Alex Cheong Pui Yin

13th October 2022 - 3 min read

Prudential Assurance Malaysia Berhad (PAMB) has introduced a new comprehensive five-in-one insurance plan that is targeted specifically at young adults in the country, dubbed PRUFirst. Offering medical, accident, life/total and permanent disability (TPD) and payor coverage all in one single plan, it also gives policyholders the flexibility to upgrade their plans with critical illness coverage or medical booster for better protection – if they wish it.

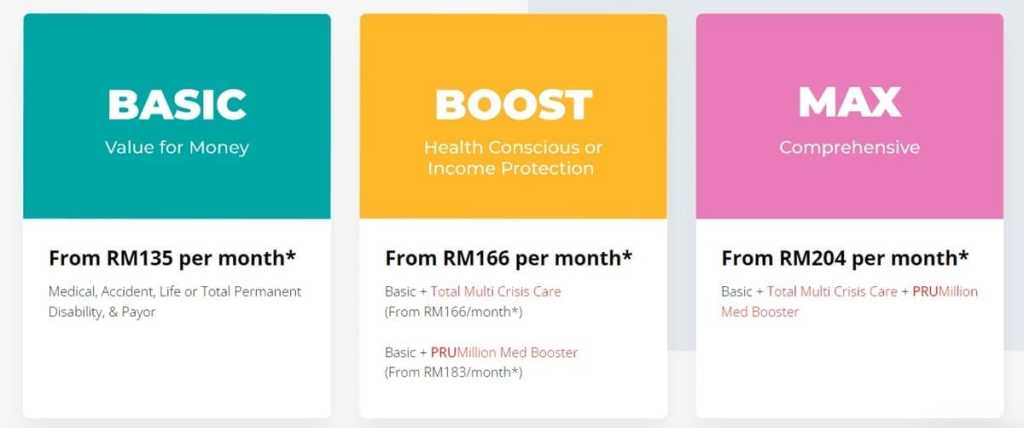

Specifically, there are three plans that you can choose from under PRUFirst, depending on your needs and preferences:

| PRUFirst plan | Coverage/Benefits | Monthly premium |

| Basic | – Medical coverage starting from RM1.38 million – Dual accident coverage with reimbursement of medical cost from RM5,000 and lump sum disability/death benefit from RM100,000 – Life or TPD coverage from RM100,000 – Payor coverage, where Prudential covers your annual premiums in the event of TPD or critical illness | RM135 per month onwards |

| Boost | Option 1 – PRUFirst basic plan – Total Multi Crisis Care (critical illness rider) Option 2 – PRUFirst basic plan – PRUMillion Med Booster (medical booster) | RM166 per month onwards RM183 per month onwards |

| Max | – PRUFirst basic plan – Total Multi Crisis Care (critical illness rider) – PRUMillion Med Booster (medical booster) | RM204 per month onwards |

Aside from that, Prudential also revealed that the basic plan for PRUFirst is based off an earlier Prudential offering named PRUWithYou, adding that the package in PRUFirst consists of components that can be purchased separately. As such, you are not obligated to select all components in the package.

Additionally, PRUFirst comes with an automatic extension of coverage terms for the basic plan, up to the age of 100 – as long as there is sufficient value of units to pay for the relevant charges during the extended term. You may, however, request for this to be disabled. As for the riders, they can be extended up to the age of 100 or the rider’s maximum coverage term (whichever is earlier) wherever applicable.

According to the chief officer product and actuarial services of Prudential, Ankur Bassi, PRUFirst was conceived with Gen Z customers aged between 19 to 30 years old in mind, in hopes that it will empower them to live on their own terms.

“PRUFirst is a simple yet comprehensive protection plan which is scalable to meet the requirements of today’s generation who seek holistic, straightforward, and convenient solutions. With customisable options to suit their budget and needs, they can safeguard their savings and lifestyle when faced with unexpected events,” said Bassi in a statement.

(Sources: Prudential, Bernama)

Comments (0)