Alex Cheong Pui Yin

3rd April 2020 - 3 min read

(Image: SoyaCincau)

Most Malaysian households will still be able to weather through their debt despite the negative effects of the current Covid-19 pandemic and an ensuing economic decline, said Bank Negara Malaysia (BNM) in a report published today. However, households that fall within the B40 category may face greater difficulty in maintaining their debt repayments.

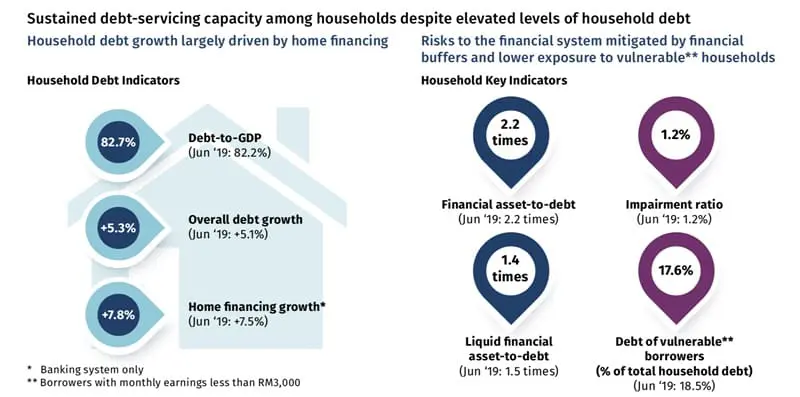

In the Financial Stability Review 2019, the central bank commented that although the country’s overall household debt has increased since the first half of 2019, most Malaysians can still survive the recent impact on the local economy. The current household debt is revealed to stand at the equivalent of 82.7% of Malaysia’s entire economy, which saw a 0.5% increase from the household debt in the first half of 2019. The report also mentioned that the increase is largely driven by home financing.

Bank Negara further commented that the households’ resilience is supported by income growth and adequate financial buffers. This is in reference to the various measures that the government, banks, and institutions in the country have introduced in a bid to help the public, such as the lowering of the overnight policy rate (OPR), a six-month automatic moratorium, the Economic Stimulus Package 2020, and the Prihatin Economic Stimulus Package. Additionally, the prudent lending guidelines practiced by local banks in providing loans – thereby ensuring that all borrowers are properly qualified – have also proved to be vital in reducing the risks of households experiencing financial difficulties as a result of their loans.

“At the aggregate level, both outstanding household financial assets and liquid financial assets remained broadly stable at 2.2 times and 1.4 times of debt, respectively,” said the report.

Households earning below RM3,000, however, face a less optimistic prospect as the report indicated that there is a high likelihood of them defaulting on their loans, particularly mortgages. In Malaysia, such households fall within the category of B40, an income group with a median income of RM3,000 per month.

(Image: EdgeProp)

Additionally, the report mentioned that households in this group typically have about nine times more debt than assets. The situation is primarily caused by the increase in residential loans, which occurred due to the launch of the Home Ownership Campaign 2019.

“Low income, coupled with poor financial planning, continued to be the main causes of financial difficulty faced by these borrowers, as they tend to overestimate their ability to cope with higher costs of living and debt obligations,” said BNM, who also noted that the B40 category accounted for more than half of those who sought for credit counselling.

The situation for the B40 category is exacerbated by the ongoing movement control order (MCO), which required the stop of all non-essential businesses. This subsequently meant a halt to their earnings and livelihood as many of them are day labourers who are paid only when they work.

However, the central bank again stressed that the various financial measures that have been offered thus far should lighten their burden, in particular the Prihatin Economic Stimulus Package and the automatic moratorium.

(Source: Malay Mail, Bank Negara Malaysia)

Comments (0)