Alex Cheong Pui Yin

23rd January 2024 - 3 min read

Digital life insurer, Tune Protect Life has launched a new offering called FLEXIOne, which gives customers the freedom to customise their own insurance plans by mixing and matching life, medical, and critical illness coverage based on their needs and budget. Said to be a first in the market, the flexible insurance solution is also enhanced with an AI-powered virtual assistant and plan recommender that can guide customers throughout the purchase journey.

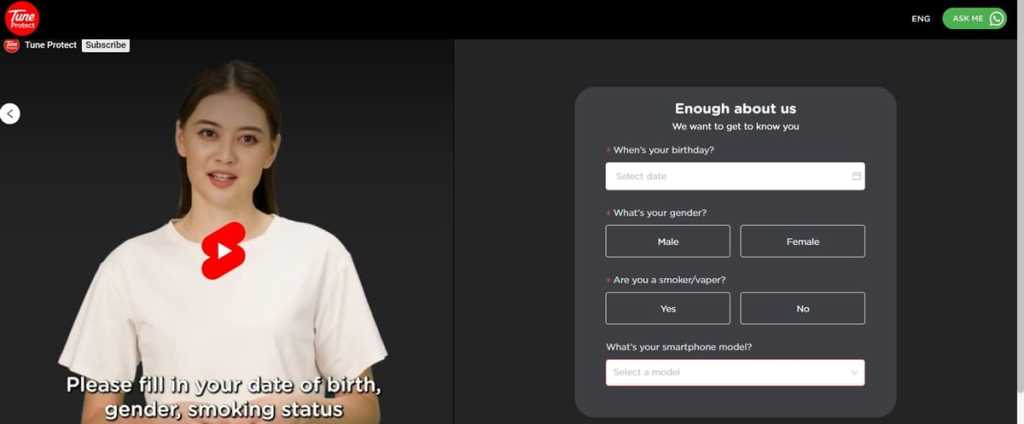

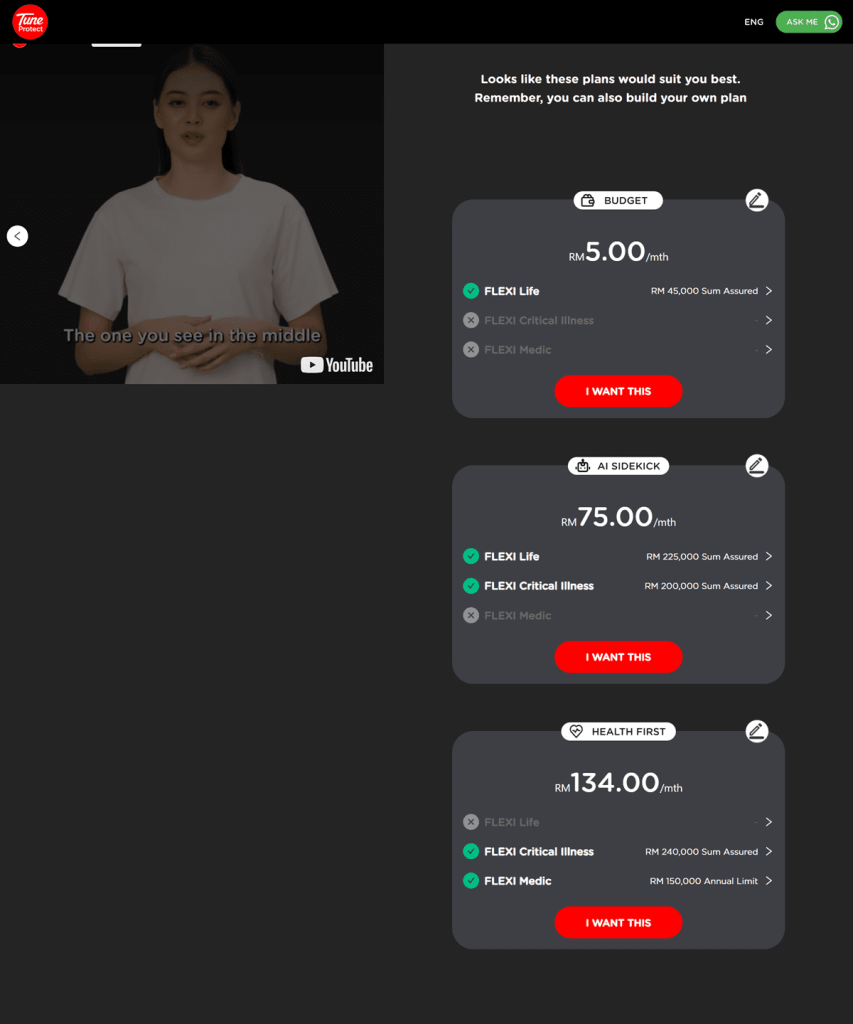

Designed especially for young individuals who are on a shoe-string budget, the premiums for FLEXIOne start from as low as RM5 per month. All customers can begin the purchase journey by providing some required information to FLEXIOne’s virtual assistant, Tracy – such as age and gender – who will then recommend three pre-packaged plans.

Each pre-packaged plan may comprise of a combination of the following protection plans (one, two, or all of them):

- Life Cover (Flexi Life): Up to RM250,000 coverage for death and permanent disability

- Medical Cover (Flexi Medic): Up to RM150,000 coverage (annual limit)

- Critical Illness Cover (Flexi Critical Illness): Up to RM250,000 coverage

If you’re a first-time customer who’s new to insurance, these recommended pre-packaged plans by Tracy will be especially useful. Meanwhile, those who are more experienced and would like to customise their own plan can go ahead and do so by adjusting the individual sliders for each Cover to change the sum assured.

Ultimately, Tune Protect’s intention in incorporating an AI-powered virtual assistant is to simplify the whole customer experience, making it a more convenient and less stressful one for everyone.

Another benefit to the FLEXIOne plan is the ability to upgrade or downgrade your plan according to your finances. “For instance, should a customer be in a tight financial situation, the customer can still maintain his/her insurance at a reduced premium by downgrading to a lower plan, and not need be forced to give it up entirely,” said Tune Protect in its statement.

Principal officer of Tune Protect Life, Koot Chiew Ling said that with the launch of FLEXIOne, the company hopes to bust the myth that insurance is expensive and rigid. “Starting from just RM5 a month, FLEXIOne is ideal for millennials and Gen Zs who are beginners to insurance and want something light on the pocket, as well as those who are looking to top up their current insurance coverage,” she said.

Koot also emphasised that Tune Protect will continue to commit to its 3:3:3 customer promise with FLEXIOne. This essentially refers to the insurer’s commitment in enabling individuals so that they can purchase insurance in just three minutes, receive a response in three hours, and receive their claims payout in three days.

In conjunction with the launch of FLEXIOne, Tune Protect is currently offering two months of free FLEXIOne insurance, up to a total of RM300 for purchases made through its platform. Additionally, there is a referral campaign, where each successful referral will earn you RM20.

Comments (0)