Alex Cheong Pui Yin

8th June 2023 - 4 min read

Last month, Standard Chartered had announced that it is rebranding its popular WorldMiles World Mastercard to the new Standard Chartered Journey credit card, with revised benefits. While this revamp is only set to take effect on 10 June, Standard Chartered’s webpage for the Journey card has now been published, offering us our first look at the new card face (as you can see above!), along with some extra information that were not made available previously – so let’s dive in!

The new card face design is a similar design language to recent cards launched by Standard Chartered including the SimplyCash and Smart credit cards. It’s a big change away from the old WorldMiles design, which was more unique and recognisable.

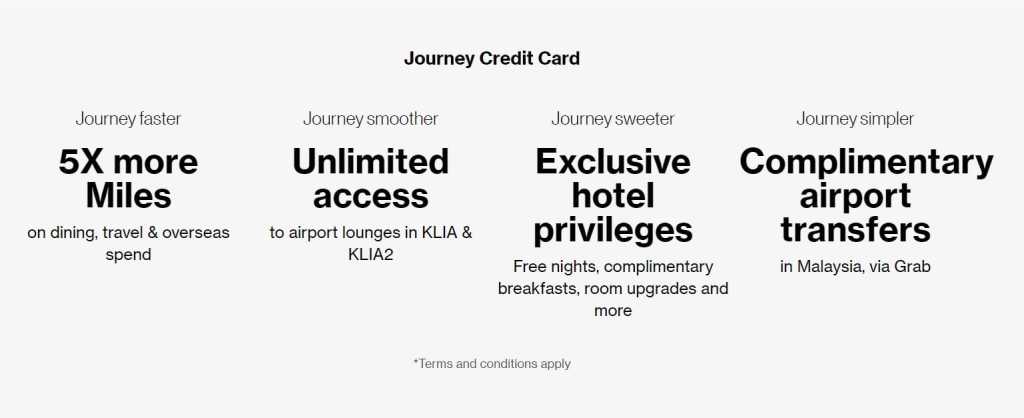

Moving on, in our previous coverage we touched on the revised points earning benefits of the card, which will include accelerated miles earning benefits not only for travel and overseas retail transactions, but dining as well, as broken down below:

- 1 Miles Points for every RM1 spent on dining, travel (airlines, hotels, and online travel agencies), and overseas retail transactions

- 1 Miles Points for every RM5 spent on other eligible local spend (excluding transactions such as government-related expenses, cash withdrawals, utilities, e-wallets, and special events categories)

Meanwhile, the Journey product page now officially confirms that the air miles redemption rate will remain the same as that of the outgoing WorldMiles card. 1 air mile can be redeemed for 2 Miles Points – though it is still not confirmed from the website if the list of frequent flyer programmes will remain the same (currently for WorldMiles points conversion, cardholders may redeem air miles/points from AirAsia, Asia Miles, Enrich, and KrisFlyer).

Aside from that, the Journey card will retain another favourite feature of the WorldMiles World Mastercard as well: unlimited access to airport lounges in KLIA and KLIA2. This was a highly valued feature of the WorldMiles World Mastercard, making it – and now the Journey card – one of the very few cards in Malaysia to still allow unlimited lounge access (and the only one in its income range to offer this perk). For those who travel frequently for work, this is a strong perk to consider.

Cardholders will also be able to redeem complimentary airport transfers in the form of Grab rides from any airport in Malaysia, capped at RM65 (the standard Grab fare for a trip to/from KLIA Terminal 1/2 and the Klang Valley, excluding toll fares) which will credited into your Journey card account within 60 days after your ride. Note that this benefit can only be redeemed with a minimum spend of RM2,500 on travel expenses (Airlines, Hotels, & Online Travel Agencies), and must be made within 90 days before the Grab ride transaction.

These changes expand the airport transfer benefit to cover all airports in Malaysia as well as the scope of coverage to local travel as well – the WorldMiles airport transfer benefit was previously limited only to KLIA Terminal 1/2, and is only eligible when the cardholder makes three transactions in foreign currencies.

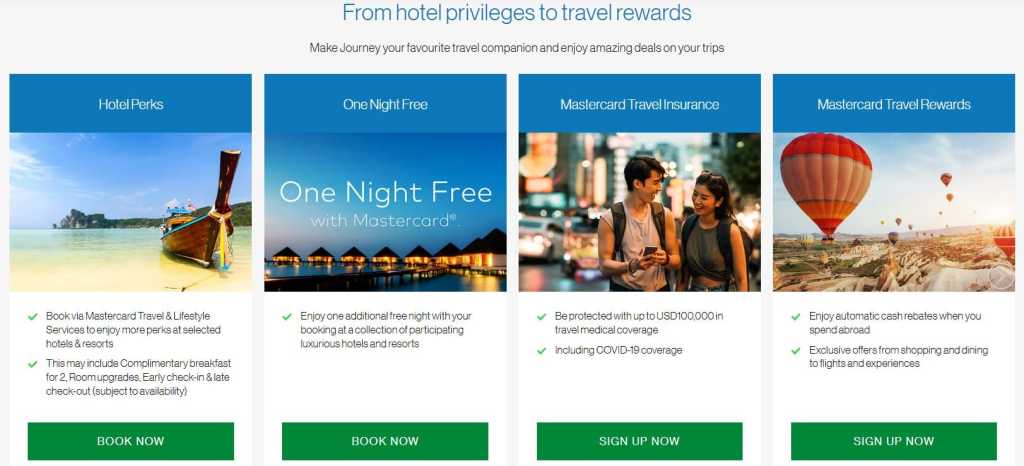

Other notable travel perks that are also provided under the Journey card include travel medical coverage of US$100,000 (inclusive of Covid-19 coverage), as well as exclusive hotel privileges at participating hotels or resorts in partnership with Mastercard. These include free nights, complimentary breakfasts, room upgrades, as well as early check-ins and late check-outs.

One final note is that the SC Journey card is a CarbonNeutral card – in line with Standard Chartered’s global launch of its carbon neutral credit and debit cards since end of 2021.

As for eligibility and annual fees, the Journey card can be applied by those who earn a minimum annual income of RM90,000, with an annual fee of RM600 – unchanged from the WorldMiles World Mastercard. Similarly, you’ll also get a waiver on the annual fee without condition for the first year, and then for subsequent years with a minimum spend of RM60,000 per year.

Finally, a note to those who are interested in applying for the new Journey card immediately: although the page for the card is certainly live, we don’t believe it is ready to accept applications yet. At present, when you click on the “Apply Now” button on the page, it still leads you to the application form for the WorldMiles World Mastercard. As such, it may be a better idea to wait until the actual date of the launch (10 June) or more likely the following work day (12 June) to submit your applications, just to be sure.

(Source: Standard Chartered)

Comments (2)

Do you need to have purchased your ticket with the SC Card to enjoy the lounge? I mean cause i used a different card when booking my ticket?

no, you don’t. but you must have your card with you to be able to enter.