Eloise Lau

23rd December 2025 - 6 min read

I got married at the end of last year, and I’ve since developed a concerning relationship with a pot of black soup.

Like many newlyweds who want to start a family soon, I’ve become a little obsessed with saving money. 2025 was the year I discovered just how far I’m willing to go to keep a few extra ringgit in my pocket. Some of these tactics were genius. Others made my husband question his life choices. All of them worked.

1. I Kept A Perpetual Stew Going For An Entire Month

It started innocently enough. I had chicken bones, carrots, onions, and celery that needed using up. Instead of making one batch of soup and calling it a day, I decided to keep the pot going. Every few days, I’d add whatever needed clearing from the fridge: leftover vegetables, bits of protein, that half-portion of rice from last night’s dinner.

For the first two weeks, it was genuinely delicious. Rich, complex, layered with flavour from all the different additions. My husband was impressed. “This is so good,” he said, going back for seconds.

By week three, the soup had turned a deep, murky brown.

By week four, it was black.

Not grey. Not dark brown. Black.

It still tasted incredible. All those weeks of ingredients had created something deeply savoury and satisfying. But the visual was challenging. My husband, who had been a willing participant in the perpetual stew experiment, quietly fell out of love with the concept somewhere around day 25.

I finally retired the pot after a full month. My rough estimate: I saved around RM200-300 that month by barely buying groceries and clearing out everything in the fridge and pantry instead. The cost was one pot, one ladle, and possibly some of my husband’s trust.

Would I do it again? Absolutely. Would I stop before the soup turns black next time? Probably not.

2. I Ate My Way Through My Birthday Using Nothing But Free Vouchers

Every year, brands send you birthday freebies. Most people redeem maybe one or two. I decided to see how far I could stretch it.

My birthday this year involved strategic planning worthy of a military operation. I mapped out which outlets I’d hit, in what order, and what I’d claim at each stop.

The haul:

- Starbucks – Free cake slice AND a free drink (the MVP of birthday freebies, honestly)

- Coffee Bean – Free slice of cake

- Inside Scoop – Free ice cream scoop

- Juiceworks – Free juice

- Family Mart – Free soft serve

By the end of the day, I’d accumulated close to RM100 worth of free food and drinks. I was stuffed, slightly sick from all the sugar, and absolutely triumphant.

Did I feel any shame about this? Not even a little bit. It was genuinely one of the most fun birthdays I’ve had. There’s something deeply satisfying about gaming the system, especially when the system is literally designed to give you free things.

If you’re not maximising your birthday freebies, start now. Sign up for every loyalty programme, check your emails in the weeks leading up to your birthday, and plan your route.

3. I Collected Hair Ties Off The Ground

This is the one that makes people look at me differently.

About a year ago, I started noticing something: people drop hair ties constantly. On busy sidewalks, in shopping malls, at the gym, in office corridors. They’re everywhere, just sitting there, abandoned.

So I started picking them up.

Yes, I wash them. Hot water, soap, the works. They come out perfectly fine.

By the end of 2025, I’d collected about 10 hair ties this way. That’s roughly the same frequency as finding dropped coins, except hair ties are actually useful and don’t require you to fish around in a drain.

Has anyone ever caught me doing this? No. I’m very casual about it. A smooth swoop, straight into the pocket. No one suspects a thing.

I haven’t bought hair ties in over a year.

