Pang Tun Yau

9th April 2024 - 6 min read

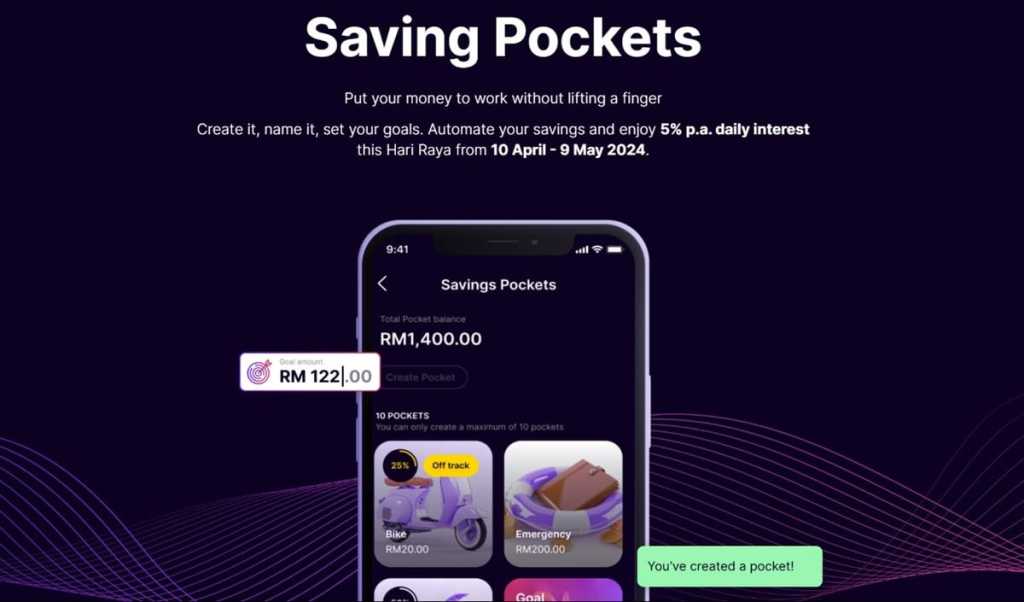

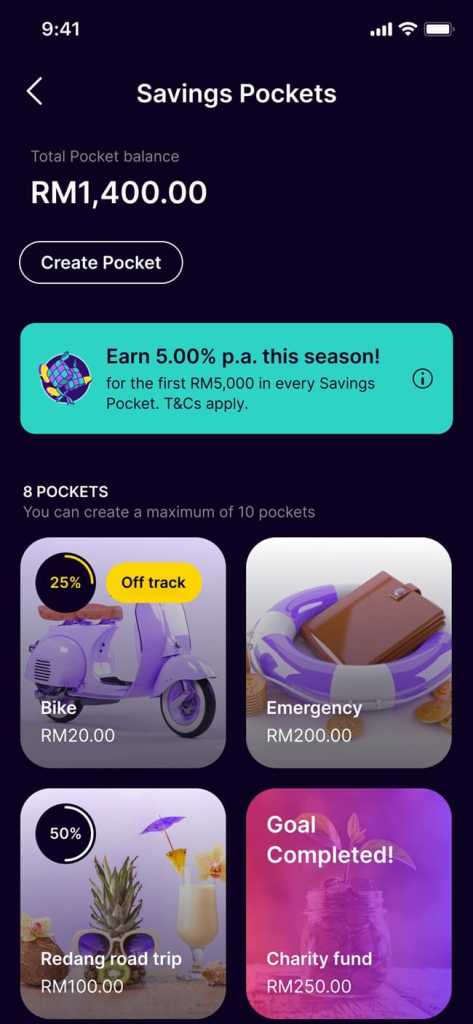

In conjunction with the upcoming Hari Raya celebration, GXBank has announced the GX Raya Bonus Interest campaign, which is set to run on 10 April to 9 May 2024. It offers 5% p.a. daily interest on the first RM5,000 end-of-day balance that you maintain in each Pocket created under your GXBank account (up to a maximum of 10 Pockets).

With even the most competitive offers from banking institutions and investment platforms currently providing a maximum interest rate of between 3% p.a. to 4% p.a. on their savings products, it’s easy to see why GXBank’s promotional 5% p.a. rate is enticing – there’s also no minimum deposit amounts, zero lock-in periods, or any other restrictions!

If you’re curious to know how to maximise your earnings for this campaign, let’s break it down.

How does GXBank calculate interest rate for Pockets?

