Alex Cheong Pui Yin

22nd March 2021 - 7 min read

Everyone aims to achieve some form of financial goal. Whether it is a long-term one such as purchasing a house, retiring comfortably, or even short-term ones such as saving up for a new smartphone, it is extremely unlikely that one can go through life without a financial goal.

That said, meeting these goals can be a major challenge if you do not have an understanding about your finances as well as ways that you can use to manage them wisely. This is where financial planning comes into play, allowing you to prepare yourself to the best of your abilities (and resources, of course).

What is financial planning?

Simply put, financial planning is a continuous process of managing your current financial status, determining your short- and long-term goals, as well as drawing up specific strategies to help you achieve those goals.

If you set aside a portion of your salary as savings each month, you’re already doing some form of financial planning. However, there’s a lot more to financial planning than just saving – comprehensive financial planning encompasses aspects such as cash flow, savings, assets, debts, investments, insurance, and so on. The idea behind it is to ensure you are not just on track to achieving your financial goals, but also covered in areas you may not have considered or even thought about.

Why is financial planning important?

There are many reasons why financial planning is important. Here are some key benefits to consider:

It helps you identify financial lapses and take steps to fix them.

Proper financial planning is crucial in helping you to discover and rectify possible financial oversights – because you’re always kept informed about the state of your finances. For instance, you may be able to identify some outstanding credit card balance that may have accidentally forgotten (it can and does happen), or realise that the unit trust fund you’ve been investing in every month hasn’t been performing as it should. From there, your next steps to rectify them becomes easier and more effective.

It allows you to make the most out of your assets.

Just as how you’d plan vacations to make the most of your holiday, financial planning helps you make informed decisions so that you can manage your resources to its most efficient state. Some good questions to ask yourself can be:

- How can you safely set aside your emergency savings while still earning higher interest than a basic savings account?

- How can you still generate returns even when you are spending?

- How do you maximise your income tax returns?

There are of course many more questions like the above. At the end of the day, you should have the mentality that your assets should be working hard for you.

It lets you measure your progress.

Having a financial plan in place means you can now measure the progress to your financial goals as most plans will require you to quantify your goals or set estimated deadlines. Some, for example, may involve you creating a few savings accounts for separate goals, and then contributing to each account over a period. This way, you can actually see yourself progressively saving up for something (which can be very motivating!), and also know how soon you can achieve your goals!

It enables you to improve your cash flow.

Financial planning can help you improve your immediate cash flow by monitoring your spending patterns and nature of your expenses. With some measure of planning and budgeting, you can easily identify and prioritise essential obligations, which can then encourage you to be more prudent about your expenses, ultimately leading to a healthier cash flow.

***

So as you can see, financial planning is a critical step in safeguarding your future; it is about creating a roadmap for your finances. More importantly, it isn’t something that only the wealthy should do – everyone needs to have their own “financial roadmap”.

Of course, it is entirely possible for you to make a financial plan yourself, but sometimes, the process can get too overwhelming, especially if you have limited experience with the financial instruments and options available. This is where a financial planner comes in.

What is a financial planner?

Think of them a little like a doctor. A financial planner is a qualified professional who can guide you in “diagnosing” your existing financial situation and, after taking account of your future goals, draw up strategies to achieve those goals. The scope of their services is extensive, covering the following areas:

- Cash flow management

- Risk management

- Investment planning

- Tax/zakat planning

- Retirement planning

- Estate planning

In most cases, financial planners will start by having you fill out a questionnaire to help them evaluate and identify potential areas for improvement. You may be asked to answer questions about your current debt, savings, investments, insurance policies, and risk tolerance. From there, you’ll both be involved in discussions to draft out a financial plan (aka your “plan of attack”) for reaching your goals.

A common misconception about financial planners is that their services are better served for those with complex financial circumstances and for the wealthy. With a financial planner’s objective and expert consultation on managing your assets, their services can actually benefit all of us – and especially when you’re facing major life changes, such as a marriage or moving up to a better-paying job.

What qualifications or certifications should a financial planner have?

If you’re now better informed of the importance of a financial planner, that’s great! But before you go ahead and engage one, here’s one thing you must be aware of: individuals who wish to practise as financial planners must first be licenced by the Securities Commission Malaysia (SC). This, in turn, requires them to possess relevant certifications and meet certain requirements.

In Malaysia, some key professional qualifications that you can expect a financial planner to have include the following:

| Certification | Association/Board |

| Certified Financial Planner (CFP) | Certification issued by the Financial Planning Association of Malaysia (FPAM) |

| Islamic Financial Planner (IFP) | |

| Registered Financial Planner (RFP) | Certification issued by the Malaysian Financial Planning Council (MFPC) |

| Shariah Registered Financial Planner (Shariah RFP) |

Essentially, Licensed Financial Planners (with the CFP certification) and Registered Financial Planners (with the RFP certification) provide the same scope of financial planning services, but the certifications are issued by the different boards that the individual registers with. Meanwhile, Islamic Financial Planner (IFP) and Shariah Registered Financial Planner (Shariah RFP) are qualified to provide financial planning services using shariah-compliant financial products within the Islamic financial framework.

