RinggitPlus

3rd March 2015 - 4 min read

In our day to day life, there are bound to be times when we encounter the unexpected and it oftentime forces us to spend. But are you prepared for whatever is to come? We highlight four desperate circumstances that will make you wish you had an emergency savings fund.

1. Medical Attention

Illness and disease can happen to anyone. If you catch a cold or fever, a quick stop at your family clinic or pharmacy is all you need to get common medicines. But what about something a little more serious?

With the ongoing dengue epidemic, you will never know when a dengue mosquito will equate a 7 day hospital ward bill. If your situation requires you to be admitted to the hospital, you will need the funds to pay the medical bill. It costs more if you have to stay for a couple more days for additional monitoring.

The case of dengue viral fever is just one the many diseases and illnesses that could happen to you or your dependent and burn a hole in your wallet. Things could get much worse if you don’t have an insurance policy to fall back on.

Although having an existing insurance policy is another form of financial backup, it cannot be the only thing you have in case for whatever reason, your claim was rejected or delayed. That said, you’ll feel much more secure knowing that you have some emergency savings to pay off those medical bills while you are recovering.

2. Repair Works

Having your car break down in the middle of the road; or finding the walls of your roof leaking? These troublesome situations can be frustrating. Unless its free because your landlord is paying it; the cost of repair works can get out of hand. On top of that, it can be inconvenient as you might need to rent a car while your car is at the workshop; or bunk in with your friend or relative until your house is fixed.

Instead of scrambling for a solution when the time comes; an emergency fund will ensure you are ready for anything.

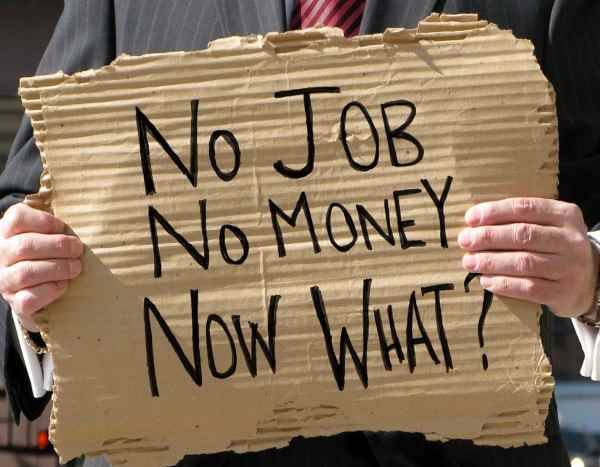

3. Unemployment

Your company needs to lay off a few employees and you happen to be one of the few unlucky ones. Jeepers! Now you have to hunt for a new job and it may take some time. Lay-offs can happen to even the best of employees so how will you pay your bills then?

Having an emergency fund acts as safety net during temporary unemployment. You could pay off some bills with it if it’s going to take while for you to find a job. Job-hunting in itself is a precarious thing and may be a hit or miss so you’ll want to be adequately covered until you find a new one.

4. Strapped for cash

The end of the month isn’t quite here and you’ve already used up your paycheck. That’s always the case for some of us especially during times where we lose track of our budget and overspend; or it maybe it was the festive season. Whatever the reason; you’re broke a lot faster than usual and to make it worse, next month’s salary is still many days away.

While you are waiting for your next pay, resorting to instant noodles isn’t the best way to go about it. If you have a credit card, making cash withdrawals can be costly so it wouldn’t be ideal though it will be good as a last resort.

An emergency fund is a better alternative when you’re strapped for cash. But hopefully you don’t deplete your emergency savings fund by resorting to it more often than necessary.

Unfortunate things can happen. Having equipped yourself with an emergency savings fund to fall back on can avoid frazzled nerves and sleepless nights. Don’t have an emergency savings fund yet? Start saving today and keep the financial blues away.

Comments (0)