RinggitPlus

29th September 2020 - 6 min read

Did you know?

HSBC Bank Malaysia was one of the pilot banks to adopt and launch DuitNow QR when it was first introduced to Malaysians in 2018 – showing that HSBC Bank Malaysia has always been at the forefront of mobile banking innovations.

With mobile banking users to grow 2 billion large this year and expected to reach 3 billion by 2021, it’s no wonder HSBC Bank Malaysia is stepping up its banking innovation this year by introducing its newly improved HSBC/HSBC Amanah Online Banking and HSBC Malaysia Mobile Banking app.

Aiming to provide a simpler, easier, and faster banking experience, here’s how HSBC Bank Malaysia is designing its banking experience for the convenience of fellow Malaysians.

The HSBC Online Banking Is Now Simpler To Navigate, With New Modern Design For Users

If you’ve recently visited HSBC Online Banking website, you may have noticed a change of look in its design interface. In its effort to provide consumers with a simpler and easier online banking experience, HSBC has recently revamped its online banking website with features streamlined according to your banking needs.

In addition to HSBC Online Banking’s new look, HSBC has also launched the new HSBC Malaysia app with the aim of providing Malaysians with the convenience of Banking 24/7, Anytime, Anywhere, all within one app.

The HSBC Malaysia app allows you to view, transfer, and manage all your financial matters at your fingertips. But besides the usual features allowing users to save their favourite beneficiaries for future transactions, Instant Transfer, Bill Payment via JomPAY, paying for groceries using DuitNow QR – what makes HSBC Malaysia app different from the others?

You Can Remit Money Both Locally & Globally In Just 6 Seconds

Staying true to its tagline Banking Anywhere, HSBC Bank Malaysia’s Global View & Global Transfer (GVGT) and Global Transfer for Family & Friends (GTFF) features will truly benefit frequent travellers and those regularly remit money to family and friends overseas. The best part? It only takes 6 seconds!

As its name suggests, GVGT allows you to move your money between your local and overseas account (for example, Hong Kong) without having to log on to your separate off-shore account. Besides that, you can also easily view and manage your funds with HSBC Online Banking.

Meanwhile, GFTT lets you transfer funds to your family and/or friends overseas. For example, transferring funds to your children who are studying overseas or if you’re the one who’s working overseas, you can easily send money to your family at home.

But what about the applicable Foreign Exchange (FX) rate when you transfer money across the globe? HSBC has got you covered with its access to real-time FX rates where you can get real-time quotes whenever you exchange foreign currency using HSBC Online Banking or HSBC Malaysia app.

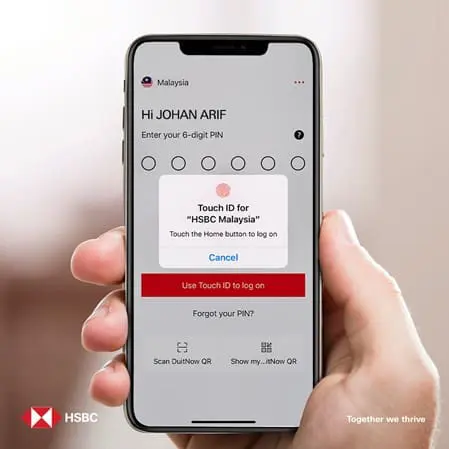

HSBC Applies Up To 6 Security Measures To Ensure Safe Online Banking For All

HSBC understands how important it is to safeguard your savings. That is why HSBC is applying some of the most stringent security measures to keep you away from fraud or any financial-related crime. Besides providing you with an easier, simpler, and faster way to manage your finance, HSBC wants to do so while also giving you peace of mind.

Rest assured that your account is in HSBC’s best care with these measures:

- Multi-layer Log On Verification

From unique username, specific memorable answer, to a time-sensitive Security Code generated by your Security Device Key – they ensure only you have access to your account even if you lose your mobile phone - Transaction Verification

Generates transaction code with your Security Device so only you can authorise any payment and third-party transfer requests - Automatic Time-out Feature

Automatically logs you out after a period of inactivity, protecting you from personal data-theft especially when in public or using foreign computer - SMS/Email Notifications

Receive confirmation of transaction via SMS or email, and alert for any suspicious transaction that you don’t initiate - Browser Authentication

An extra security layer against cyber-crimes, you’d need to verify your browser whenever you logon to Online Banking with new or unverified browser - Biometric Authentication

Verify your identity in just seconds with Face ID, iOs Touch ID or Android Fingerprint ID

Additionally, HSBC has also announced that it will soon introduce Mobile Secure Key – another move to tighten its security measure which does not compromise HSBC’s promise for easy online and mobile banking. So, what does Mobile Secure Key mean? Similar to a physical master key which opens up the main door to your home – only digitally. With a Mobile Secure Key, you can access all features in your HSBC Malaysia app such as approving online transactions, with just one single password.

HSBC Online Banking & Its New Mobile App Are Truly User-Friendly

HSBC’s improved Online Banking experience is not just designed for Banking 24/7, Anytime, Anywhere – but also for everyone, even for those with special needs.

Following closely on the Web Content Accessibility Guidelines (WCAG) in developing its Online Banking websites, HSBC aims to provide its consumers with different needs or with disabilities the accessibility to their banking accounts easily.

For example, HSBC Malaysia now provides a Security Device which features a larger display screen and audio capability to help assist those visually impaired to access their Security Code more accurately. Besides that, consumers can also easily enlarge both text and images in HSBC Online Banking homepage and their Personal Internet Banking page by simply pressing the “Ctrl” and “+” keys together. Now, isn’t that a thoughtful improvement?

#GetOnlineGetHappier Campaign – Transfer Money Online With HSBC To Win Monthly Cash Back Worth Up to RM140,000!

Now that you’ve learned how HSBC Bank Malaysia is re-imagining its Online Banking experience together with its HSBC Malaysia app for simpler, easier and faster banking process – if you are an account holder with HSBC Bank Malaysia, and you haven’t already registered for HSBC Online Banking account, now could be the best time to do so. While you’re at it, you might also want to download HSBC Malaysia app.

Because from now until 31 December 2020, HSBC Bank Malaysia will be rewarding lucky consumers with cash back worth up to RM140,000 every month! All you have to do is transact with HSBC Online Banking or HSBC Malaysia app to be in the running. The more you transact, the higher chances of you grabbing a portion of the monthly cashback. Visit HSBC Bank Malaysia now for more information!

For HSBC Amanah, you can visit HSBC Amanah Online Banking.

Comments (2)

you’re kidding me. I’m still having the worst experience with HSBC online banking/app compared to other banks.

Does HSBC Malaysia banking App require Malaysian registered phone or does it also work with a foreign phone number?