First of all, you should know how GXBank actually calculates daily interest for its savings product, Pocket. As highlighted on its Help page, this is the formula that is utilised by GXBank in its calculation:

End-of-day balance x (interest rate/total days of the year) = Interest amount

As such, in the case of this campaign, the interest calculation for a Pocket with RM5,000 end-of-day balance is as follows:

| Number of Pockets | Calculation | Amount |

| 1 Pocket | RM5,000 x (5% / 366) | RM0.68306 (rounded up to RM0.68) |

| 10 Pockets | [RM5,000 x (5% / 366)]*10 | RM6.8306 (rounded up to RM6.80) |

The campaign FAQ also states a few important things when it comes to the interest calculation. Firstly, the 5% p.a interest is only given to the first RM5,000 of each Pocket, and anything above it will continue to earn the base 3% p.a. rate that GXBank is offering for all deposits.

Secondly, the interest crediting mechanics will be split into two portions: a 3% Base rate and a 2% Bonus rate. And lastly, the daily interest rate is calculated by rounding up or down the calculation to two decimal places.

How to maximise returns for GX Raya Campaign?

Therefore, if you put RM5,000 into a Pocket, this base deposit will earn the full 3+2% p.a. interest throughout the campaign duration of 30 days. Meanwhile, the interest earned from the base deposit will subsequently earn the base 3% p.a. interest, which will compound over 30 days (and beyond, as long as it stays deposited at the bank).

This means that over the campaign period, a RM5,000 deposit will earn a total of RM20.40. At 10 Pockets of RM5,000 each (for a total of RM50,000 deposit), the total returns earned will yield RM204 during the 30-day campaign period.

While the calculations may seem complicated, it shows that during this campaign period you can potentially earn 0.408% (RM204 / RM50,000) just by taking advantage of this campaign and GXBank’s daily interest crediting mechanism that enables daily compounding of interest.

So, with all that math out of the way, how best to maximise your returns from this campaign?

Tip 1: Split deposits into multiple Pockets if you wish to save more than RM5,000

This is very straightforward – if you have more than RM5,000 ready to deposit (and less than RM50,000), split them into multiple Pockets to earn the highest possible interest. As the FAQ document states, the 5% p.a. rate only applies to the first RM5,000 of each Pocket, so any additional deposit after (including any interest generated) will only earn the base 3% p.a. rate.

For example, if you have RM7,000 in savings to deposit, it’s best to set up two Pockets and leave some room in each Pocket to ensure the interest generated will also earn the 5% p.a. rate. Pocket 1 with RM5,000 and Pocket 2 with RM2,000 is not optimal as Pocket 1’s interest earnings will be capped at 3% p.a. – every sen counts!

Tip 2: Set up your Pocket(s) as early as possible

From our experience, we know that there is a huge amount of “FD Hunters” who are ready with large sums of money to deposit into high-yield FD promos. We also know that there are just as many Malaysians who regularly tap into FD alternatives like high-interest savings accounts (HISA) and money market funds offered by various platforms today.

Hence, it won’t be a stretch to assume that these groups will not hesitate to transfer their savings to tap into the GX Raya Campaign and maximise their returns over the next 30 days.

Why is this important to note? The campaign FAQ states that the campaign will only offer bonus interest on the first RM1 billion in deposits on a first come, first served basis. You can be certain that there will be those who will open GXBank accounts for their parents, children, spouses etc to maxi-maximise their returns – it’s free money after all with just a few taps on their phones.

Not to forget, the document also mentions that the Bonus rate will apply to both new and existing Pockets, so you can already start setting them up now before the campaign begins.

Tip 3: Stay deposited!

GXBank has previously stated that this campaign was to encourage more Malaysians to adopt a healthier savings habit. With the digital bank’s seamless account opening process and easy set up of dedicated savings pockets, this campaign also aims to show how easy it is to save – and earn higher returns in the process.

Naturally, if 3% p.a. isn’t high enough for you, there are various other options available – check out our FD alternatives article to learn more about them. However, do note that not all of them are PIDM-insured.

***

Now that you’re aware of how to maximise your earnings on GXBank’s 5% Raya Bonus Interest campaign, it’s best to prepare soon so that once the promotional rate kicks in tomorrow, you’re ready to go! If you’re already an existing GXBank customer, it only takes a few seconds to set up a Pocket and to deposit funds into it. If you’re not, there’s still time to apply for a GXBank account – it’s instant and fully online!

With this, we’d also like to wish you Selamat Hari Raya!

Comments (0)