Alex Cheong Pui Yin

28th October 2021 - 3 min read

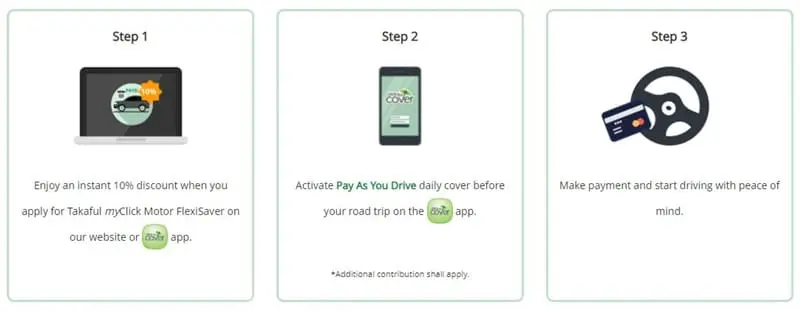

Syarikat Takaful Malaysia Am Bhd (Takaful Malaysia) has introduced its latest product, the Takaful myClick Motor FlexiSaver with an optional Pay As You Drive (PAYD) daily cover. It is Malaysia’s first flexi motor takaful plan with such a cover, allowing motorists to activate the plan and be charged for it only on the days that they drive.

Offering savings of up to 70%, Takaful Malaysia said that its new plan differs from the flexible insurance plans that are offered by other insurance companies as the Takaful myClick Motor FlexiSaver with PAYD daily cover is based on the days it is utilised instead of mileage. Motorists will only need to activate the plan through the Takaful Malaysia mobile app for the days that they drive, and they will be charged accordingly.

Customer who purchase the Takaful myClick Motor FlexiSaver will be covered for the following damages under the base FlexiCover (automatic coverage for a year) and the PAYD daily cover (if activated):

- Injury or death to third party

- Damage to third-party property/vehicle

- Loss or damage to your vehicle due to fire or theft

- 24-hour roadside assistance programe for unlimited breakdown towing and minor roadside repair (such as tyre change, fuel delivery, battery change, and jumpstart)

- Damage to your vehicle (if PAYD is activated)

If you do decide to activate the optional PAYD daily cover when subscribing to the base plan of the Takaful myClick Motor FlexiSaver, you’ll also enjoy additional benefits such as an instant 10% discount, a complimentary personal accident cover of RM15,000 for you and your passengers, as well as accident towing at the scene of the accident.

Here’s an estimation from Takaful Malaysia as to how much you can potentially save on your motor insurance if you purchase the Takaful myClick Motor FlexiSaver:

For drivers who finds themselves in need of more protection, there are also several add-ons that you can purchase, such as coverage for windscreen, window, and sunroof, as well as key replacement. You can also get an additional Motor PA Plus add-on if you wish to increase your personal accident coverage.

Note, however, that the plan is only open to qualified drivers with cars that are valued between RM100,000 to RM1.5 million, and are aged below 11 years.

The chairman of Takaful Malaysia, Datuk Mohammed Hussein said this new product is ideal and rewarding as more people are driving less these days, given the new norm in the Covid-19 climate. The flexibility of the plan will also benefit individuals who are struggling financially due to the impact of the pandemic. “Offering insurance and takaful products in the new mobility space that are simple, flexible, and usage-based is revolutionising the industry. This means consumers have the option to decide and pay for just the coverage they need, as and when they need it,” he said.

(Sources: Takaful Malaysia [1, 2], New Straits Times)

Comments (0)