Alex Cheong Pui Yin

10th April 2023 - 3 min read

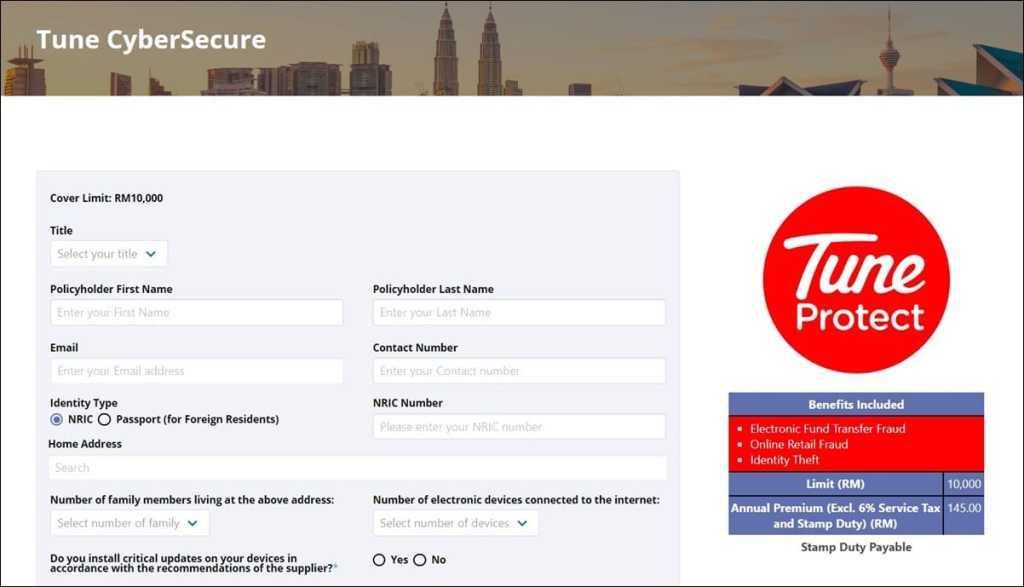

Malaysian insurer Tune Protect has launched its first personal cybercrime insurance for individuals, dubbed Tune CyberSecure. Offering coverage of up to RM10,000, the new product protects policyholders against several types of cyber risks, including electronic fund transfer fraud and online retail fraud.

Specifically, Tune CyberSecure will offer annual protection against the following cyber threats with premiums starting from as low as RM145 per year (excluding 6% service tax and RM10 stamp duty):

| Cyber threat | Details of the threat | Benefits provided |

| Electronic fund transfer fraud | – Policyholders become the victims of email phishing attacks, where their e-banking login credentials are disclosed – The data is then used to steal funds from their online bank accounts, including e-wallets and cards | – Reimbursement of financial loss due to unauthorised use of your online payment services – Immediate advice and support by Tune Protect team on how to minimise potential losses |

| Online retail fraud | – Policyholders make purchases from fake websites that look like those of known retailers – Orders made are not fulfilled | Reimbursement of the purchase price of goods you bought online, but which are not delivered |

| Identity theft | – Policyholders’ credit card details are stolen and sold on the dark web – The data is then used to fraudulently to buy goods | – Reimbursement of the cost to rectify record with banks and authorities – Costs to restore credit records and personal identity |

In addition to these reimbursements, Tune CyberSecure also comes with the support of cybersecurity experts at all times of the day (24/7) to advise policyholders should they have any doubts or queries. The team can be contacted via a toll-free line at 1800 819 783. On top of that, the team will also help you to identify online vulnerabilities or data breaches with cybersecurity monitoring tools if needed.

Tune Protect further clarified that the policy will cover the entire family and electronic devices that are connected to the internet at the registered address. Note as well that if fraud does happen, you must notify the insurer within seven days and submit all relevant supporting documents within fourteen days.

If you’re interested in purchasing the Tune CyberSecure policy, you can do so via Tune Protect’s insurtech partner for this product, Senang. The entire process can be performed quickly online; simply visit the website here and fill in the online form. Once you have submitted the form and made your payments – Tune Protect says that it can provide coverage confirmation within just seven minutes – your insurance policy will be activated. Meanwhile, a soft copy of the insurance certificate will be issued to you within an hour from your successful payment.

“Cyber insurance has previously been seen as something only relevant to businesses, but this is no longer the case due to the rapidly increasing number of cybercrimes against individuals. In line with our digital and mobile-first strategy, we are thrilled to introduce Tune CyberSecure as one of our initiatives to make cybersecurity accessible to everyone,” said the chief executive officer of Tune Protect Malaysia, Jubin Mehta, adding that more than 4,700 online fraud cases were reported in 2022 alone.

Those who have enquiries regarding Tune CyberSecure can contact Tune Protect at 1800 88 5753. Alternatively, you can email them at [email protected].

(Source: Tune Protect)

Comments (0)