Pang Tun Yau

19th March 2021 - 5 min read

UPDATE: RinggitPlus Financial Planner is currently undergoing a rebranding exercise, and will relaunch in January 2023. During this period our website will be under maintenance. For rates and enquiries, please click here to drop a WhatsApp message – the team will respond within 1 business day.

RinggitPlus has launched RinggitPlus Financial Planner, a new one-to-one digital financial planning service for Malaysians. The new product expands the brand’s offerings in line with its mission of empowering Malaysians to make smarter financial decisions.

With a bold mission to disrupt the financial services industry in Malaysia, RinggitPlus Financial Planner is offering comprehensive financial planning services at affordable fees – dispelling the myth that financial planning services are only reserved for the rich. At a time when many Malaysians are facing financial challenges and have to potentially make difficult financial decisions, RinggitPlus Financial Planner is a powerful tool that can truly help Malaysians.

Interestingly, it is also the first company to offer a fully-digital financial planning service, where the entire process from booking to consultation is conducted online.

Hann Liew, CFA, CFP, & co-founder of RinggitPlus

“Financial planning is an exceptionally important task that many people know they should do, but usually don’t. It’s like the advice of going to the dentist twice a year, or doing your medical check-up every year – we know we should do it, but how many of us will?” said Hann Liew, co-founder and director of RinggitPlus.

Hann, who is also a Licensed Financial Planner himself, added: “Just as with physical health, our financial health becomes more important to monitor as we age. Licensed financial planners not only help you focus on achieving your financial goals, but they can also help you fix any financial “ailments” that you may have.”

What Is RinggitPlus Financial Planner?

RinggitPlus Financial Planner is a one-to-one guided financial planning service that covers six practices:

- Cash Flow & Net Worth Analysis

- Debt & Liability Management

- Insurance/Risk Management

- Unit Trust/Investments

- Tax/Zakat Planning

- Estate/Family Wealth Planning

A licensed financial planner will first assess the client’s current financial situation before providing a comprehensive report and financial plan which includes recommendations on what to do to achieve the client’s long-term financial goals. Depending on the package chosen, the financial planner will reconnect with the client after six months to review their progress and tweak the plan accordingly. Should the client need more sessions with the financial planner, they can do so by purchasing an Add-On pack.

In addition, all financial planners with RinggitPlus Financial Planner are licensed financial planners, members of the Financial Planning Association of Malaysia (FPAM), and are licensed by the Securities Commission of Malaysia. This is the real deal that covers all aspects of your money, unlike single product services you may get with insurance agents or so-called wealth or life planners.

Price & Packages

“Many Malaysians have a misconception that financial planning is a “rich people” activity, when the reality is that everyone needs to know how to manage their money effectively, regardless of their financial situation. In fact, the middle and lower income groups could benefit from the services of a financial planner just as much as the rich people, and with RinggitPlus Financial Planner, now they can” said Jo Yau, Chief Marketing Officer of RinggitPlus.

“We are also aware that the two main factors that prevent more people from engaging a financial planner is cost and transparency – and we’re in a position to fix both. With RinggitPlus Financial Planner, we want to democratise the industry, allowing the everyday Malaysian to have access and the opportunity to have their own financial planner,” she added.

