Alex Cheong Pui Yin

14th January 2022 - 2 min read

The Malaysia Book of Records has acknowledged Merchantrade Insure-Life as the life insurance plan with the “lowest life insurance premium, starting from as low as RM1 per month”.

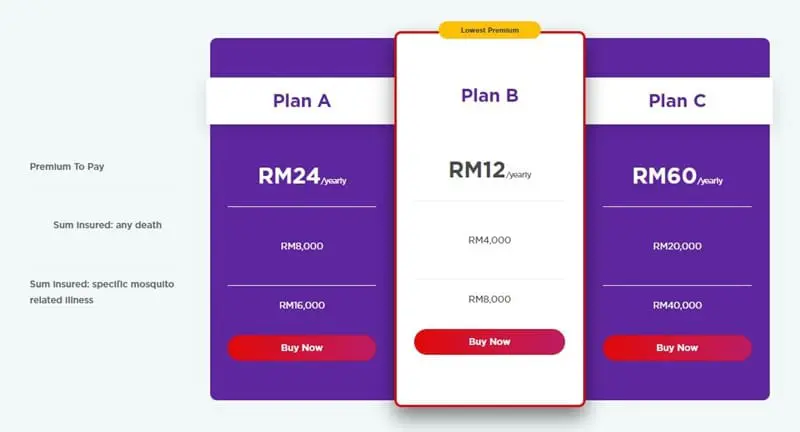

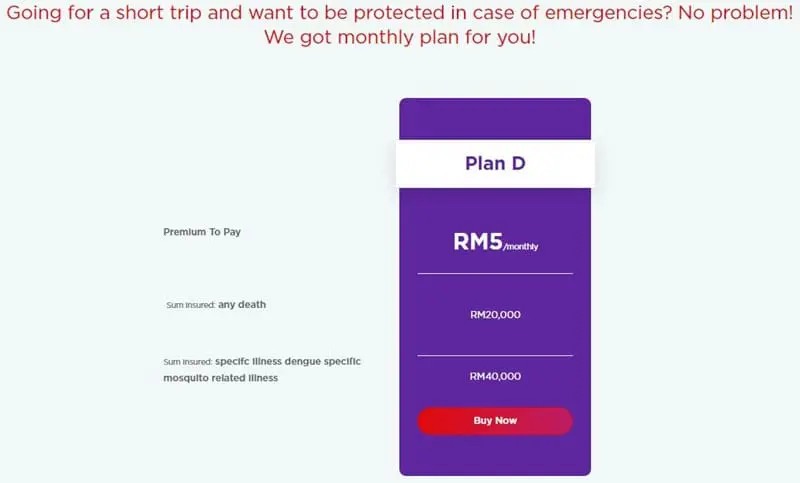

Underwritten by MCIS Insurance Berhad (MCIS Life) and marketed by Merchantrade Asia Sdn Bhd, the plan aims to make protection plans more accessible for the underserved segments in Malaysia. It has several options on offer, with varying annual or monthly premiums, yielding sum insured of up to RM20,000 in the event of death from any cause, and up to RM40,000 for death by specific illnesses.

The recognition from Malaysia Book of Records is awarded due to the Merchantrade Insure-Life (Plan B), which comes across as the most basic with its annual premium set at only RM12 (RM1 per month). It offers policyholders a basic sum insured of RM4,000, payable for death of the life assured on all causes, including Covid-19. Meanwhile, RM8,000 will be paid for death of the life assured caused by specific illnesses, including dengue, chikungunya, malaria, Japanese encephalitis, avian influenza, or the Zika virus.

The Merchantrade Insure-Life plan is available for purchase at all Merchantrade retail branches and through the Merchantrade Money e-wallet. Eligible B40 individuals can also redeem the plan using their Perlindungan Tenang vouchers (worth RM75) that are recently offered by the government under Budget 2022. To clarify, this voucher was originally worth RM50 when it was first launched back in September 2021.

In accepting the distinction, the chief executive officer and managing director of MCIS Life, Prasheem Seebran emphasised the importance of providing social protection for all underserved segments, including migrant workers. “Migrant workers play a significant role in driving the country’s economic growth, thus it is important to ensure this segment of the population who work alongside Malaysians, have equitable access to financial protection during uncertain times,” he said.

(Source: The Sun Daily)

Comments (0)