Pang Tun Yau

18th October 2024 - 1 min read

As part of the government’s efforts to expand its tax revenue without burdening the rakyat, it is aiming at a more progressive implementation of the current Sales and Service Tax (SST) instead of the rumoured return of the Goods and Services Tax (GST).

For instance, sales tax will not be applicable on essential food items, but will be applied on non-essential items such as premium imported food items like salmon and avocados. In addition, the Service Tax scope will also be expanded to cover commercial services such as fee-based financial services.

The expanded SST scope will be implemented from 1 May 2025. However, before the implementation date, the government will hold various engagement sessions with relevant parties and industries.

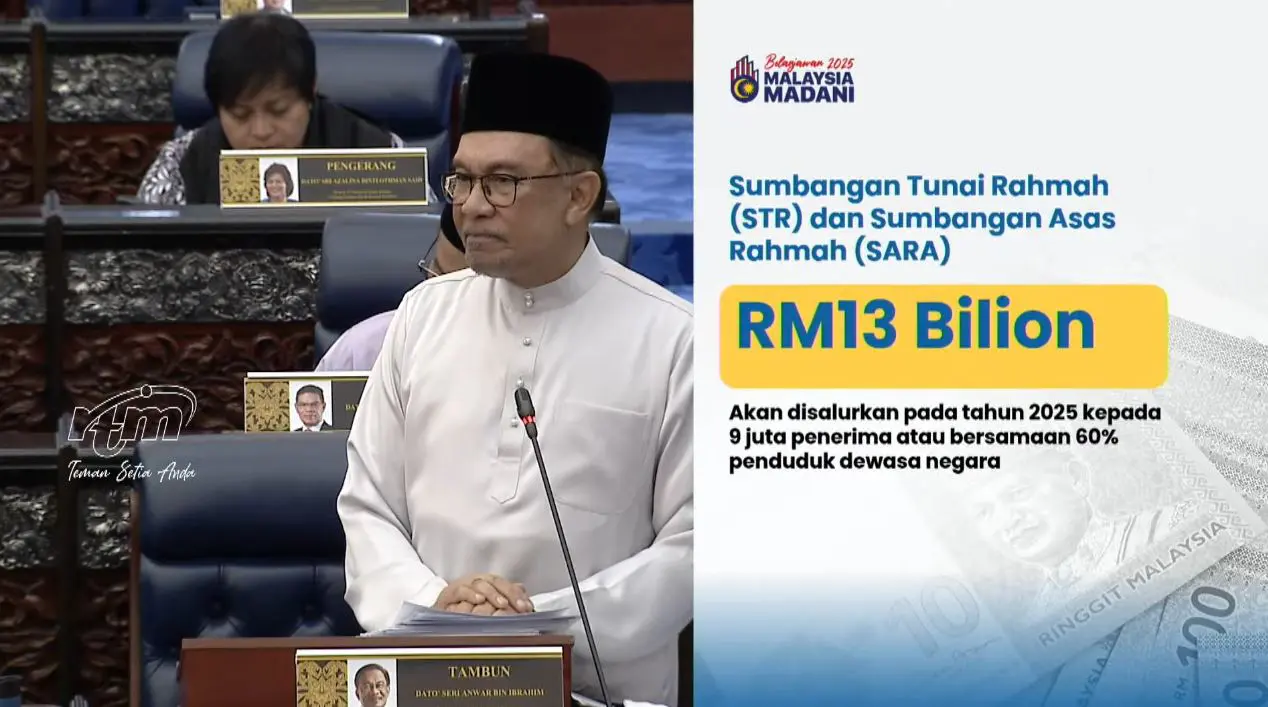

According to Prime Minister Dato’ Seri Anwar Ibrahim, part of the additional proceeds of the expanded SST will be used to improve cash handouts (which will be the highest-ever in history) and improve the quality of education and health services in the country.

A seasoned tech journalist who now focuses on his other passion, Pang is a firm believer in old-school DCA and optimised spending.

Comments (0)