Alex Cheong Pui Yin

12th October 2021 - 3 min read

The Life Insurance Association of Malaysia (LIAM) has proposed for the government to increase the tax relief for medical and health insurance premiums under Budget 2022, among other suggestions.

According to the president of LIAM, Loh Guat Lan, the suggested increase can be done via two options:

- Expand the current tax relief of RM8,000 for medical expenses on self, spouse, and children (for serious diseases) to include medical insurance premiums as well

- Increase the current combined tax relief of RM3,000 (for medical and health insurance premiums, as well as premiums for education insurance) to RM6,000

“The rationale behind this proposal is firstly, it will lift the burden of potentially large medical expenses from the taxpayer due to the pooling of risk. Secondly, the cost of medical expenses typically increases with age and taxpayers are utilising their current income to fund for their future long-term medical needs,” said Loh in a statement.

Loh also explained that basic medical insurance for an average family of two adults and three children typically costs at least RM2,500 per annum. With a tax relief of RM3,000 provided, there is only a savings of RM500 for premium per annum to support the education policy of three children – which is insufficient.

Aside from this proposal, LIAM also forwarded several other suggestions as part of its Budget 2022 wishlist, one of which is to increase the current limit of personal tax relief for life insurance premiums from RM3,000 to RM5,000. “Having a life insurance policy that can cover the total cost of the financial planning is important, such as costs associated with accidents, disability, illness and death,” said Loh.

Additionally, LIAM hopes that the government will consider waiving the 6% service tax on the Group Employee Insurance Scheme as this can encourage employers to insure their staff under a group insurance scheme. This, in turn, will increase the penetration rate of workers.

“Based on published statistics, less than half of employees is being covered by any form of group insurance. This leaves a significant insurance gap that needs to be closed, to extend the insurance safety net to as many Malaysians as possible,” Loh added, noting that with more individuals covered under private group medical insurance, the financial and capacity burden on the public healthcare system can also be reduced.

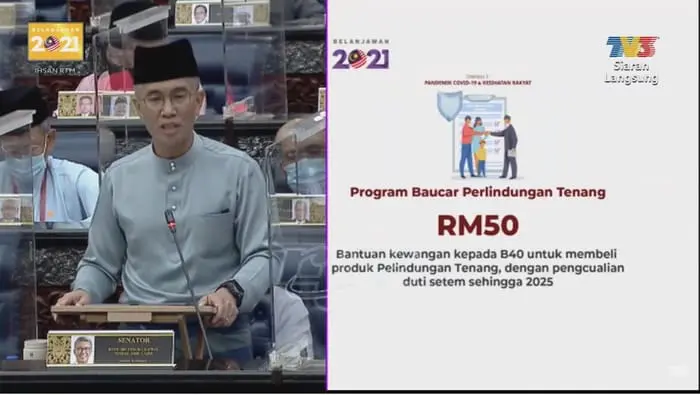

Lastly, LIAM also proposed the extension of the Perlindungan Tenang Voucher (PTV) programme for another year. The PTV programme was introduced during the tabling of Budget 2021, and was intended as way to provide better social protection for the B40 group. Under this programme, all eligible recipients will be entitled to a voucher of RM50 to purchase products from Perlindungan Tenang, a basic insurance and takaful scheme.

Loh commented that the extension is essential as recipients need time to accept insurance or takaful protection as part of their families’ financial planning. “To instil the habit of securing insurance or takaful coverage as part of their social protection, having the second premium subsidised will be necessary, especially as the recovery from Covid-19 remains uncertain. Otherwise, many of the BPR recipients are likely to discontinue their coverage and the long-term benefits of the programme will be lost,” she said.

Ultimately, LIAM hopes that its proposals can be implemented to assist the government in achieving its 3R objectives (recovery, resilience, and reform), which will then lead to a more sustainable, productive, and higher value-added economy.

(Source: LIAM)

Comments (0)