Desiree Nair

24th January 2019 - 4 min read

A Cash-Free Future

Think about the last time you carried a wad of cash to go shopping –we’re willing to bet that it’s been a while. Nowadays, all you need is to pack plastic; a debit or credit card and only a bit of spare cash, just in case. Even mobile payments are catching on with offline merchants.

Going cashless is relatively safer, convenient and what’s more, every cent spent can be tracked. Furthermore, without cash at checkout points, fewer errors can be expected where cashiers incorrectly return change.

But still, even with all these positive points and a push from Bank Negara Malaysia, are we really ready to go completely cash-free? To answer this question, let’s first look at our cashless options:

1. Bank Cards

Debit, credit and prepaid cards are the most commonly accepted and used cashless payment options in Malaysia. In recent years, debit card usage has spiked, with approximately 44 million.pdf) cards (as of 2013) in circulation. This means that when compared to the population in the country, about 1.5 debit cards has been issued for each person.

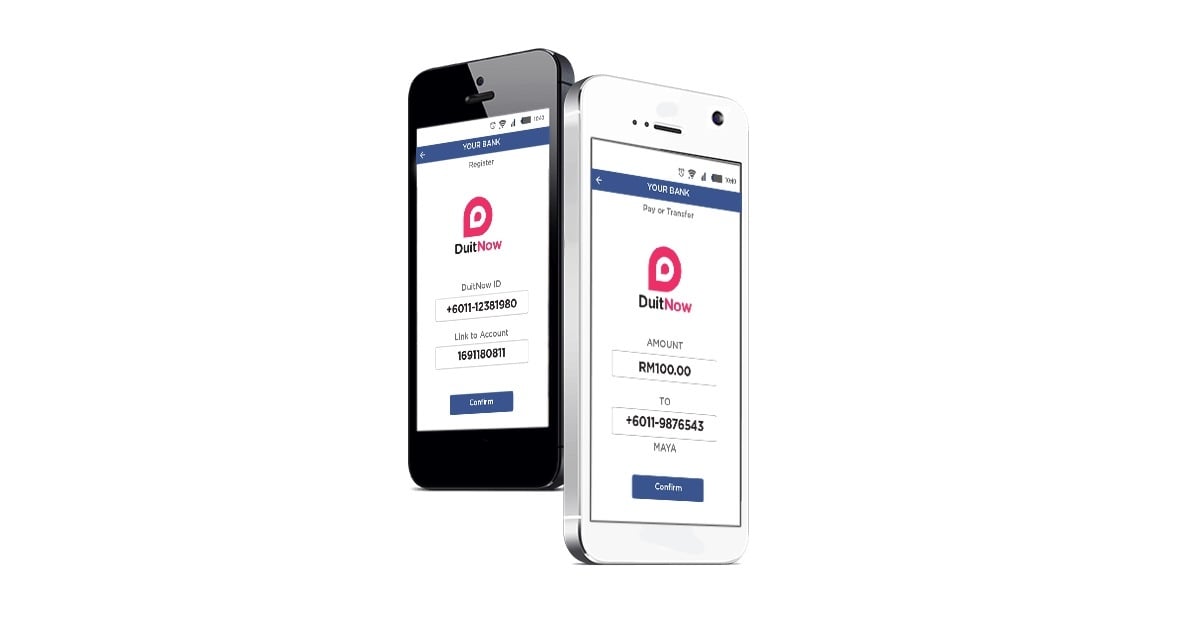

2. Mobile Transactions

Online merchants have equipped remittance systems to allow for checkouts and payment from smartphones. Even local offline merchants have incorporated mobile banking facilities as well, although in smaller numbers.

3. Contactless Payments

New tech has equipped payment cards and smartphones with contactless payment features such as Visa payWave and MasterCard® Contactless. These features speed up the checkout process; sans the need to count coins and paper money. It’s also rather convenient as you don’t have to run to the ATM as much to withdraw cash for small payments.

4. Prepaid Cards

Cards preloaded with cash like the Touch ‘n Go Zing card can be used for more than just highway tolls (which is to go fully cashless by 2018). Use it to pay for “public transport, carparks, petrol, retail chains, restaurants and healthcare”. Visa and MasterCard prepaid cards are also available for use at many more merchants.

5. Virtual Money

Digital currency and Cryptocurrency such as Bitcoin are not recognised as legal tender in Malaysia just yet, but locals are still using it. A petrol station in Jalan Raja Chulan started accepting bitcoins for payment in 2014, in addition to a VPN service and boutique café in Taman Tun Dr Ismail.

Barriers to a Fully Cashless System

Even while all these payment options are available to Malaysians, there are a couple of obstacles that need to addressed before we can truly go cashless.

- Not Accepted Everywhere

At present, the cashless option as a payment method isn’t available everywhere. Have you tried paying for your teh tarik and roti canai at the local mamak? It probably won’t work. Apart from these small-scale operators, even certain fast-food joints, convenience stores and health clinics are still only accepting cash.

In fact, usage of cashless options appears to be focussed in city areas and within larger retail establishments.

Thus, even if Malaysian consumers are equipped with cashless payment articles; vendors and merchants will need to adopt the system before we fully (or mostly) go cashless.

- A Cash Mindset and Trust Issues

While it appears that the majority of Malaysian consumers are embracing cashless systems, it is possible that usage is confined mostly to those in the capital, major cities and towns.

Denizens of rural areas and outskirts of Malaysia are still very much dependent on cash. And even as numerous cashless payment options are available, changing mind sets and addressing trust issues apparent with cashless systems is going to take time.

Riding the Cashless Wave

If you’re ready to join the cashless world, note that one of the best cashless options currently available is still your credit card. This is because it has numerous fraud protection protocols in place, especially when shopping with overseas online merchants and is often accompanied by special perks.

If you don’t already have one or are simply looking for a better card, do head on over to our comparison page to find the best credit card for your needs.

Comments (0)