RinggitPlus

1st April 2018 - 3 min read

It’s true that applying for banking and insurance products online can be easier than tracking down a branch and scheduling an appointment. However, this makes it a little harder for the companies to verify your identity, which is why they rely so heavily on the documents you submit.

A certain standard of quality is applied on all scanned documents to prevent fraud and used as a security measure to accommodate the world going digital. So, here are some tips to help you ensure your scanned documents are up to par.

Don’t have a scanner at home or at work?

Relax, there is another way to scan your documents, sitting at your fingertips. That’s right, you just can take a photo of the documents with your phone.

Fortunately, banks and insurers will accept photos of your documents as long as they meet their requirement for a scanned copy and have a good image resolution. Here are some tips to ensure that photos of your documents will be accepted.

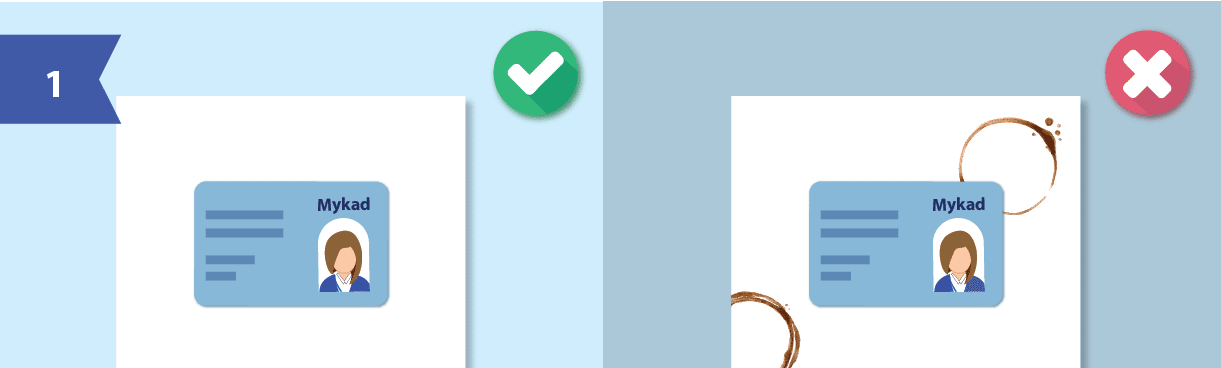

1) Place your IC on a piece of blank white paper. For this part, it is in your best interest to use a fresh piece of paper to avoid complications. (You will see why.)

2) Ensure the surrounding area is free from clutter. If not, the photo you take might not resemble a scanned image/ document.

3) When you taking the photo of your document, make sure your phone is parallel to your document. One way to help you achieve this is using the paper as the frame.

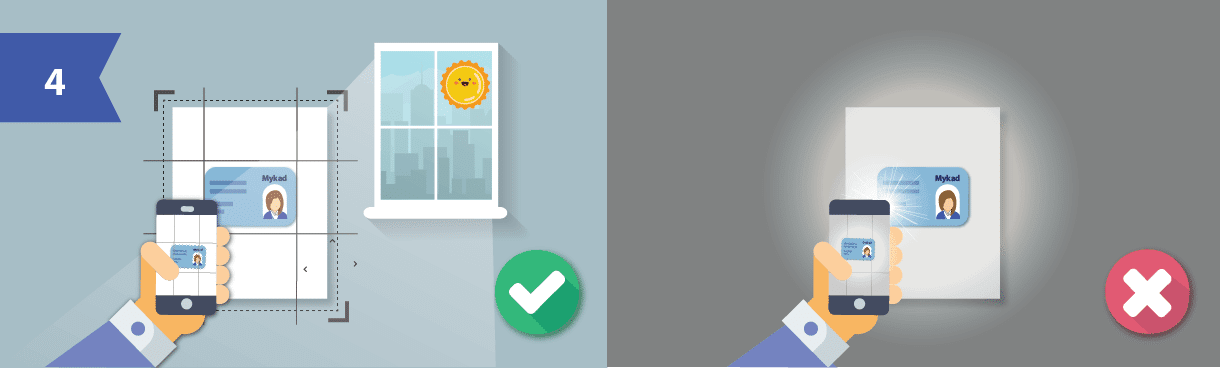

4) It is advisable to use natural light with no flash for the photo. Try not to use the flash to avoid blocking out certain details on the document.