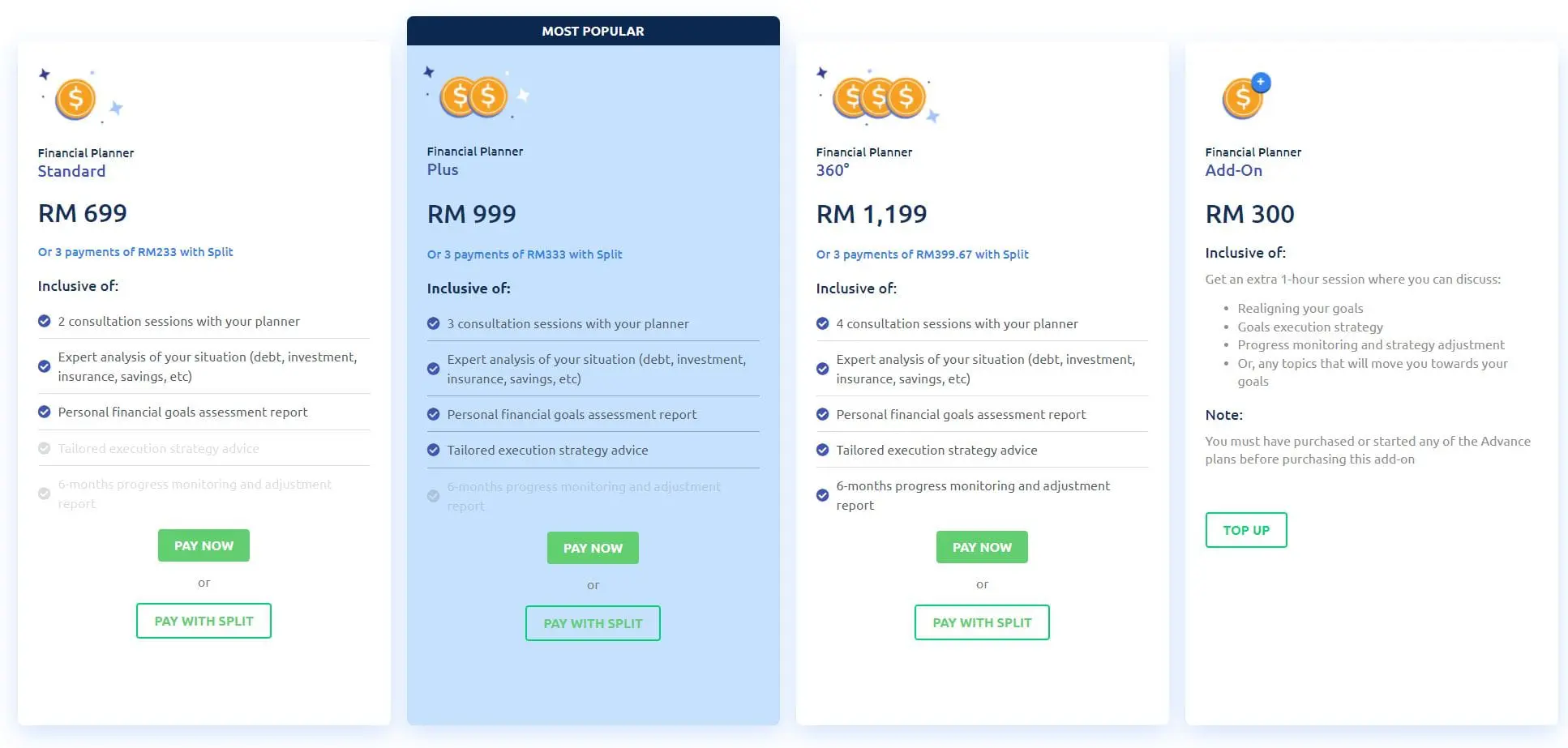

To cater to the different needs of clients, RinggitPlus Financial Planner is offered in three packages: Standard at RM699, Plus at RM999, and 360 for RM1,199. All packages are inclusive of:

- Gathering personal & financial information

- Defining financial goals

- Identifying gaps & opportunities

- Creating a financial plan

The Intermediate package offers additional guidance on the plan’s execution process, while the 360 package offers execution guidance and another session with the planner after six months to review and tweak the plan if necessary. As mentioned earlier, an “Add-On” package is also available to existing RinggitPlus Financial Planner clients for extended monitoring, consultation, and execution guidance.

Disrupting The Industry

The high costs of engaging a licensed financial planner is one of the main factors why many assume it is only for the wealthy. On top of that, there is the other issue of how financial planners charge for their services – some planners charge based on time/duration or sessions, while others may charge based on products sold to the client. This opacity makes many potential clients wary of hidden charges and usually turns them away from engaging with one.

RinggitPlus Financial Planner aims to tackle both issues, by offering affordable fees and transparent pricing without hidden charges. With prices starting from just RM699 and transparent add-on packages, RinggitPlus Financial Planner’s prices are, on average, up to 83% lower than other financial planning services available in Malaysia.

Azril Ikram, IFP, CFA

“We believe that financial planning should be taken seriously, and even more so at a time like this. Malaysians, especially the younger generation, do not have to suffer the same issues as the previous generation who struggle to save enough money for retirement.

From just RM699, Malaysians can get the stepping stone they need to realign their financial health and get a headstart towards their financial goals. For our Muslim clients, we also provide advice on Shariah-compliant investment strategies, optimisation of tax payable via zakat and estate planning involving hibah, faraid, and wasiyyah ” said Azril Ikram, one of the licensed financial planners for RinggitPlus Financial Planner. Azril is also a licensed Islamic Financial Planner.

RinggitPlus Financial Planner is now open for booking. For more information or to reserve a slot, head on to the official RinggitPlus Financial Planner website.

Comments (2)

The key question is RinggitPlus putting the clients interest always first . Or is RinggitPlus makind commisions somehow or truing to make commissions after getting our database??

Hi Robert, the RinggitPlus Financial Planner service works like other licensed financial planning services in Malaysia, which is governed and overseen by the Securities Commission. In essence, you pay for the financial planning service, where the Licensed Financial Planners will provide recommendations on products that fit your financial goals (among other things – you get a personalised report and explanations on your current financial status and progress on your financial goals). As such, there is no hard selling (since technically our revenue comes from the sessions themselves, not the number of commissions sold). Currently, the track record of our existing… Read more »