Pang Tun Yau

18th August 2022 - 3 min read

Retirement is often referred to as the “golden years”, and it brings to mind a phase of life that is filled with complete respite and comfort. It’s a time when you reap the fruits of your hard work over the past decades – and just enjoy the good life as it should be lived.

But here’s the thing: it takes more than just being dedicated to your job to obtain a comfortable retirement. Instead, it often involves a good deal of planning, particularly in terms of ensuring that you have the monetary means to sustain yourself during your retirement – so it pays to start early when you’re still young. This is especially as you consider matters like inflation and the rising cost of living – both of which can undermine the vision of a happy retirement.

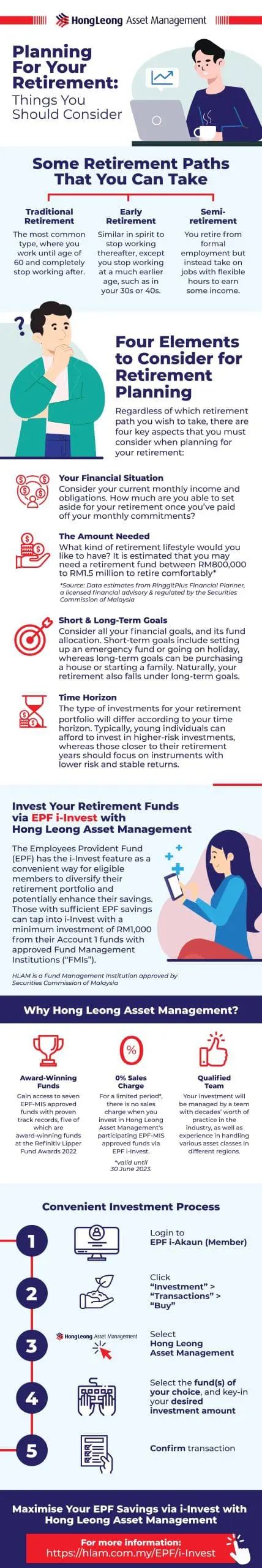

Even more interestingly, the new generation of employees are also beginning to redefine and embrace new concepts of retirement, such as exploring the possibility of retiring earlier or even semi-retirement. Here’s a look at some other variations of retirement, along with four key things that you must consider in order to retire comfortably.

As mentioned earlier, planning for your retirement is not a process that can be taken lightly; the earlier you begin, the better – especially if you want to ride on the benefits of compounding interest to grow your retirement funds. So make the most out of your investments, and start today!

Disclaimer: This infographic article has not been reviewed by the Securities Commission Malaysia. Investors are advised to read and understand the contents of the Hong Leong Master Prospectus dated 27 February 2023 and its First Supplemental Hong Leong Master Prospectus dated 18 August 2023 and the Product Highlight Sheet (“PHS”) before investing. The Prospectus has been registered and PHS lodged with the Securities Commission Malaysia, which takes no responsibility for the contents. A copy of the Prospectus and PHS can be obtained from any of Hong Leong Asset Management Bhd (“HLAM”) offices, agents or authorised distributors. Investors are advised to consider the fees and charges involved before investing. Prices of units and distributions payable, if any, may go down or up and past performance is not a guarantee of future performance. Investors are advised to be aware of the risks associated with each fund before investing. The funds may not be suitable for all investors and where in doubt, investors are advised to seek independent advice.

Comments (1)

I am already retired. 58 yrs old.

Looking for good advice for investment if it’s good.