Alex Cheong Pui Yin

26th March 2021 - 6 min read

The new investment feature in Touch ‘n Go (TNG) eWallet, GO+, has now been made available to more users since we first reported it. Interestingly, the roll-out is several days ahead of its official launch – which is set to happen on 29 March (next Monday) – allowing these users an early opportunity to test out the new feature and its benefits.

Now that our apps have been updated with the new feature, let’s go through a deep dive of what looks like the first e-wallet in Malaysia to offer “interest” or returns to a user’s wallet balance.

What is GO+ by TNG eWallet?

Essentially, GO+ lets you earn potential daily returns on your TNG eWallet credit, provided that you park the credit under your GO+ account. The balance will be invested in a low-risk money market fund to provide you with income and liquidity.

The key benefit to using GO+ is that your TNG eWallet balance can now earn extra cash for you even as it sits within your e-wallet. Balances put into the GO+ wallet is invested into a money market fund managed by Principal Asset Management Berhad, called the Principal e-Cash Fund. With it, you’ll be able to earn returns on a daily basis, which will then be credited into your account the following day. The indicative return rate will vary from day to day depending on market conditions; as of the time of writing, the rate is projected at 1.47% p.a., which is a slight increase from 1.35% p.a. for the day before.

GO+ also has the convenient Quick Reload Payment service, which enables it to automatically reload your eWallet with the GO+ wallet to the exact amount needed if you have insufficient eWallet balance. So if, for instance, you have an eWallet balance of RM5 and a GO+ balance of RM10, and are paying for a meal that costs RM8, GO+ will automatically reload your eWallet with RM3 – allowing you to complete your purchase seamlessly. The Quick Reload Payment service supports all payments (retail, toll, and online payments), except for P2P transactions.

Aside from that, other GO+ benefits include the affordable initial investment amount (minimum cash in amount) as well as flexible withdrawal option (cash out). We’ll talk more about this in the coming sections.

Activating your GO+ account

GO+ is only available to Malaysian users above 18 years old with verified TNG eWallet accounts. The onboarding process isn’t complicated either; you’ll be requested to fill in some personal details and complete the verification process, and after that, you’ll be invited to “cash in” an initial investment amount into your GO+ account (at least RM10).

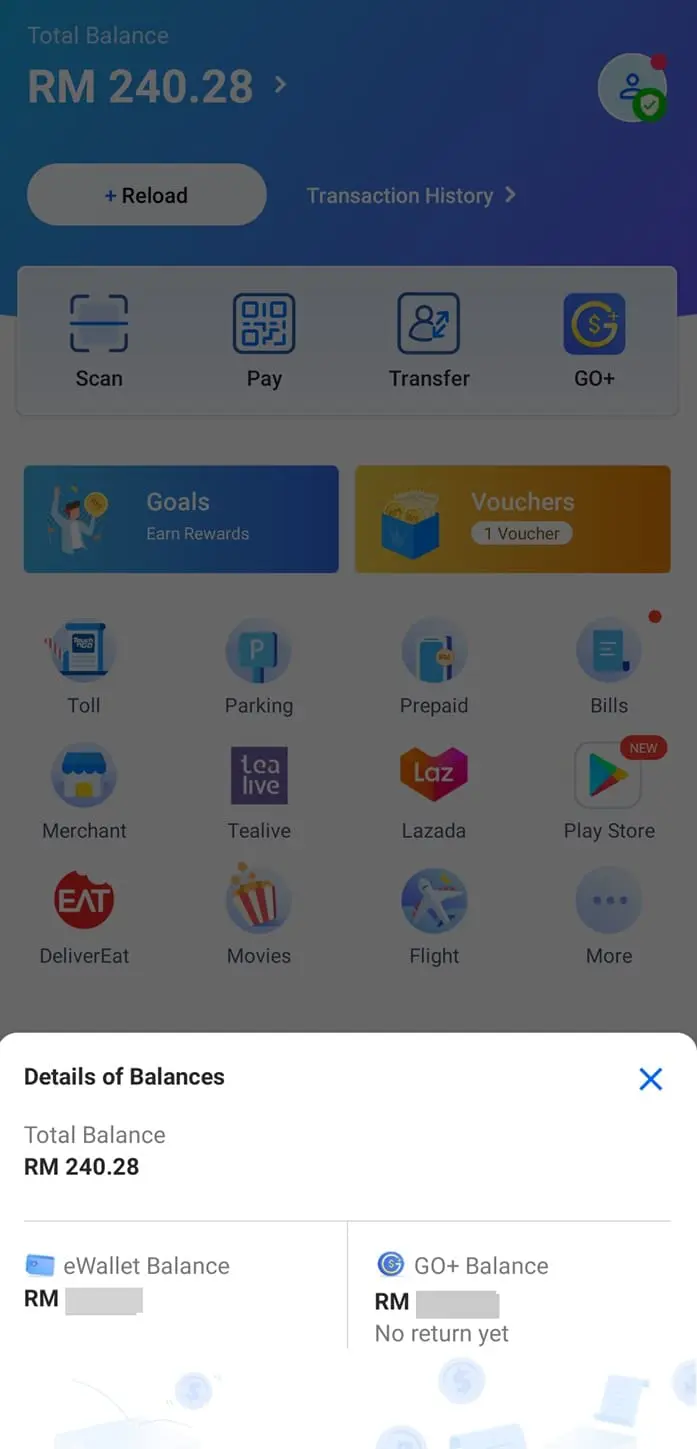

When you’re done, you’ll be able to see the total TNG eWallet balance, as well as a breakdown of the actual funds that are in your eWallet and GO+ account.

