Alex Cheong Pui Yin

19th August 2020 - 3 min read

(Image: Bernama)

The Malaysian government has announced the issuance of the country’s first digital sukuk, Sukuk Prihatin, as part of the PENJANA economic recovery plan.

According to the Ministry of Finance, the sukuk (also known as Shariah-compliant bonds) – which is based on the principle of Tawarruq via the Commodity Murabahah arrangement – was issued as various parties from the Malaysian public have expressed the desire to contribute to the country’s recovery efforts.

“Proceeds from the Sukuk Prihatin will be channeled to the Kumpulan Wang Covid-19 for the implementation of economic recovery measures that include, among others, enhancing connectivity to rural schools, supporting research grants for infectious diseases, and financing micro SMEs, particularly women entrepreneurs,” said the ministry in a statement.

(Image: Bernama)

The Ministry of Finance further mentioned that the sukuk has a total target issuance of RM500 million with a maturity period of two years. It offers a profit rate of 2% p.a., which will be paid out on a quarterly basis. The profit payments will be credited directly into sukukholders’ accounts, and are exempted from tax.

To qualify for the sukuk, you need to be a citizen aged 18 years and above. The minimum contribution accepted for the programme is RM500, and there is no maximum limit to your investment. Additionally, you can opt to donate the principal amount to any approved government trust accounts once the sukuk matures. This contribution will also be eligible for tax deductions.

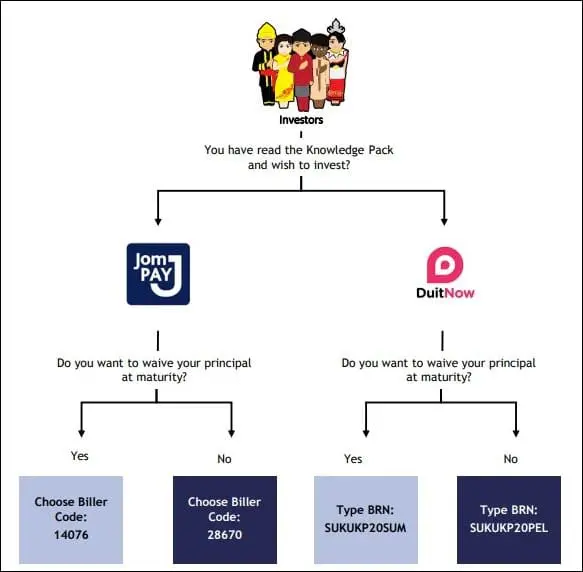

Interested individuals can subscribe to the sukuk through JomPay and DuitNow; both services are available via the mobile banking platforms of 27 participating banks nationwide. Interestingly, individuals can either “invest” or “donate” through this sukuk – investors have the option of waiving the principal upon maturity.

If you’re applying through JomPay, start by keying in the biller code. The code will differ depending on whether you only wish to invest in the sukuk, or to donate the principal amount upon maturity. Once done, enter your contact number, email address, as well as the amount that you wish to invest. You’re only allowed to invest in multiples of RM100. Once completed, click to pay, and you’re done!

Similarly, those applying through DuitNow will also need to key in the business registration number depending on your intention to only invest or to donate upon maturity . You’ll then be prompted to enter your contact details and the amount of investment as well, although there’s also an additional step where you need to select the current date as the effective date of investment.

The sukuk will be distributed on a first-come first-served basis through its primary distribution bank, Maybank. Note that while you can start subscribing starting from today until 17 September 2020, the sukuk will only be issued on 22 September 2020, setting its maturity date to 22 September 2022.

Successful applicants will be notified through email within 14 business days from the closing of the offering date of the Sukuk Prihatin. If your application is unsuccessful, your contribution will be auto refunded to your account within five working days from the application date.

You can find out more about the Sukuk Prihatin here.

(Source: The Edge Markets, Ministry of Finance)

Comments (0)