RinggitPlus

26th April 2017 - 4 min read

In the past few decades, buying or renewing a motor insurance policy has been a pretty much straightforward process. Your premium is determined by the type of model, the age of the car, the engine capacity of your vehicle, and no claim discount up to 55% if you don’t make a claim.

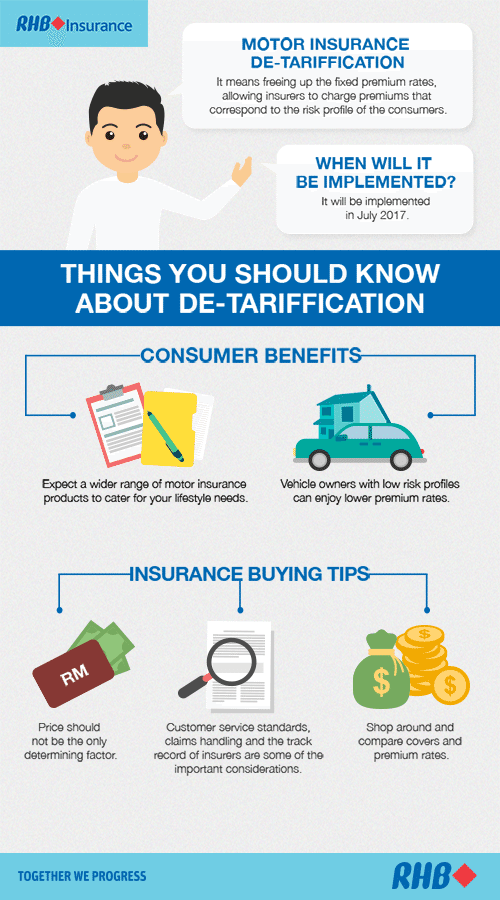

However, in July 2017, the motor insurance market will be de-tariffied in Malaysia which will change the way you purchase motor insurance. Let’s find out more.

How Will De-Tariffication Affect Me?

Let’s use Teh Ais – a favourite drink among Malaysians – as an example;

If the cost of a glass of Teh Ais were regulated by the government and is set at between RM2.20 to RM2.50 per glass that would mean it’s a tariffed product. If the government later decides to de-tariff Teh Ais, the restaurants and eateries are then free to charge a glass of Teh Ais according to their incurred costs and discretion.

What Are The Factors That Determine The Premium?

Insurance providers can adjust premium rates based on your risk factors as a driver, which is known as a “Risk-Based Premium Calculation”. The higher your risk is, the higher your premium will be. Some of these factors include:

- Gender

- Age

- Vehicle make and model

- Claims history

- Occupation

- Place of residence

- Use of vehicle

These are just a few of the risk factors that insurers will take into consideration when determining your premium rate. Countries like Germany, China, USA, UK, and Singapore have beat us to it by years. So don’t worry, it’s hardly a new concept!

How Will It Benefit You?

So, here are some things we think will benefit you as a customer:

- New innovative insurance products to cater to a wider range of customer profiles. Even a husband and wife living in a same household can now have different motor insurance plans to cater their different needs.

- Smoother and more efficient services. Now that the market is competitive, insurance providers will go all out in terms of improved product and services to win you over.

- Fairer price based on risk profile. Drivers with safe driving behavior will be seen as having a lower risk profile and they will likely pay less for their motor insurance.

How Can You Prepare For It?

Here are some of the things that you can do to prepare for the changes:

- Lower your risks as a driver as much as possible, as soon as you can. If you’re prone to reckless driving (a habit you should lose for your own safety anyway), it’s time to improve yourself and be a responsible driver.

- Compare across insurers and be aware that insurers may reduce a product’s coverage and features to lessen the premium price. A lower premium may attract you at first, but you might regret it when you get into an accident and find that parts of the damages are not covered under your policy.

If you aren’t sure on what to compare when buying a motor insurance policy, here are some of the things that you need to take note of and consider:

a) The quality of their customer service.

b) The ease of making a claim.

c) The speed of their claims process.

d) Whether the level and type of coverage is sufficient for your needs.

These tips will help you to shortlist the insurers that you can consider purchasing from after the de-tariffication. You should also compare the products from reputable insurance providers that are recognised by Malaysians, such as RHB Insurance Motor Insurance.

What are your thoughts on the de-tariffication? Do you think it will benefit you as a consumer? What other ways can you do to lower your premium after it takes effect? Share your opinions and tips in the comment section below!

Comments (0)