Eloise Lau

28th May 2015 - 4 min read

Did you know – the moment you drive your brand-new car out of the dealership, its value starts to drop? Whether you’re driving a luxury sedan or an every day commuter, a local or foreign brand, depreciation affects all vehicles at varying rates. In fact, some estimates suggest that a car loses about 15% of its value within the first year alone. Over time, this figure can rise to a staggering 50% within 5 years.

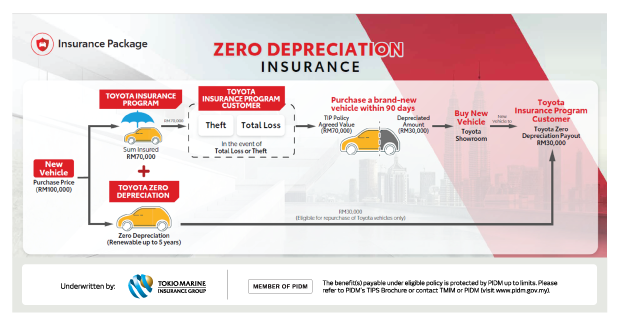

Enter Toyota’s Zero Depreciation Insurance, developed in partnership with Tokio Marine Insurans (Malaysia) Berhad . This unique insurance plan protects the full agreed value (which is the Original Purchase Price of the vehicle) of your Toyota vehicle, ensuring that you don’t lose out financially, even in the event of a total loss or theft.

Protect Your Toyota’s Value With Zero Depreciation Insurance

Toyota’s Zero Depreciation Insurance ensures that if your Toyota vehicle is stolen or declared a total loss, you’ll be compensated with the full purchase price of the vehicle (the amount you originally paid), rather than its depreciated value. This ensures you won’t face financial loss in the event of theft or total loss, and you’ll be able to buy a brand-new Toyota.

This coverage applies to newly purchased Toyota cars for up to 5 years, provided the customer continues to renew with Toyota dealers. It’s a tailored plan for Toyota owners who want to protect the value of their vehicle in the first few years of ownership where the rate of depreciation is at its highest.

Key Benefits

The primary advantage of Toyota’s Zero Depreciation Insurance is that it covers your car at its original purchase price for up to 5 years. In the event of total loss or theft during this period, you’ll be compensated based on the original purchased price of your vehicle value—not the depreciated market value—helping minimise your financial loss.

Moreover, this insurance plan offers a quick and seamless repurchase option within the first two years of ownership, exclusively for Toyota vehicles. It ensures you can get back on the road with a brand-new Toyota, without disrupting your schedule.

Who Should Consider Zero Depreciation Insurance?

Toyota’s Zero Depreciation Insurance is especially advantageous for certain types of drivers. Here are a few scenarios where this coverage can be particularly beneficial:

- Frequent drivers: If you spend a significant amount of time on the road or regularly cover long distances, the risk of accidents naturally increases. Zero Depreciation Insurance provides you with peace of mind, ensuring the original purchase price of your car is protected in the event of total loss or theft.

- Drivers in Flood-Prone Areas: In regions prone to heavy rain, flooding, or other natural disasters, the risk of a total loss due to damage increases significantly. With Zero Depreciation Insurance and Special Perils add-on coverage, you are safeguarded against these unexpected costs, offering comprehensive protection of your car’s original purchase price.

- New Car Owners: If you’ve recently purchased a new Toyota, this insurance plan ensures you’re fully covered during the critical early years of ownership when depreciation is at its peak. It’s an ideal way to protect your investment and avoid significant financial losses

***

In a world where car depreciation is inevitable, Toyota Zero Depreciation Insurance empowers you to retain your car’s original purchase price instead of settling for its depreciated market value. Whether you’re a frequent traveler, live in a high-risk area, or simply want added peace of mind, this add-on coverage is a smart, long-term financial decision.

To find out more about Toyota’s Zero Depreciation Insurance, visit your nearest Toyota Showroom or Sales Advisor today! Click here to find a Toyota dealer or service centre near you.

Comments (0)