

Investing globally also helps you tap into the potential of companies not listed in your local bourse. There are over 900 companies listed on Malaysia’s exchange but there are over 41,000 companies listed globally with a combined market value of more than US$80 trillion.

Some of the most sought after stocks today are multinational tech stocks like Apple and Microsoft which are listed on the New York Stock Exchange (NYSE) in the United States.

Malaysians are already recognising the potential of opening up their portfolio with overseas investments such as global tech stocks. According to Focus Malaysia, nine out of the top 10 invested stocks by Malaysians in April last year on an investment portal amid the pandemic were technology companies such as AMD.

4. Possibly Better Returns

Lastly, owning foreign stocks will not only help you diversify your portfolio and hedge against risk, but also allow you to tap into the growth of economies aside from Malaysia’s economy. During a stay-at-home economy, technology has been an integral part of our daily lives with this seemingly to have translated to its performance in the markets.

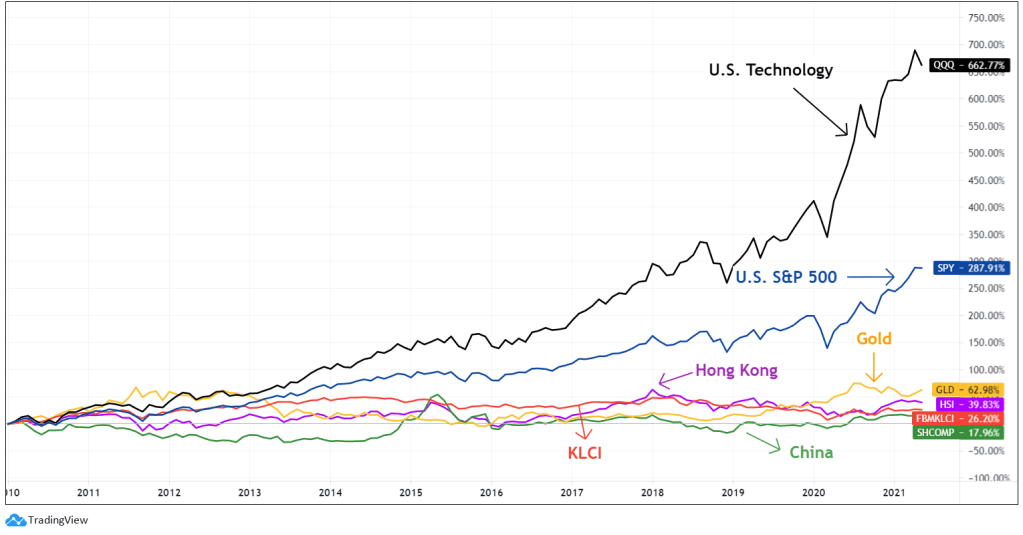

As seen in the chart below, the US stock markets especially the Nasdaq 100 have shown tremendous growth in the past year. This is followed by the S&P 500 which tracks the 500 largest publicly traded companies in the US. In comparison, the US market strongly outperformed the other indices over the past decade.

Source: TradingView

***

While investing in global markets can help diversify one’s investment portfolio, a good combination of technical knowledge, experience, and skills are required to maximise opportunities.

One way to equip yourself with the right knowledge is to learn from an established academy, such as Beyond Insights that has been around for 13 years. You can now register for Beyond Insights’ online seminar titled, “Global Investing Made Simple” for free and learn how to trade in the global stock market with just four steps from founder Kathlyn Toh. Having coached nearly 5,000 students from all walks of life – business owners, financial controllers, accountants, doctors, stockbrokers, full-time traders, housewives, college students, and even retirees since 2008, Beyond Insights is an award-winning investment and trading education provider.

Find out more about Beyond Insights’ upcoming webinar here.

Comments (0)