Alex Cheong Pui Yin

1st April 2020 - 2 min read

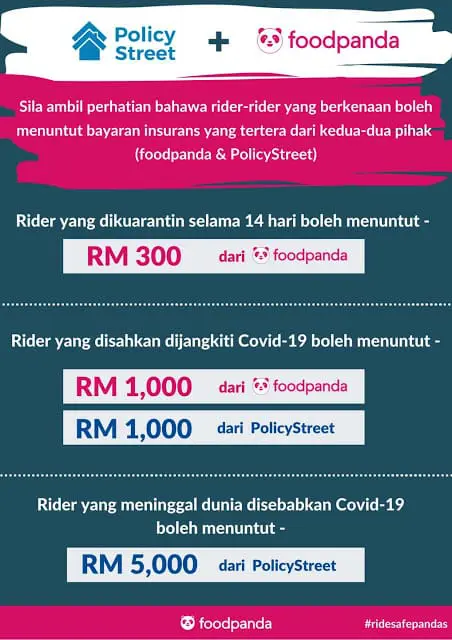

foodpanda riders will now be entitled to additional insurance coverage amidst the Covid-19 pandemic, consisting of an extra RM1,000 claim and death benefit. This comes as a result of a collaboration between the online food delivery service with PolicyStreet, a local insurtech company, to offer better protection to its fleet.

Through this partnership, foodpanda riders will be able to claim an extra RM1,000 from PolicyStreet if they test positive for Covid-19. Additionally, riders are also eligible for a death benefit of RM5,000 in the event of their demise due to the coronavirus, paid to their family members.

This extra coverage is in addition to a financial support already in place for riders impacted by the pandemic. The existing assistance includes a RM1,000 aid for delivery partners who test positive for Covid-19, and RM300 allowance for riders who are quarantined because of the coronavirus – both paid for by foodpanda.

(Image: Oh!Media)

“We are grateful to have our insurance partner, PolicyStreet, to join efforts in ensuring that the welfare of our frontliners are protected. Our delivery partners’ safety and health will always come first,” said the head of logistics for foodpanda, Shubham Saran. He also added that the company is committed to providing more support and contingencies for its delivery partners, if needed.

PolicyStreet – which boasts partnerships with insurers such as AIA, Great Eastern, and Etiqa – is also a financial advisor approved by Bank Negara Malaysia (BNM).

(Source: FintechNews Malaysia)

Comments (0)