Alex Cheong Pui Yin

13th January 2021 - 5 min read

Standard Chartered Bank has announced several sweeping changes to its Privilege$aver high interest savings account, slated to take effect from 1 February 2021 until 31 January 2022. The revisions cover the base and bonus interest rates, the caps on the monthly amount that you can earn interest on, as well as the earning requirements for some bonus categories. Interestingly, it potentially allows you to earn more interest than before.

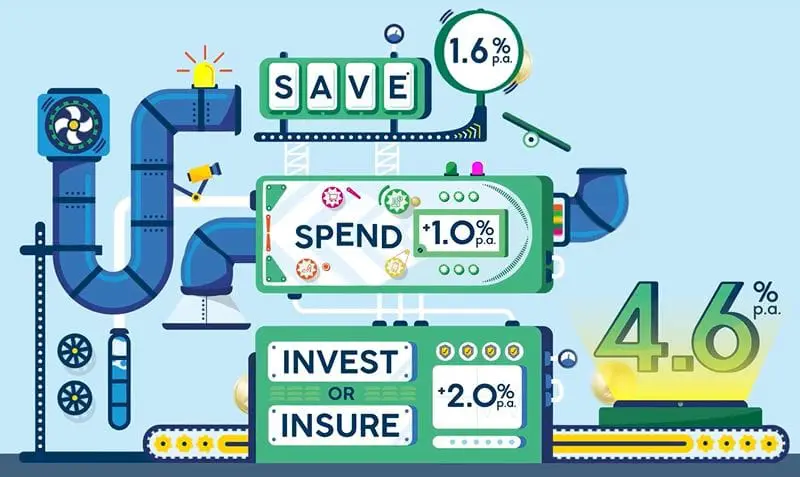

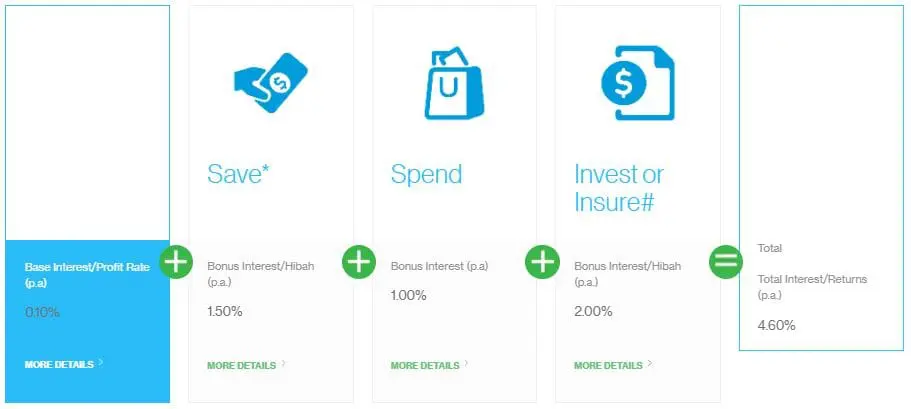

The existing Privilege$aver campaign allows accountholders to earn a maximum total interest of 4.6% p.a. when they carry out certain transactions under the Save, Spend, and Invest/Insure categories.

Come 1 February 2021, however, you will see quite a fair amount of changes being implemented, which will enable you to earn interest of up to 4.75% p.a. instead. We’ve summarised the upcoming revisions in the table below:

| Category | Before 1 Feb 2021 | Effective 1 Feb 2021 | Criteria effective 1 Feb 2021 | ||

| Rate | MAB Cap | Rate | MAB Cap | ||

| Base rate | 0.10% p.a. | All balance | 0.05% p.a. | All balance | – |

| Save | 1.50% p.a. | RM200,000 | 0.90% p.a. | RM100,000 | Single deposit of minimum RM3,000 in fresh funds |

| Spend

(i) Credit card |

1.00% p.a. |

RM100,000 |

0.90% p.a. |

RM100,000 |

Minimum spend of RM1,000 |

| (ii) Debit card | – | – | 0.90% p.a. | RM100,000 | Minimum 5 transactions per month |

| Invest/Insure | 2.00% p.a. | RM20,000 or RM100,000 | 2.00% p.a. | RM100,000 | Minimum RM30,000 investment in unit trust, or RM30,000 annual premium in insurance products |

| Total rate | 4.60% p.a. | 4.75% p.a. | |||

Here are the full changes to every category in the Privilege$aver campaign in the upcoming revision:

Base interest rate

The base interest rate for the Privilege$aver account will be reduced from 0.1% p.a. to 0.05% p.a..

Bonus category: Save

The bonus interest rate for the Save category will be reduced from 1.5% p.a. to 0.9% p.a., and the cap on the monthly average balance (MAB) is also slashed from RM200,000 to RM100,000. The minimum deposit amount remains unchanged at RM3,000 per month.

In other words, you are currently able to earn 1.5% p.a. bonus interest on up to a monthly amount of RM200,000 via this category. After 1 February, however, your earnings will be limited to 0.9% p.a. bonus interest on a maximum MAB of RM100,000.

Bonus category: Spend

At present, accountholders are allowed to earn 1% p.a. when they spend a minimum of RM1,000 on their Standard Chartered credit cards. Starting from 1 February, Standard Chartered will revamp this category to offer a bonus interest of 0.9% p.a. for both credit and debit card spend. This means that you can earn a total bonus interest of 1.8% p.a. by using both Standard Chartered credit and debit cards.

For credit card expenses, you will still need to meet a minimum spend requirement of RM1,000 to get the 0.9% p.a. bonus interest, applicable on up to RM100,000 MAB. The new debit card requirement lets you earn an additional 0.9% p.a. bonus interest by performing at least five retail transactions on your debit card. This is also applicable on up to RM100,000 MAB.

It’s worth highlighting here that Standard Chartered is effectively letting you earn more bonus interest (1.8% p.a. vs 1.5% currently) with the upcoming revision. We’ve reached out to the bank to check if there’s a minimum amount required for the five debit card transactions, and have been told that there will not be one – making it a lot easier to unlock 1.8% p.a. bonus interest come 1 February onwards.

Bonus category: Invest/Insure

The bonus interest provided under the Invest/Insure category will remain at 2.0% p.a., but the earning requirement will be revised. Currently, you are required to spend a minimum of RM1,000 per month on selected unit trust or insurance products via a Regular Savings Plan to get the bonus interest. With the latest revisions in place, you will need to spend at least RM30,000 annually on similar products to qualify for the bonus interest instead.

In addition, the bonus interest – which was previously paid monthly for 12 months when you meet the requirements – will now only be paid for 3 months. Standard Chartered is also standardising the MAB to only RM100,000, as compared to the previous tiers of RM20,000 or RM100,000 (depending on the minimum spent on investment or insurance products).

(Image: Global Business Outlook)

The latest revision to the Privilege$aver account will require accountholders to be tweak their strategies in order to meet these new requirements. The new Spend requirements will make it easier to unlock 1.8% p.a., but those who wish to unlock the Invest/Insure bonus will need to spend more to earn it (from RM1,000/month to RM30,000 annually).

Additionally, the standardisation of the MAB caps effectively means all interest earned will only be applicable to a maximum MAB of RM100,000 – so if you have more, it’s a good idea to split the surplus savings to some of the other best high-interest savings accounts in Malaysia.

(Source: Standard Chartered)

Comments (0)