Pang Tun Yau

25th February 2020 - 7 min read

When the Securities Commission of Malaysia launched the Digital Investment Management framework in 2017, it set off a chain reaction that has gotten more Malaysians interested in investing. Using algorithms and artificial intelligence, these “robo-advisors” – as they are more popularly known – offer a unique new investment tool for Malaysians.

We spoke to Ronnie Tan, CEO and Managing Director of GAX MD, which runs MYTHEO, one of only three licensed digital investment management platforms currently in Malaysia, to learn more about how robo-advisors work and why new investment tools like MYTHEO matters for Malaysians, especially the younger generation who struggle with saving money.

A heavyweight enters Malaysia

MyTheo is the Malaysian arm of THEO, the first robo-advisory service in Japan which launched in 2016. Developed by fintech company Money Design, THEO now handles over 75,000 investors with more than US$450 million in assets.

Money Design then worked with Silverlake Group, a legendary entity with over 30 years of experience in the financial, capital market, fund management, payment, and digital economy services, to form GAX MD, to oversee the THEO investment service in Malaysia. Hence, after being granted with a robo-advisory license from the Securities Commission, MYTHEO was launched in Malaysia in June 2019.

Today, MYTHEO has seen a consistent growth in terms of user base and assets under management (AUM) of around 25% each month since its launch. Interestingly, the company is happy to focus on organic growth, with minimal marketing efforts made in the market since its launch.

Instead, the company is heavily invested in educating consumers and advocating financial literacy on a grassroots level.

Unit trust vs robo-advisors – what’s the difference?

While unit trust investments have been around for much longer, robo-advisors aim to differentiate on several key areas: diversification, impartiality, and cost.

Some unit trust companies are restricted in their offerings, usually due to a need to offer its own products. This results in a lack of impartiality in choosing the best funds for the client. Robo-advisors, on the other hand, do not have this issue. In the case of MYTHEO, it invests in a mix of 59 exchange-traded funds (ETF) which have exposure to over 10,000 companies from over 86 countries.

Besides that, one key difference between robo-advisors and the more traditional unit trust investments lie in how the clients’ money is invested. Where unit trust funds rely on human fund managers who make the call, robo-advisors rely on algorithms that are not swayed by human emotions and market noise.

Finally, there is the affordability of robo-advisory platforms. Where unit trusts usually come with upfront fees and a high minimum investment amount, robo-advisory companies like MYTHEO disrupt the fee structure associated with investing. Initial investments can start as low as RM100, and the only fees clients pay are the management fees that never go higher than 1% of the AUM.

Safeguarded investment

According to Tan, obtaining the robo-advisory license to operate legally in Malaysia involved a strict and robust compliance procedure as set by the Securities Commission. During the audit process, all digital investment management companies (including MYTHEO) must meet strict standards in the following criteria: system readiness, cybersecurity, data protection, and operational readiness. On top of that, the credibility of the managers across the company must also be independently verified.

As a technological tool reliant on its algorithm, the Securities Commission also required the companies to provide back-tested results as a proof of the algorithms capabilities. In MYTHEO’s case, Tan added that the company also took the liberty of getting an external audit as an extra measure as it is investing public money.

As with other financial entities managing client money, funds deposited by clients are not held by MYTHEO. Instead, all funds are held in a trust account. Even invested assets are backed and held in custodian, which essentially means at no point does MYTHEO hold a single Ringgit owned by its clients.

Trusting the algorithm

As a passive investment tool, Tan says that MYTHEO does not time the market or actively trade based on trends or even current news. Instead, MYTHEO’s strategy of wide diversification across various asset classes and even countries mean short-term blips rarely affects long-term investors.

MYTHEO also employs artificial intelligence to track the risk base of its investments. This allows MYTHEO to choose funds not by best returns, but by “risk-rated returns” for optimum results. In addition, there is also an Auto Rebalance feature within the investment engine that rebalances a client’s unique portfolio automatically when needed.

In terms of track record, it does appear that MYTHEO’s funds can perform well. In 2019, its three functional portfolios: Growth, Inflation Hedge, and Income recorded returns of 20.24%, 18.01%, and 9.64% respectively.

Solving a very real problem

It is well-known that many Malaysians have difficulty when it comes to saving money. When it comes to retirement this issue is worse, as many put off retirement plans and hope their EPF savings would be enough (it isn’t).

Robo-advisory platforms eliminate the two main excuses of why people don’t invest: lack of knowledge and high barrier of entry. All three robo-advisors in Malaysia have initial investment amounts that start from just RM100, 10 times less that of most unit trust funds. Subsequent investment can be done easily via FPX bank online transfers, and even more easily by “set and forget” auto-debit.

