Alex Cheong Pui Yin

17th November 2023 - 3 min read

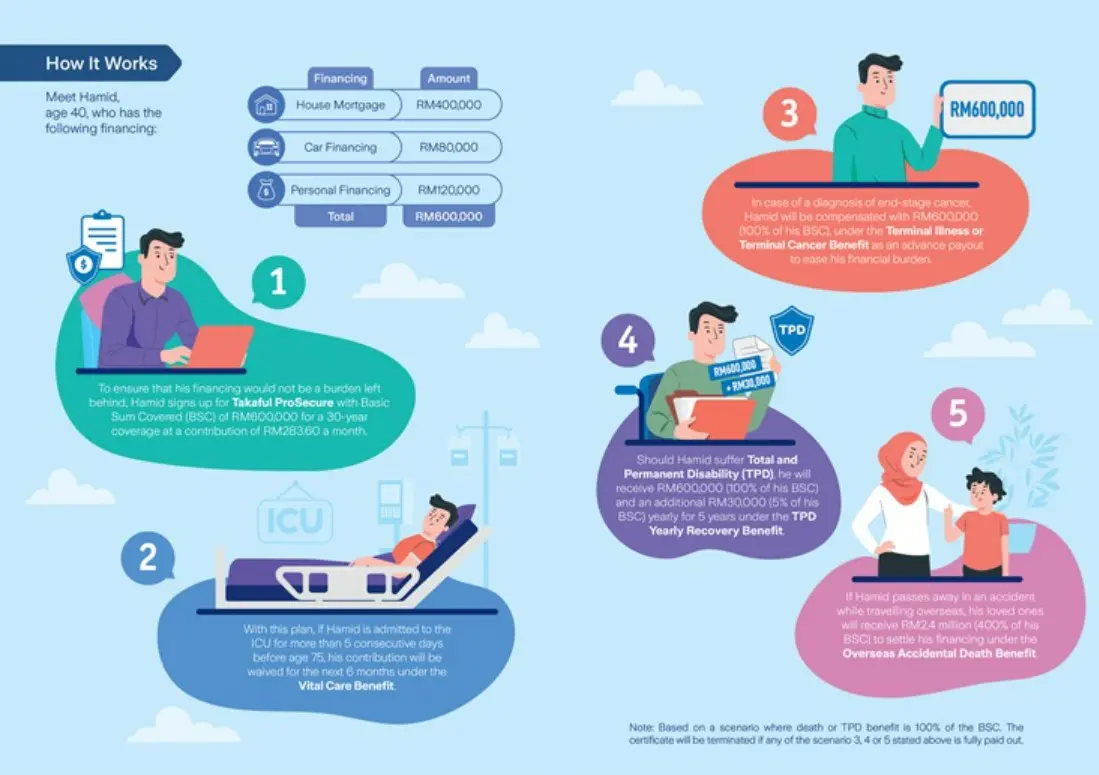

Zurich Takaful Malaysia has launched a new takaful life plan by the name of Takaful ProSecure, which offers coverage starting from RM300,000 with an affordable contribution of RM56 per month upwards. It also comes with other perks – such as the Vital Care and terminal illness or terminal cancer benefit – and is aimed at providing financial assistance to Malaysians in times of need.

According to Zurich Takaful, its new Takaful ProSecure plan will offer the following protection for its policyholders, with the option to choose from a 10-, 20-, or 30 year coverage plan:

| Benefits | Coverage |

| Death/Total and permanent disability (TPD)/Golden age disability (GAD) | 100% of basic sum covered or total contribution made, whichever higher |

| Public transport accidental death | Death benefit + 200% of basic sum covered |

| Overseas accidental death | Death benefit + 300% of basic sum covered |

Zurich Takaful stressed that with coverage starting from a basic sum covered of RM300,000, the Takaful ProSecure plan is a particularly good option for those who have accumulated a fair amount of debt obligations. “This substantial coverage aims to provide peace of mind by reducing the accumulation of debts for their [the policyholder’s] loved ones in the event of their absence,” Zurich Takaful further shared in a statement.

Aside from the coverage, the Takaful ProSecure plan also includes a terminal illness/terminal cancer (TITC) benefit, where you will be entitled to an advanced payout (100% of basic sum covered or total contribution made, whichever is higher) upon confirmation of your incurable condition. This feature is designed to assist individuals in managing their final journey of life, ensuring that both the policyholder and family members are financially supported during a challenging time.

Additionally, there is the Vital Care benefit, which waives your contribution for six months if you were admitted to the intensive care unit (ICU) for more than five consecutive days. This allows you to focus on your recovery instead of worrying about financial obligations.

Another notable benefit that is also offered under the Takaful ProSecure plan is the TPD yearly recovery benefit, which gives you an additional 5% of your basic sum covered (payable yearly for five years from the occurrence of the TPD). There is the enhanced family accidental death benefit as well, where you will receive a lump-sum of RM10,000 per family member if any of your four family members pass away due to an accident (parents, spouse, or children).

On top of that, up to four of your family members can tap into the family care privilege, which comes after your passing. They can essentially obtain a new takaful certificate with coverage of up to 25% of the basic sum covered each, without medical underwriting.

“We understand that life can be unpredictable, and we are committed to supporting individuals and families in securing their financial futures. As a trusted partner for all Malaysians, the launch of Takaful ProSecure is another step towards creating a brighter future, providing financial peace of mind and protection against life’s uncertainties, aligning with our brand campaign ‘Care For What Matters’ ethos,” said the authorised representative of Zurich Takaful, Nur Fatihah Mustafa.

In conjunction with this launch, Zurich Takaful is hosting the “We Can Duit Bersama Zurich Takaful” weekend from today until 19 November at the MyTOWN Shopping Gallery, where there will be games and activities. The public can also consult Zurich Takaful’s wealth planners on the newly launched product, as well as its introductory promo where those who sign up for Takaful ProSecure between today until 29 December will be able to win a 999.9 Gold Bullion.

Comments (0)