Note, though, that earning these qualifications does not automatically make someone a licensed financial planner. They’ll need to clock in at least three years of relevant work experience before they can eventually obtain their licences from the SC – and the right to call themselves a financial planner.

RinggitPlus Financial Planner: A comprehensive financial planning service

As you can see, financial planning is something that can benefit everyone, regardless of their wealth status or financial circumstances. To meet this particular need, we have launched RinggitPlus Financial Planner.

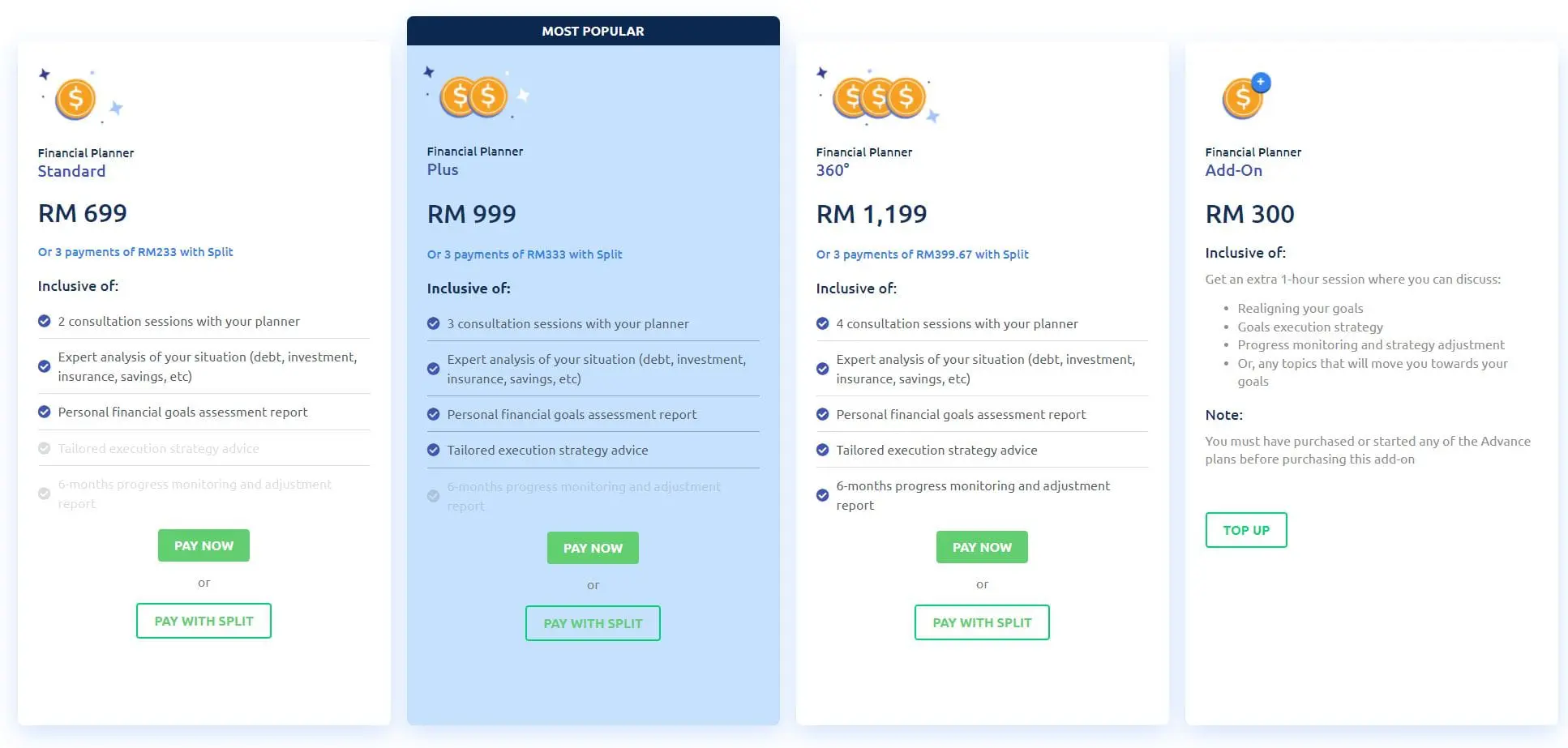

RinggitPlus Financial Planner provides comprehensive one-on-one financial planning sessions with our Licensed Financial Planners, enabling you to take charge of your money to achieve your goals in life. After an initial assessment, you’ll meet one of our Licensed Financial Planners for an in-depth consultation, and receive a personalised financial plan to guide you. And depending on the package that you subscribe to, our Licensed Financial Planners will also be at hand to advise you on the execution of your plan or to review it after a period of time.

Aside from that, RinggitPlus Financial Planner consultation sessions are fully conducted online for your safety and convenience. This means that you can browse and purchase your preferred package from our website, fill in your profile via our online chatbot, and talk to our Licensed Financial Planners through a one-on-one video session – all from the safety of your home!

Finally, RinggitPlus Financial Planner is also up to 83% more affordable than standard market rates*. So, do check out RinggitPlus Financial Planner and give your finances a boost with a financial plan that is specially customised for you.

* Benchmarked to 27 licensed planners in KL listed in Smartfinance.my

Comments (0)