45107559 – woman hands working on calculator close up

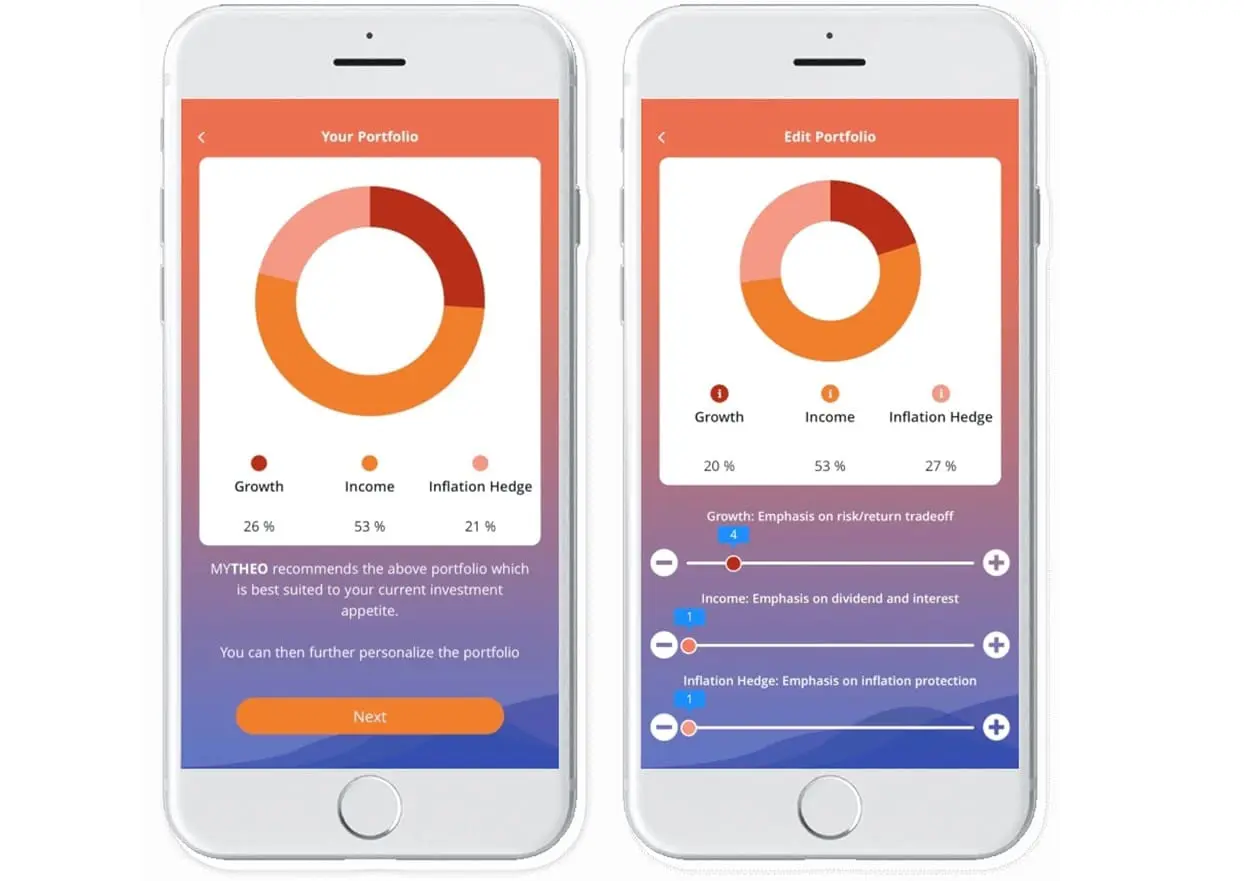

On top of that, robo-advisors make investment as easy as setting up a risk profile upon signing up, and keeping to a regular deposit each month. These platforms’ algorithms, as Tan says, “take the nitty gritties away”, with the heavy lifting being done via software. The client’s risk profile is unique, and MYTHEO’s algorithm uses each individual profile to allocate funds accordingly to the three functional portfolios (Growth, Inflation Hedge, and Income).

As such, Tan believes that robo-advisors like MYTHEO are the best investment tool for those who want to invest, but do not have the time to read up on it. In particular, it’s perfect for the young millennial generation on their first jobs who want their savings to work harder for them, but may not be able to commit the time to do so. Of course, robo-advisors have a place for seasoned investors too, as a useful diversification tool.

Omakase Or a la Carte? Your Choice.

Using a Japanese fine dining restaurant as a metaphor, Tan describes MYTHEO as being able to offer “omakase” sets for the beginners, and an “a la carte” menu for those who wish to customise their fine dining experience.

New investors will have their funds automatically allocated to the three functional portfolios based on their risk profile for optimum returns. But by tracking the journey of the investor via the MYTHEO app, investors can unlock the ability to create and customise their own allocation of the three functional portfolios, regardless of their risk profile. Investors can create up to six custom portfolios, should they wish to have different investment horizons or time frames.

Interestingly, of the three digital investment management platforms currently available in Malaysia, only MYTHEO offers users the ability to customise their investment allocation.

A modern way to invest

Digital investment management platforms may still be an offspring in the industry, but it is fast gaining traction here in Malaysia. With its inherent asset diversification, low fees, and the use of modern technology, Malaysians may now have another useful investment tool to help them invest.

A seasoned tech journalist who now focuses on his other passion, Pang is a firm believer in old-school DCA and optimised spending.

Comments (0)