Alex Cheong Pui Yin

30th March 2020 - 3 min read

To ensure that insurance policy and certificate holders affected by the Covid-19 pandemic are able to keep their protection amidst the current financial climate, the Life Insurance Association of Malaysia (LIAM) and the Malaysian Takaful Association (MTA) have announced two relief measures.

The two relief measures include the deferment of payment of life insurance premiums and family takaful contributions, as well as the extension of flexibilities to reinstate or preserve life insurance and family takaful protection.

The deferment of payment of life insurance premiums and family takaful contributions will give affected policyholders the option to postpone their regular premium payments for 90 days without affecting the policy coverage. According to an FAQ released by the associations, affected policyholders refer to:

- Individuals who have been infected, home quarantined (mandatory) or suffered a loss of income, caused by reasons such as retrenchment, shorter working hours, or commission reductions.

- SMEs and those who are self-employed, which have experienced a loss of income as a result of the economic impact of the Covid-19 situation.

The deferment applies to all policies and certificates where premiums and contributions are due on 18 March to 31 December 2020, but excludes those that have prior outstanding payments. That said, it is not automatic, and you will need to apply to your respective life insurer or family takaful operator. Applications will be open starting from 1 April 2020 onwards. Note also that the 90-day deferment of your premium payment will begin from the last payment due date.

The second measure relief, on the other hand, allows the extension of flexibilities to reinstate or preserve life insurance and family takaful protection for affected policyholders until 31 December 2020. Through this assistance, life insurers and family takaful operators will extend the period during which policyholders can reinstate their lapsed policy.

Life insurers and family takaful operators may also provide options to enable policyholders to continue meeting their premium payments, such as making changes to the sum assured/covered, restructuring the premium payments, or converting selected policies into paid-up policies. Additionally, fees and charges imposed for changes made, as well as any penalties for late payments of premiums will also be waived. However, policyholders are advised to check with their respective life insurance companies or takaful operators for more details as the flexibilities provided will vary from company to company.

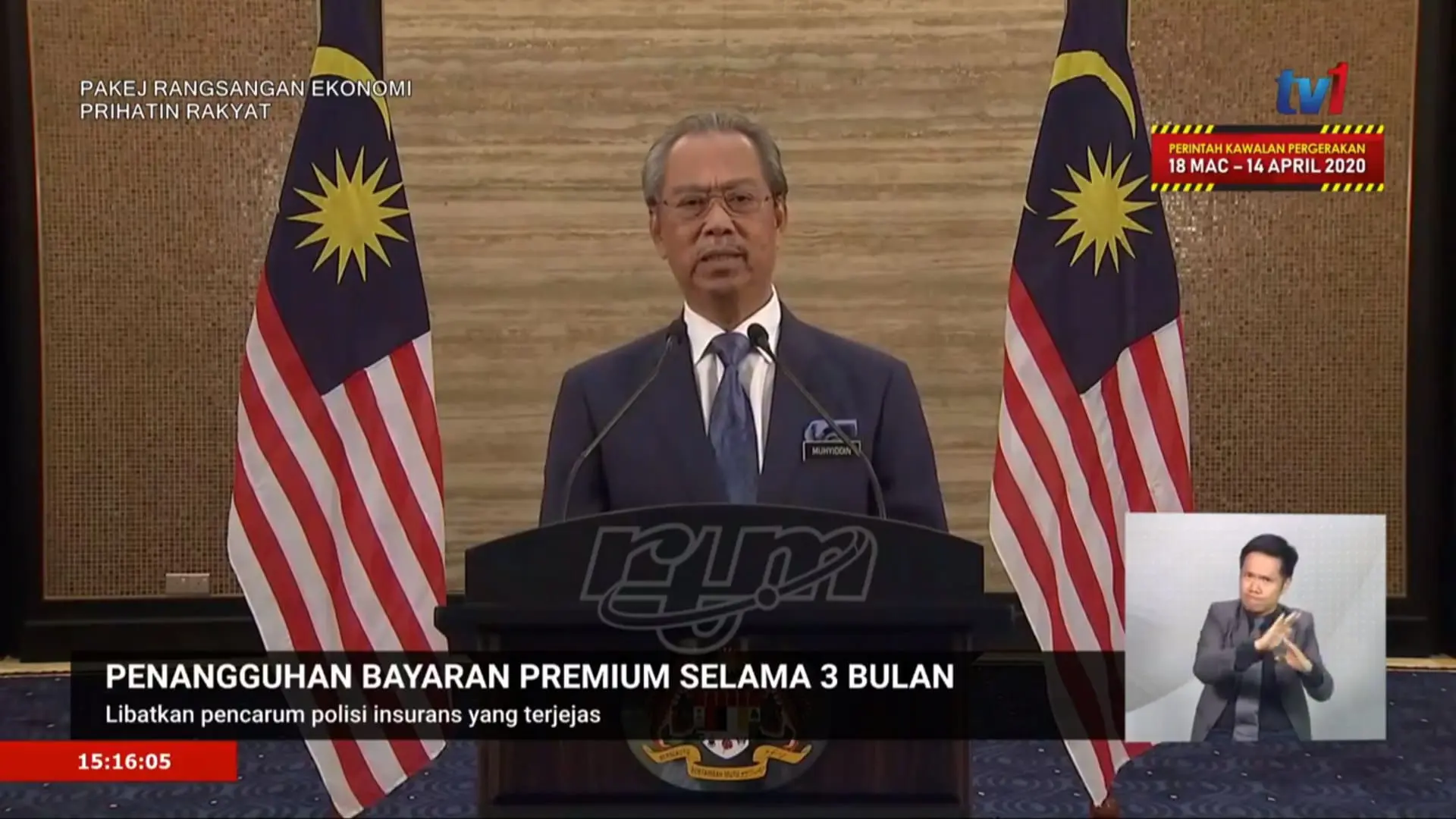

These relief measures are offered following the announcement of the Prihatin Economic Stimulus Package by Prime Minister Tan Sri Muhyiddin Yassin. One of the many incentives announced during the reveal of the second stimulus package included a three-month premium deferment for policyholders and takaful certificate holders whose source of income is affected by the Covid-19 pandemic.

For more information, do check out the full FAQ released by LIAM and MTA.

Comments (0)