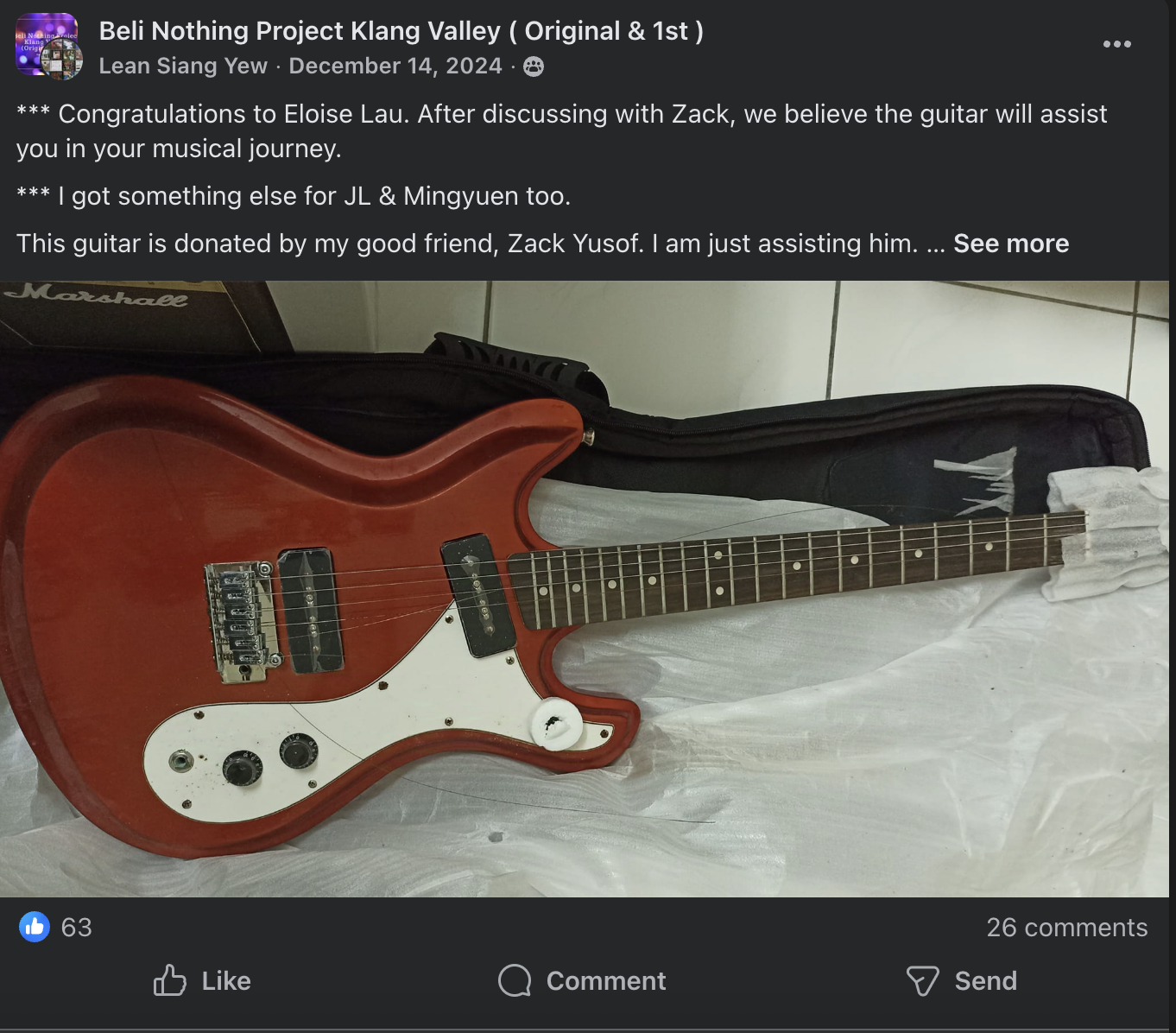

4. I Got A Free Guitar From ‘Beli Nothing’ Group

If you’re not in a Buy Nothing group yet, these are community Facebook groups where people give away things they no longer need. Most posts are furniture, kitchenware, clothes…practical stuff.

I was not expecting to find a guitar.

But there it was one evening: a guitar, free to whoever could pick it up. The owner had a few to give away but did not know what to do with them. I messaged immediately, picked it up the next day, and assessed the damage.

It wasn’t in great condition and definitely needed work. But the wood was still solid. I’ve since taken it apart completely and I’m in the process of restoring it. Once it’s done, I’ll have a perfectly functional guitar.

A new electric guitar of similar quality would cost at least RM500. Instead, I’m putting in some elbow grease and learning basic guitar repair in the process. Not a bad trade.

5. I Used My Job To Sell My Slightly Used iPhone (And Buy A New One)

I write about personal finance for a living. Part of my job involves testing financial apps and services, which means having a reasonably current phone is… professionally relevant.

When the iPhone 17 launched in September, I saw an opportunity.

My iPhone 13 Pro was still working fine. But I’d been eyeing an upgrade, and I realised I could write an article about the smartest way to buy a new iPhone while also, conveniently, buying a new iPhone.

So I did what any reasonable personal finance writer would do: I turned my phone upgrade into a two-part content series.

First, I visited eight different stores across KL to find the best place to sell a used iPhone. Eight stores. I made a spreadsheet. I compared quotes. I wrote it all up in “We Visited 8 Stores To Find The Best Place To Sell A Used iPhone In Malaysia.”

Then, armed with the knowledge from my very thorough research, I sold my iPhone 13 Pro for RM2,000 on Carousell.

Then I bought the base iPhone 17 (256GB, Misty Blue) for RM3,999, and wrote “We Found Out How to Buy the New iPhone For (Almost) Free?!” to complete the saga.

“It’s for work,” I told my husband.

“You just wanted a new phone,” he said.

He’s not wrong.

So, Was It Worth It?

Between the perpetual stew, birthday freebies, pavement hair ties, free guitar, and strategic iPhone upgrade, I reckon I saved somewhere between RM600-800 this year through sheer stubbornness and a willingness to look slightly unhinged in public. Add the iPhone trade-up strategy and that’s closer to RM2,500.

That’s not life-changing money. It’s not going to pay for a house deposit or fund a baby’s first year of expenses. But it adds up, and more importantly, it changed how I think about spending.

If you’ve ever felt embarrassed about being a little weird with money, let me be the first to say: don’t. Pick up that hair tie. Eat that free birthday cake. Keep the soup going for one more week.

Your savings account will thank you. Your spouse’s patience may vary.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)