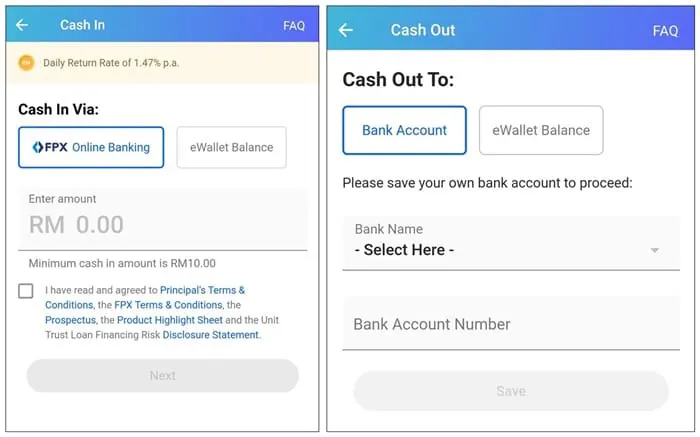

Cash In, Cash Out

After signing up, you’ll be allowed to carry out cash in and cash out transactions from your GO+ account. Simply put, cashing in money is the process of depositing money into your GO+ account, which can be done either via FPX (online banking) or from your existing TNG eWallet balance. Meanwhile, cashing out is when you withdraw money out from your GO+ account, transferring it back into your eWallet account or bank account.

Here’s a table to better explain the maximum and minimum amounts that you can cash in or cash out:

|

Cash in |

Cash out |

|||

|

From TNG eWallet |

From bank account (FPX) | To TNG eWallet |

To bank account (FPX) |

|

| Minimum amount |

RM10 |

RM10 | RM10 |

RM10 |

| Maximum amount |

RM5,000 |

RM9,500 per transaction | RM5,000 |

No limit |

For cash out requests, your money will be credited instantly if you choose to cash out to your TNG eWallet. If you opt to transfer to your bank account, however, your first cash out request will take between one to two business days to process (depending on whether you make your request before or after 4pm). Subsequent cash out requests to verified bank accounts will then take two calendar days.

Holding Limits For Your GO+ Account

TNG’s FAQ clarified that the maximum limit for your GO+ account balance is currently set at RM9,500. In other words, your GO+ account can only hold a total of RM9,500 at any one time.

Fees To Consider

As with other money market funds, there will be no application fee or sales charges when you cash in into GO+, but do be aware that there is a management fee of up to 0.45% p.a., and a trustee fee of up to 0.03% p.a..

According to the fund’s prospectus, both the management fee and trustee fee are accrued on a daily basis and will be paid monthly. Neither the prospectus nor TNG’s FAQ on GO+ indicates how these fees will be paid by the user – we’ll clarify with TNG and update this section when we get an answer.

Meanwhile, there are currently no charges or fees applicable for the cashing out of money from your GO+ account.

Explaining Indicative Return Rate

Earlier, we mentioned that GO+ lets you earn daily returns at an indicative return rate, which is then credited into your account the next day. But what is an indicative return rate?

The indicative return rate is basically the approximate return rate that is expected, predicted based on historical prices, past performances, and various other market volatilities. It is not the actual return that you will get; depending on market performance, the actual amount credited into your account may do better or worse than the indicative return rate. As such, the figure will fluctuate on a daily basis – though for low-risk investments such as a money market fund, the fluctuation spread is small and the actual return rate will not stray too far from what is stated.

In the case of the Principal e-Cash Fund, which is the underlying fund for GO+, it has investments in the following:

- Money market instruments

- Deposits (including cash (at bank) and placement of deposits)

- Debt instruments

- Any other form of investments as may be permitted by the Securities Commission from time to time

You may also want to find out about how Principal Asset Management prices its units to provide you with your returns. These information can be found in the Principal e-Cash Fund prospectus.

***

In promoting its new GO+ feature, TNG has also cautioned its users of some key details, namely that it is not protected by PIDM, and that it is not shariah-compliant. Its FAQ also advised that the feature should not be treated as e-money, nor is it similar to placing a deposit with a financial institution.

On the other hand, GO+ takes advantage of existing investment tools, simplify it, and make it accessible to a much larger audience. For this alone, the team at TNG Digital has firmly disrupted the conventional perception of banking and investments – which is what fintech is all about.

All information in this article is derived from publicly available data, including the GO+ FAQ and Principal e-Cash Fund prospectus.

Comments (1)

Hi, may i know is the article has been updated with the latest information on the Syariah compliance and Management Fee section. Thanks