Pang Tun Yau

7th October 2022 - 2 min read

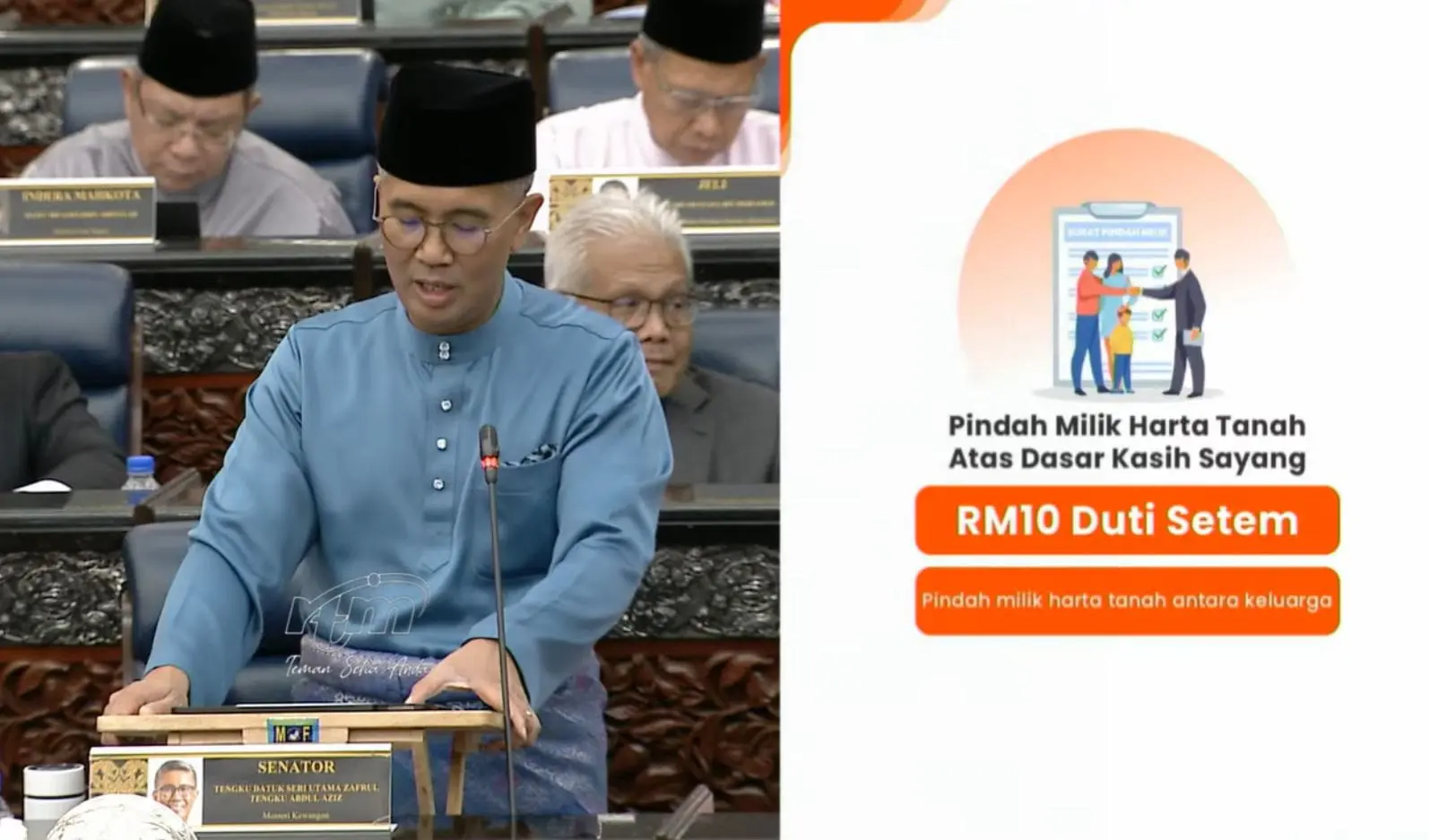

From 2023, the transfer of properties between family members will be set at a fixed rate of just RM10. Meanwhile, there will also be an increase to the stamp duty exemption for property transfer and loan agreements for houses worth between RM500,000 to RM1 million.

In the tabling of Budget 2023, Finance Minister Datuk Seri Tengku Zafrul Aziz stated that the government will set a nominal rate of just RM10 for transfer of properties “based on love”. This includes transfers between spouses, parent and children, as well as grandparents and grandchildren.

The amount saved can be very steep, considering that currently, the stamp duty exemption for property transfers between parent and children is only 50%, while there are no stamp duty discounts for gifts between grandparents and grandchildren (and any other family relation). The only full exemption of stamp duty is between spouses.

On a separate note, Tengku Zafrul also announced that the stamp duty for houses worth between RM500,001 to RM1 million will be increased to 75% from the current rate of 50%, effective until 31 December 2023. This is on top of the 100% stamp duty exemption for houses below RM500,000. This is aimed at further encouraging ownership of first homes, as the stamp duty exemptions can be quite substantial.

“For example, a 100% exemption for a RM300,000 property purchase can save RM6,500 (in stamp duty) while a 75% exemption for a RM750,000 property purchase can save the rakyat up to RM15,000 (in stamp duty),” he said.

Comments (3)

Has this being gazetted? Last month I was at LHDN Jln Duta and was told these clauses has not been gazetted yet

yes, when start?

Is this still valid for budget 2023?