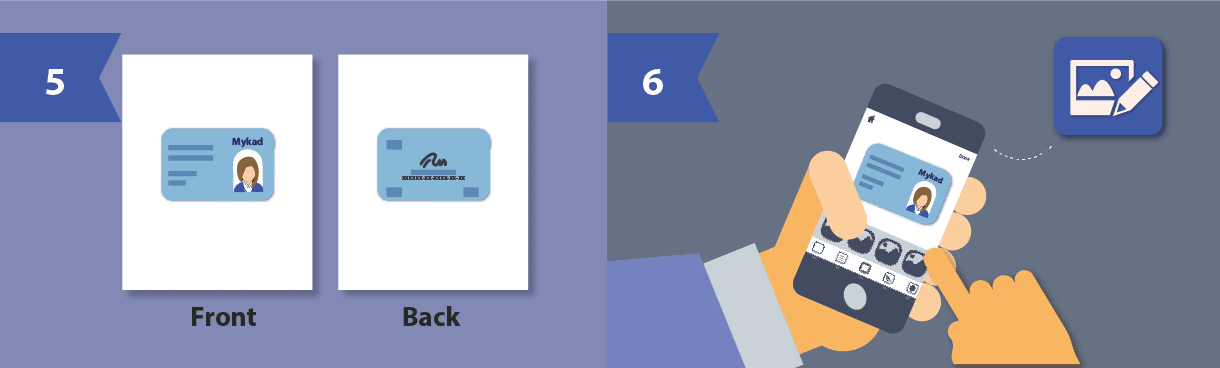

5) For NRIC copies, you need to do the first four steps twice for both the front and back of your NRIC.

6) You can always use a photo editing tool to spruce it up if you need to.

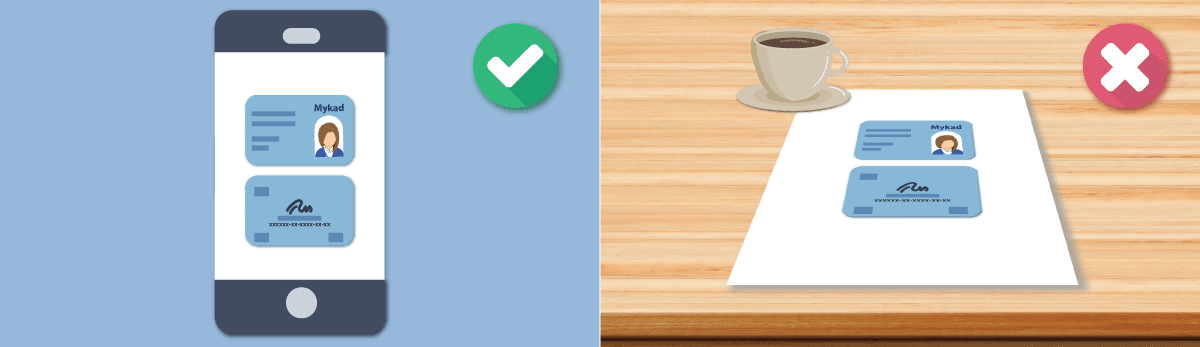

The following is the end result that you should achieve.

Digital Copies

Not all documents need to be scanned for bank submissions as you might already have it in a soft copy format. Documents such as your credit report, EPF statement and salary slip can be easily obtained online.

Always Be Prepared

We hope that you have found this article useful. Remember that it is advisable to check with your bank or insurance provider on what is the acceptable in terms of document submission, before you start preparing them.

Want to be rewarded when you apply for a credit card? Our Best Credit Card Sign Up Offers page shows the best available!

Comments (1)

Brilliant!