Samuel Chua

24th April 2025 - 2 min read

Standard Chartered Bank Malaysia Berhad has announced that its ‘Pay Bills’ online service will be discontinued from 1 June 2025 on both the SC Mobile App and Online Banking platform. Clients who currently rely on the ‘Pay Bills’ feature are advised to transition to alternative payment methods such as JomPAY, FPX, and Direct Debit to avoid any disruption to their bill payments.

In anticipation of this change, the bank is offering a limited-time incentive. Clients who switch to JomPAY, FPX, or Direct Debit and make payments to specified billers between 28 April 2025 and 31 May 2025 will be eligible to receive RM10 in Touch ‘n Go eWallet credit. Each eligible client will be entitled to a maximum of one reward, subject to the terms and conditions outlined on the bank’s website.

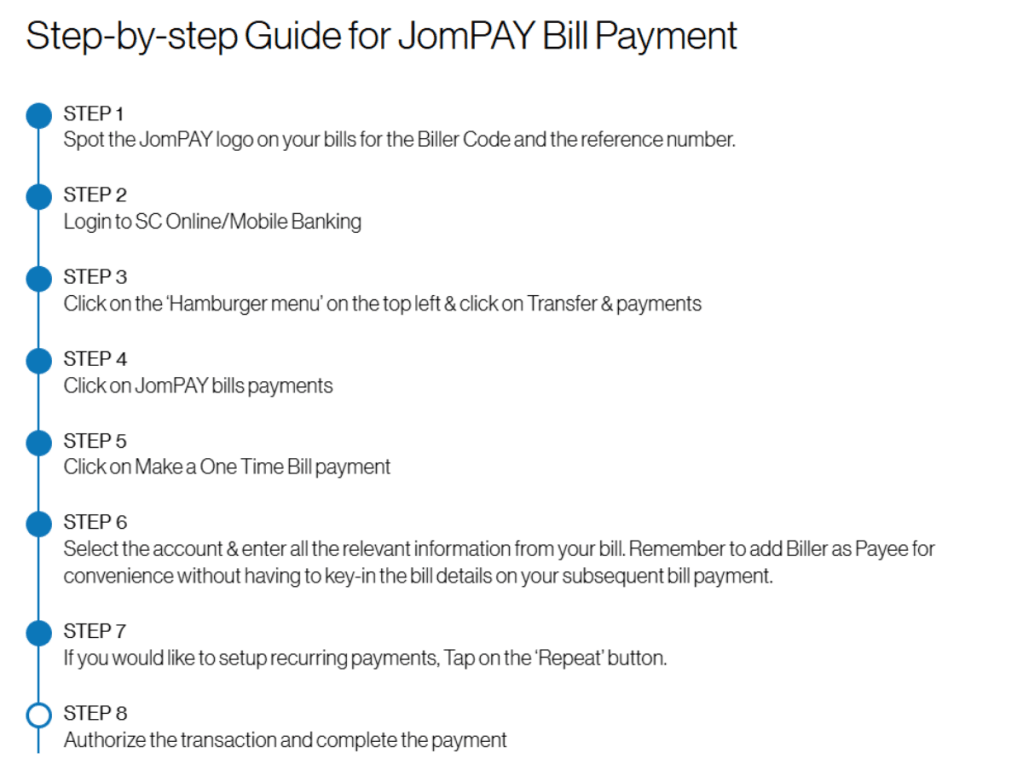

The affected billers include a range of organisations such as MSIG Insurance, Tabung Haji, Pusat Pungutan Zakat, and The Royal Selangor Golf Club, among others. Clients can use JomPAY for either one-time or recurring payments by entering the Biller Code and Ref-1 number available on their bills through the SC Mobile App or Online Banking.

For specific billers like Prudential Assurance Malaysia and Prudential BSN Takaful Berhad, clients may either use FPX via the respective company portals or set up Direct Debit instructions directly. Similar arrangements are advised for billers such as Sungai Long Golf Resort Berhad, where Direct Debit remains the preferred method of payment.

The bank has published detailed guides for setting up each payment method, ensuring that clients are supported during the transition. Further information, including the list of affected billers and step-by-step instructions, is available on the Standard Chartered Malaysia website.

(Source: Standard Chartered Bank)

Comments (0)