Alex Cheong Pui Yin

7th October 2022 - 2 min read

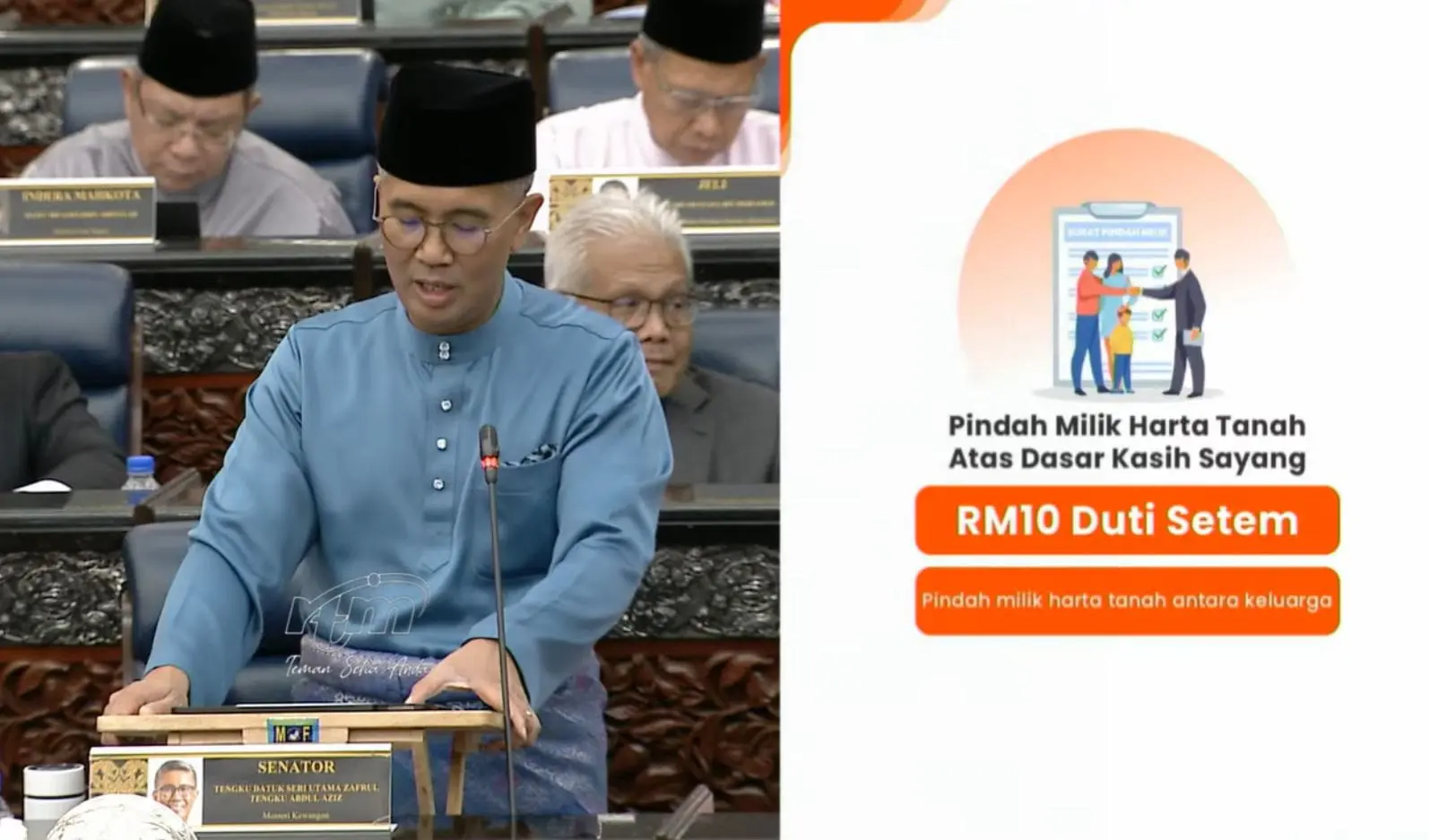

Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz has announced that under Budget 2023, the government will reduce the tax rates for taxable income ranging between RM50,001 to RM70,000, and RM70,001 to RM100,000 by 2%.

At present, those with a chargeable income of between RM50,001 to RM70,000 are required to pay 13% tax, while those in the RM70,001 to RM100,000 taxable income bracket must pay 21%. With this update, the new tax rates for these two groups are as follows:

| Chargeable income (RM) | Current income tax rate | New income tax rate |

| 50,001 – 70,000 | 13% | 11% |

| 70,001 – 100,000 | 21% | 19% |

Aside from this, Tengku Zafrul also said that the tax rates for those in the RM250,001 to RM400,000, and the RM400,001 to RM600,000 taxable income brackets will both be standardised to 25% next year. At present, only individuals in the RM400,001 to RM600,000 income bracket are required to pay 25% tax; those earning between RM250,001 to RM400,000 per year, meanwhile, are currently paying a tax rate of 24.5%.

Tengku Zafrul also noted that these changes will allow the middle income group to enjoy tax savings of up to RM1,000, while high income group will save up to RM250. This also means that an estimated surplus of RM800 million will be freed for the people to spend.

The tax rates for other chargeable income brackets remain unchanged.

Comments (2)

So am I right to say those earning 250,001-400,000 will have to pay 0.5% more tax next year?

can you explain how high income group will save up to RM250? from what i understand, those who earn 250k to 400k is getting a higher tax rate.