Alex Cheong Pui Yin

14th September 2020 - 2 min read

(Image: Bernama)

Deputy Finance Minister II, Mohd Shahar Abdullah, has emphasised that Bank Negara Malaysia (BNM) is adopting a balanced approach in the matter of establishing the country’s digital banks. This is to enable the setting up of digital banks with strong value propositions and the ability to preserve the integrity and stability of the financial system.

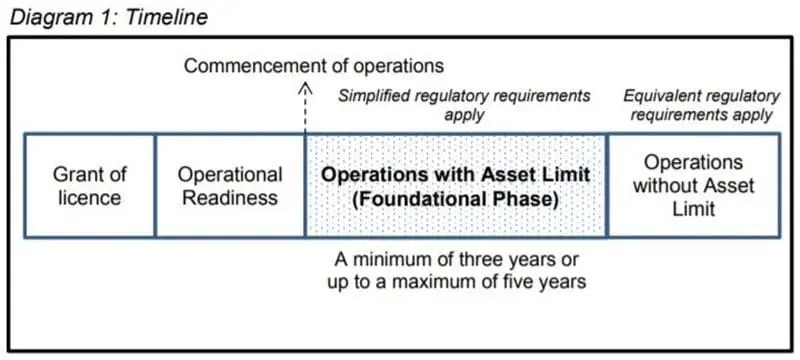

“Through this approach, BNM sets the cumulative asset threshold that can be generated by digital banks of not more than RM2 billion in the initial three to five years of operations. The foundational phase aims for digital banks to demonstrate their viability and sound operations, while BNM monitors their performance and any attendant risks,” said Shahar during a Dewan Negara session.

Aside from the cumulative asset threshold requirement, Shahar said that digital banks will also need to comply with the Financial Services Act 2013 or the Islamic Financial Services Act 2013. These include abiding by standards on prudential business conduct and consumer protection, as well as anti-money laundering and terrorism financing.

Shahar also noted that during the foundational phase, licensed digital banks will be subjected to a more simplified regulatory requirement with regard to their capital adequacy, liquidity, stress testing, and public disclosure. “This is in line with the objective to encourage growth and innovation by digital banks, especially to increase financial access to segments that are lacking or do not have financial services,” he added.

Shahar had been referencing an exposure draft on licencing framework for digital banks that was released by BNM earlier this year. The draft was open for negotiation and feedback until 30 June 2020. BNM is currently reviewing the responses obtained during the negotiation period, and will finalise the digital licencing policy document before opening applications for the licence.

(Source: Bernama)

Comments (0)